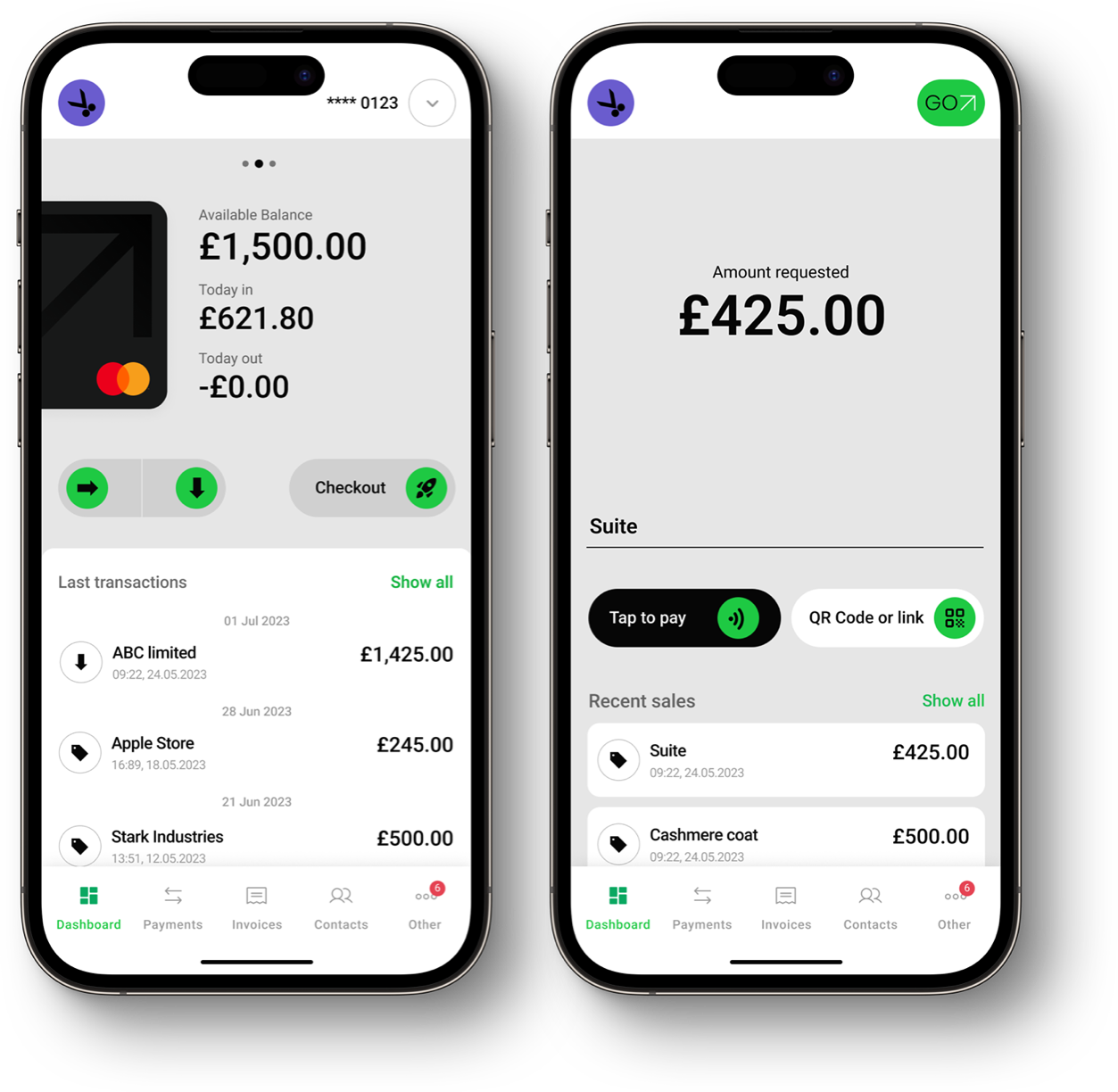

The GoSolo mobile app provides all the functionality you need. Here is all you need to know about sending an online invoice:

Small Business Invoicing: Go Digital with Gosolo

Manual invoicing is still a possibility. Yet, it has some inherent challenges. It's easy for customers to misplace invoices. If you're sending the invoice via post, there may be delays before getting paid. You still need to digitise sales made through manual invoices, which piles up the work. Sometimes manual invoices are hard to track, introducing delays in getting paid.

An objection you may have to digital invoices is, "I don't have time to learn complicated invoicing software." That’s okay. Gosolo solves this very problem by allowing you to create invoices from templates.

Working with ready-made templates gives your invoices a professional look. You get all the key fields to ensure you’ve captured vital information, including the company name, item description, VAT, and invoice amount.

The solution is aligned with the needs for small business invoicing. It’s ideal for businesses that deal with a relatively low volume of sales and customers. You can use it in cases where it doesn't make business sense to invest in a dedicated POS system, for instance, for self-employed invoicing in the UK.

Gosolo account holders can make invoices online as long as they have a digital business account. They can access the functionality through the browser or mobile apps.

Must-have Features When Evaluating an Invoice Finance Tool

Any invoice finance tool needs some key features to make it suited to creating business invoices:

- Custom branding and logo: personalised invoices create a good impression with clients. Find a tool that permits you to add the business logo or set custom brand colours.

- Invoice previews: Avoid situations where you have to send a corrected invoice after sending one with mistakes. It may confuse customers. The ability to preview company invoices before sending remains a must-have.

- Custom message field: The invoice should have a field to accommodate extra information. You can share key details customers should know before making a payment.

- PDF versions: Customers may need to print invoices for filing purposes. Sharing a PDF gives your invoices a consistent appearance during printing or viewing on different screens.

- View receipts: You should not guess whether the customer viewed the invoice. The tool used to create invoices for businesses should provide the view of receipts.

- Automatic VAT: Adding VAT is necessary for certain goods and services. Consider using an online invoice UK-tailored tool that accommodates VAT rates.

Benefits of Using Gosolo's Invoicing Tool

Create invoices that showcase your professionalism with GoSolo's business invoice feature. You'll enjoy these benefits and more:

- Quick, easy, on the go: anyone can do it! Enjoy a quick and effortless process for creating and sending business invoices. You can even do it on the go on the mobile app.

- Fully customisable: brand your invoices by adding the business logo and using company colours. You get a professional invoice rather than using generic templates.

- Mobile-friendly designs: Our recently revamped mobile invoice layout presents all the key details at a glance, making payments quicker.

- Add VAT rates automatically: Forget the hassle of manual VAT calculations. You can even specify the VAT rate for individual products. The outstanding tax is then added to the final amount.

- Intelligent payment matching: Match payments received to your Gosolo business account to outstanding invoices. You can also mark paid invoices manually.

- Fast payments through FPS: Receive payments through FPS in seconds simply by having a Gosolo account.

- Uncomplicated payment process: Customers can pay invoices in three steps. We have made it easier to copy payment information. Similarly, anyone can quickly send a message to ask about the invoice amount or other details.

- See viewed invoices: Receive notifications when the customer views your invoice. The system records the view time for future reference.

Create an Invoice with GoSolo – How it Works

Sending an invoice with Gosolo is as easy as it gets. From your account, choose the option to create an invoice. Then, key in details about the invoice amount, customer, and products or services sold.

Consider adding a personalised message to accompany the invoice in the recipient's inbox. We strongly recommend previewing the invoice to determine its correctness. Now, hit send, and the invoice will be on its way to the customer.

After viewing the invoice, the platform generates a custom notification and records the view date. Customers can pay you in just three steps with a Gosolo account. Rather than starting from scratch every time, you can duplicate past invoices. Our team is working on a recurring invoice feature.

Get started with the new way to send small business invoices in the UK today.

5.0 ★ on App Store

5.0 ★ on App Store

4.2 ★ on Google Play

4.2 ★ on Google Play