Start a business

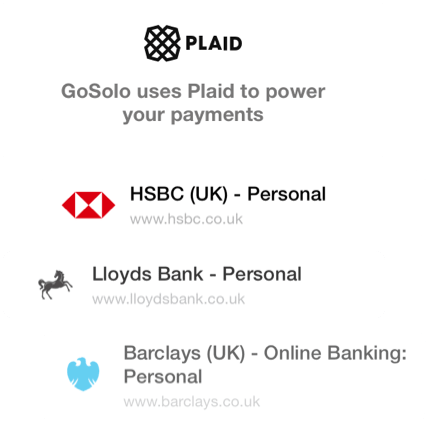

Business account

Open a smart account made for small businesses

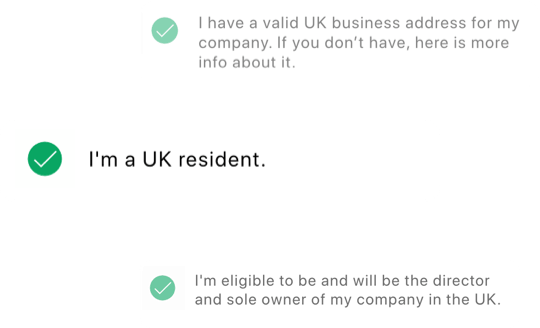

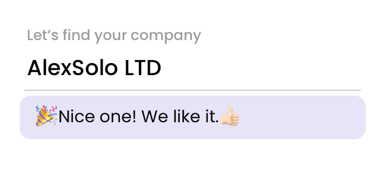

Company formation

Register a UK limited company online in minutes

Virtual business address

UK virtual office ready for you in minutes

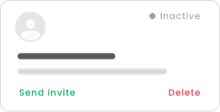

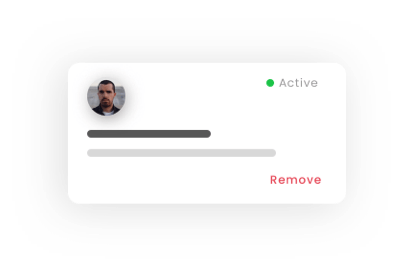

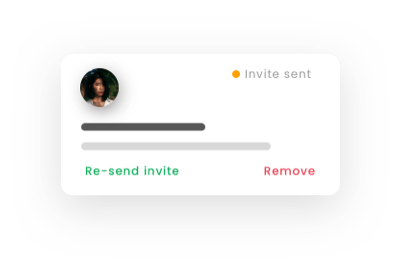

Multi-user access

Invite team members to view and manage your business

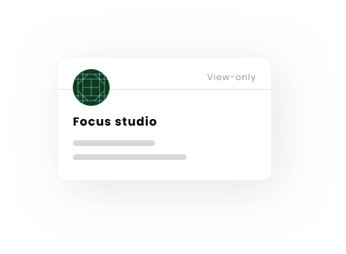

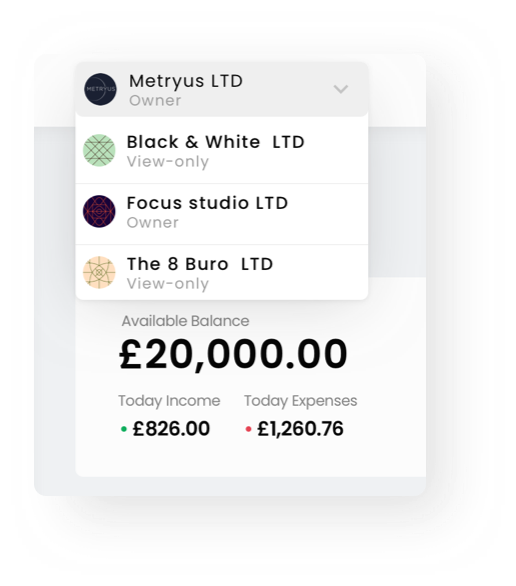

Manage multiple companies

Switch between companies in one simple dashboard

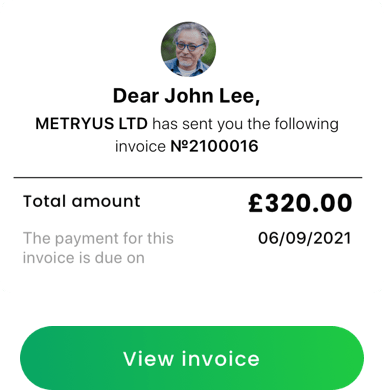

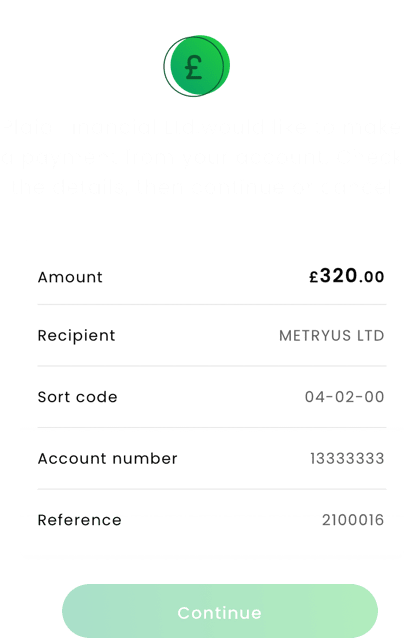

Get paid

Pricing

Solutions

Small business

Tools tailored to small business owners and freelancers

Developers & IT professionals

Business tools built for remote work and freelance billing

Startups

Set up and grow your company with minimal admin

Construction & Home Services

Get paid faster and manage jobs on the go

Non-UK residents

Run a UK company even if you live abroad

For freelancers and influencers

Create your own limited company to boost your income

About us