⚡ TL;DR: If you’ve started a UK Limited company, you must register for Corporation Tax within 3 months of trading — or risk penalties. This short guide walks you through when, how, and where to register, what HMRC will ask for, and how to avoid common mistakes. It also shows how GoSolo simplifies the setup process for new businesses.

Once you’ve got your limited company officially registered (see our previous blog post), the next thing you’ll need to do is register for corporation tax.

A letter in your post from HMRC

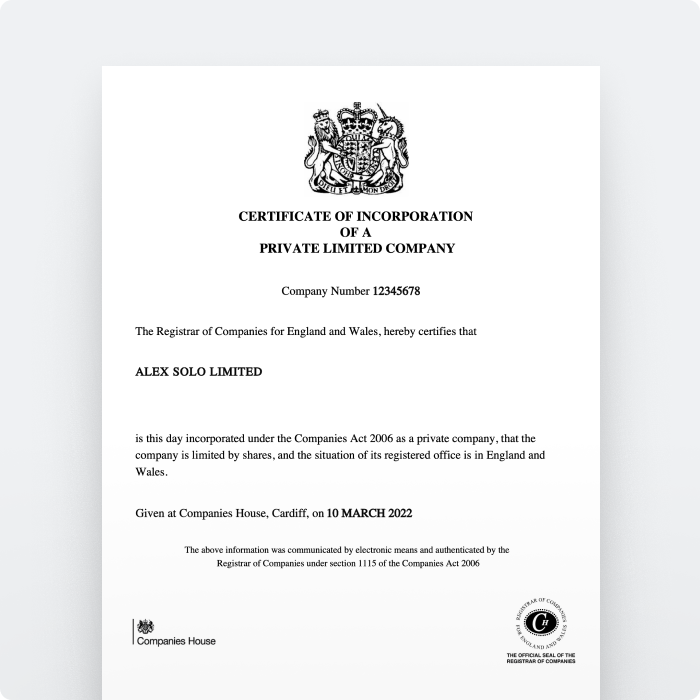

Before you rush to do it, check if you have all the documents ready. If you register your company with GoSolo, it will only take one working day to have it appear on the Companies House registrar. But, if you want to register for corporate tax straight after that, we hate to disappoint—you need to wait first for the post to arrive from Companies House and HMRC. And this may take a couple of weeks.

Unique number

Once you have a letter from HMRC, it will show your Unique Taxpayer Reference (UTR) number, which will be needed to complete the registration for corporation tax.

The ID

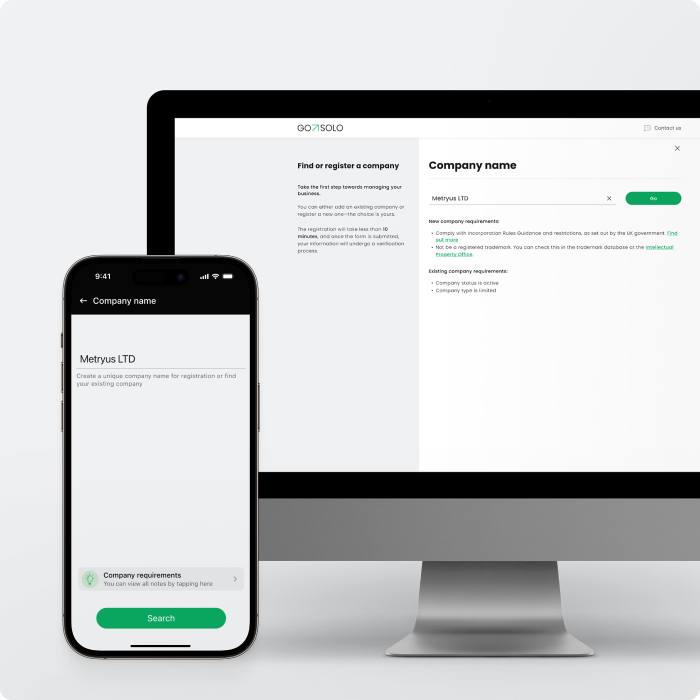

Now you can go to this page to register for Corporation Tax online. If you don’t have a Government Gateway user ID (you probably won’t at this point), you will need to complete the sign-up process, where you’d need to provide your Companies House company registration number. The ID will then be emailed to the email address you specify.

Access code

Once all of that is sorted, there is one more hoop to jump, which is—before you can register for Corporation Tax on the portal, you need to request an access code, which will come again in the post. This is done on the Government Gateway after you complete your sign-up.

Once you get it, you can log back into the Government Gateway and complete your registration for Corporation Tax.

The good thing about this is you can register for Corporation Tax at any point up to 3 months after your company started trading—counted from the first sale, advertisement, or rent. Certain things do not count as the start of your trading period, such as writing a business plan to get your business set up.

For more guidance, use information provided by the government here. Our advice is that although 3 months sounds like a lot of time, make sure you allow yourself enough time to wait for any additional mail in the post.

To simplify this for you, here’s a step-by-step guide:

-

Register a limited company (can be done here)

-

Celebrate :)

-

Wait for a letter in your post from HMRC with your company’s Unique Taxpayer Reference number (up to 2 weeks)

-

Sign up in the government portal (here)

-

Receive Government user ID to your email

-

Sign in to the Government Gateway and request an access code to register for corporation tax

-

Wait for a letter in your post with the access code (up to 2 weeks)

-

Sign in to the Government Gateway and register for corporation tax

If you are still unsure about something, feel free to write to us, and we’d be happy to help you.

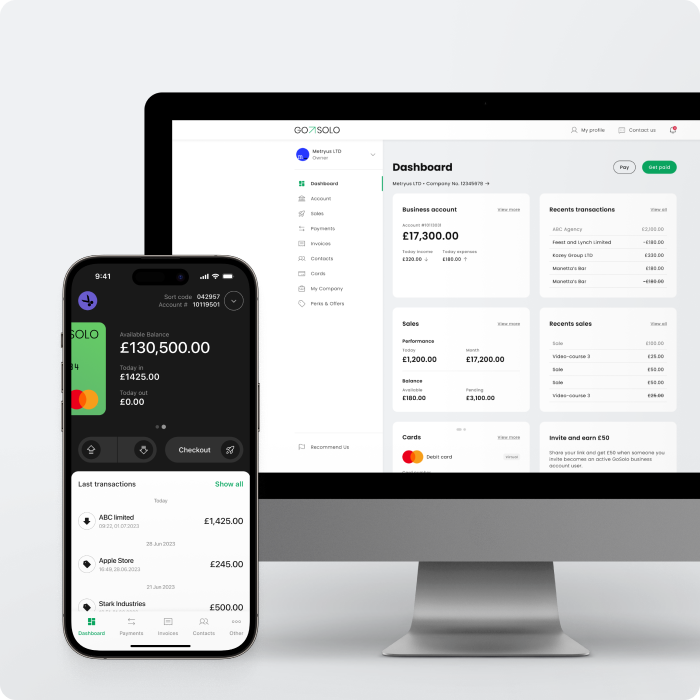

Already running a business? Handle money and accept payments in one app.

Back to Blog

Back to Blog