If you’re launching a startup in the UK, you might already be aware of the fantastic opportunities for fundraising this burgeoning business economy provides. But do you know what options are out there — and which might be the best for your business? Here, we’ll take you through the different sources of funding and help you choose the right route to success.

Start Up Loan getting

To begin with, let’s look at one of the more obvious fundraising approaches: acquiring a loan. In the UK, the government’s Start Up Loan scheme has been running for ten years, providing loans of up to £25,000 for small businesses looking to get ahead.

If you make it through the application process, you’ll have a maximum of five years to pay back the loan, at a fixed interest rate of six percent per annum.

Funding Circle investing

But that’s not the only option if you’re seeking a loan to boost your UK company. Take Funding Circle, for example, a peer-to-peer financial service that connects would-be investors with SMEs, allowing members of the public to help fund businesses that they believe in. If successful, you could secure anything up to £500,000 in unsecured loans.

Smart Grant & Tax Credit Scheme

Whatever the source, though, loans always have to be paid back — something which can prevent some small businesses from getting off the ground. Luckily, UK-based companies have a large array of grants at their disposal as well.

Take Innovate UK’s Smart Grant, for example, a £25 million pot of funding available to SMEs looking to develop game-changing products and tech. Or the R&D tax credits scheme, which pays out lump sums to businesses looking to fund research and development projects.

An angel investment

Alternatively, you might want to seek out individual investors to support your company as it grows. One option is to sign up for an angel investment scheme — a network of successful businessmen and women looking to invest capital in new projects and ideas.

Female entrepreneurs might benefit from Angel Academe, a women-centric network that focuses on fintech, cybersecurity and digital media, while Craigie Capital provides funding for London-based startups at the seed level. Whatever industry you’re entering, there’s probably an angel investment network to suit, so do some research to find the best fit.

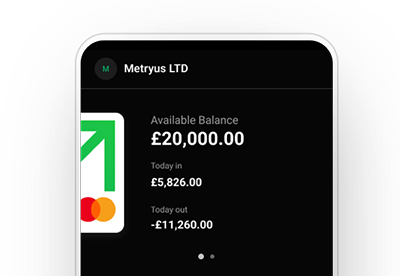

Already running a business? Handle money and accept payments in one app.

Venture capital investment

Or, if you’ve got big dreams, you might want to look into venture capital — a funding model that sees individuals invest in startups with high growth potential. Although this is one of the trickiest ways to raise cash, it’s also one of the most powerful and a great way to send your startup into the stratosphere.

For deeptech and B2B SaaS enterprises, Hoxton Ventures offers million-dollar investments to companies across Europe and have played a significant role in helping brands such as Deliveroo get where they are today. Meanwhile, Passion Capital gives financial support to UK-based startups in the seed stages, previously funding fintech success stories such as Monzo and GoCardless.

Crowdfunding platforms

Finally, there’s the crowdfunding option — an increasingly popular way to generate the cash needed to launch your startup. Generally speaking, crowdfunding platforms fall into one of two categories: either consumer or investor-focused.

The first relies on your potential customers to fund your project through platforms such as Indiegogo and Kickstarter, a great way to raise capital without the involvement of commercial investors. The second, which takes place via platforms such as Seedrs, invites members of the public to invest in a project of their choice.

Often, this method can raise more than a traditional crowdfunding campaign, although investors will own equity in your company in return.

So as you can see, there are lots of ways to secure funding for your business in the UK. But to access any of them, you’ll need to register your company and open a UK business account. Luckily, there’s a simple way to open up this world of opportunity. With a GoSolo account, you can launch a UK company in as little as 48 hours, all without setting foot on the outside.

Sign up to get your GoSolo Account now to start your UK start-up journey.

Available on Web, iOS, and Android.

Back to Blog

Back to Blog