Have you got an amazing idea for a start-up? Ready to make your business dreams a reality? Well, the first thing you’ll need is cash — and potentially lots of it. Of course, not everyone has access to large sums of money, so we’ve taken a look at some of the most popular ways to raise funds for your business.

Grants and loans

Thankfully, there are plenty of grants and loans that you can access as a small business getting started in the UK. Nationally, schemes such as Innovate UK and R&D tax relief offer financial support to start-ups, while many local councils operate their own programmes as well. And if you’ve been trading for less than 36 months, you can apply for a government-backed Start Up Loan, which comes with 12 months of complimentary business mentoring.

Investment

Another way to raise funds is to attract individuals willing to invest money in your business. For many entrepreneurs, that means asking family and friends to loan out the cash required to get things started. If you go down this route, make sure you get proper legal advice first — after all, nothing sours a relationship faster than financial conflict. Or, you could try and attract the interest of professionals via what’s known as an angel investment scheme — a network of successful businessmen and women looking to invest capital in new projects and ideas.

Crowdfunding

In the last decade or so, crowdfunding has become an increasingly popular way for entrepreneurs to raise the cash they need to launch their businesses. If you’re social media savvy, and good at promoting your brand, this could be the right approach for you. Just choose a platform — Kickstarter and Indiegogo are the most popular choices for UK companies — and get promoted. In return for donations, supporters typically receive perks, so make sure you make a full business plan and account for any associated costs.

Bootstrapping

Don’t want to rely on external funding sources? You could try bootstrapping, an approach that involves using your personal finances, or money generated by your start-up, to operate your business. If you’ve got a bad credit rating and you’re in the red, this might not be the best option for you, but some entrepreneurs have had plenty of success relying on savings, credit cards and second mortgages to get the ball rolling.

Part-time work

Of course, it can be tempting to quit the day job and dedicate yourself entirely to your start-up dream. But the reality is that bills still need to be paid. Instead of struggling to pay yourself a wage, why not pursue a part-time position that will keep the cash flowing while you establish your business? People find all kinds of extra work via sites like Jooble, so take some time to see what’s available in your area.

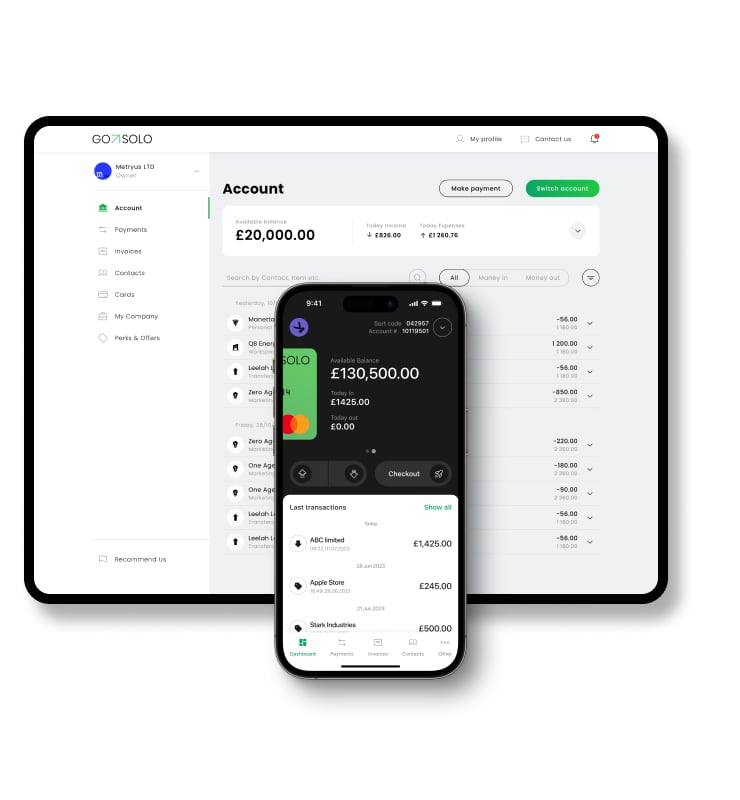

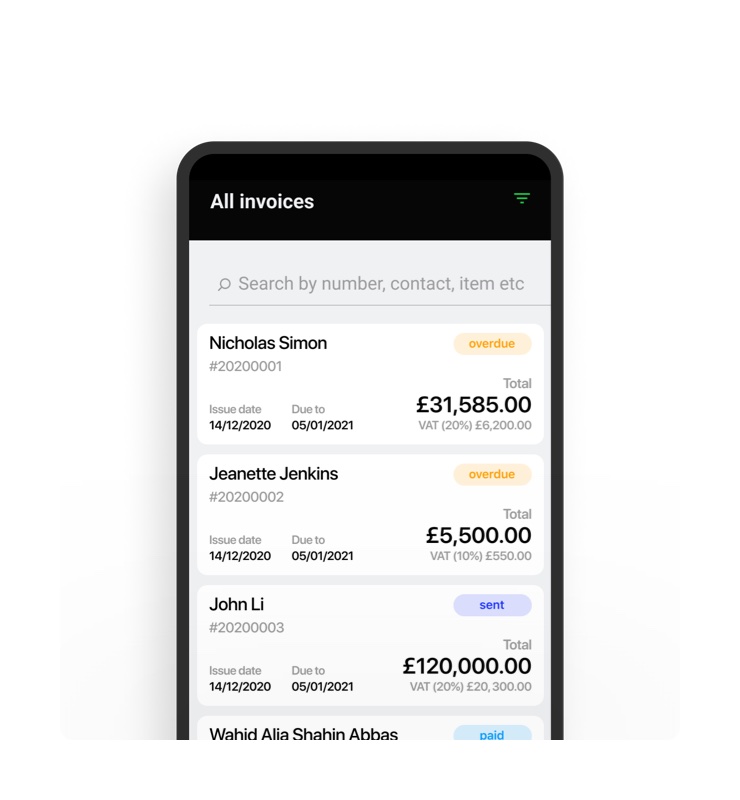

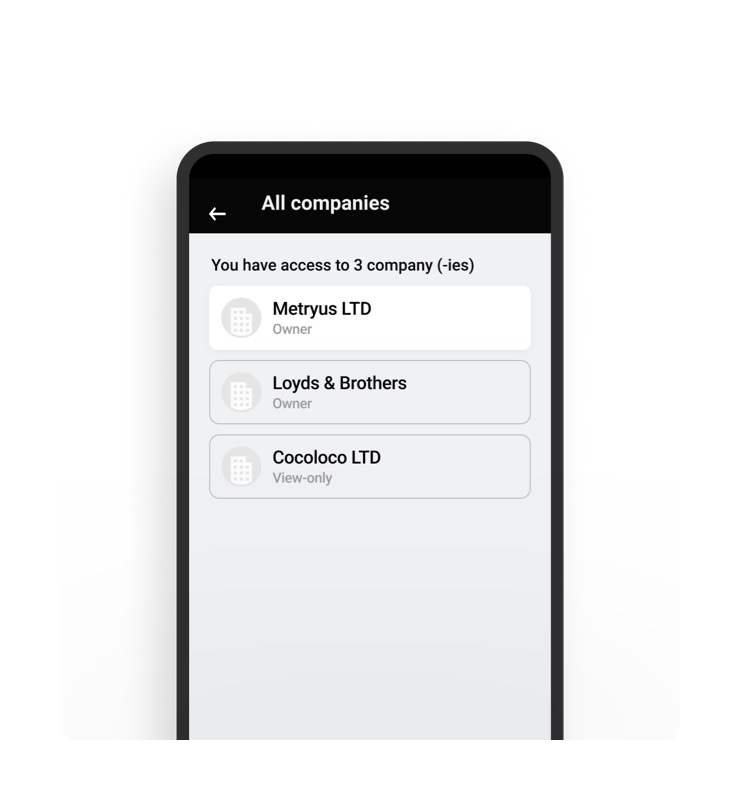

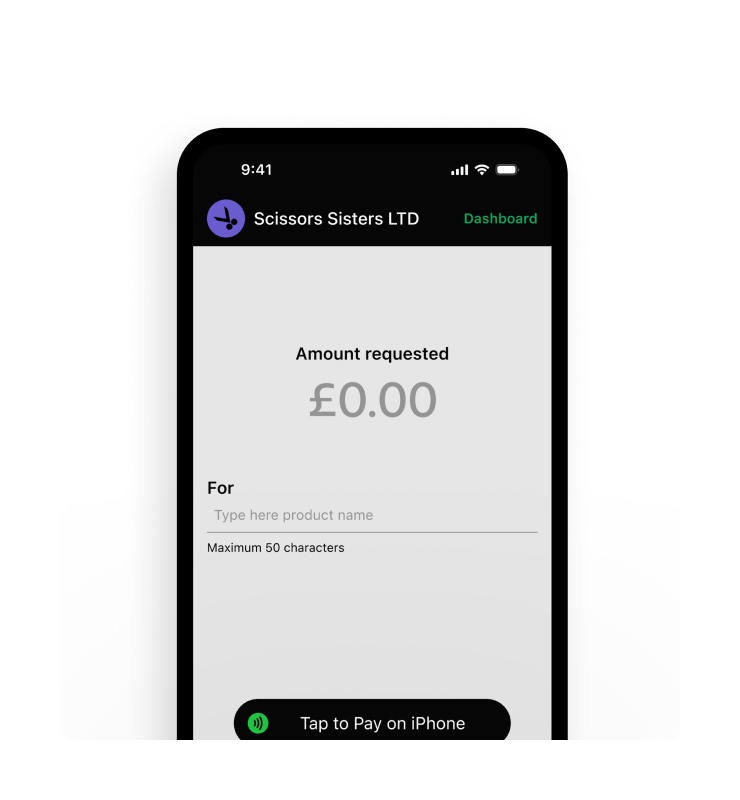

Already Ltd? Manage your business account + admin in one app.

Back to Blog

Back to Blog