These are the 2023 important tax dates for the small business you need to be aware of to keep on top of your accounting this year. Keeping your finances up to date is a great way to prime your business for success this year, despite all the upheaval going on in the world.

Here are some of the 2023 critical tax dates for your calendar.

January – self-assessment due

If you pay your taxes via self-assessment, January 31, 2023, is the final date for submitting your online return. It’s also the deadline for settling any outstanding balance on your account, so make sure that all your payments are up-to-date.

April – end of an old tax year and the start of the new tax year

The 2022/2023 tax year ends on April 5, 2023. The 2023/2024 tax year begins on April 6, 2023. Keep a note of these critical dates in your calendar for easy reference.

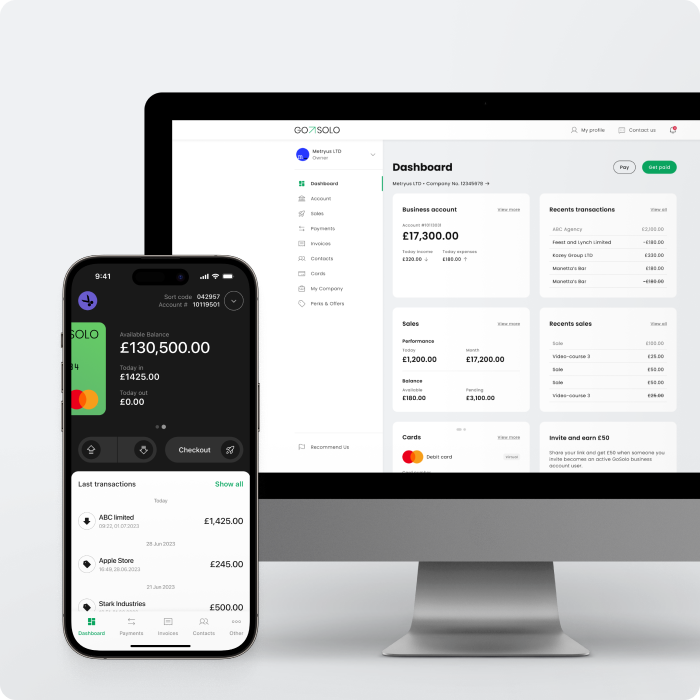

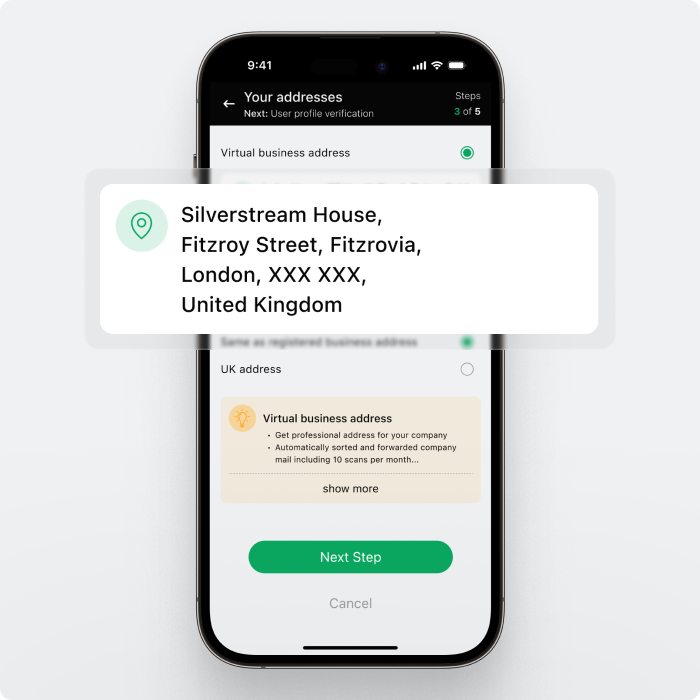

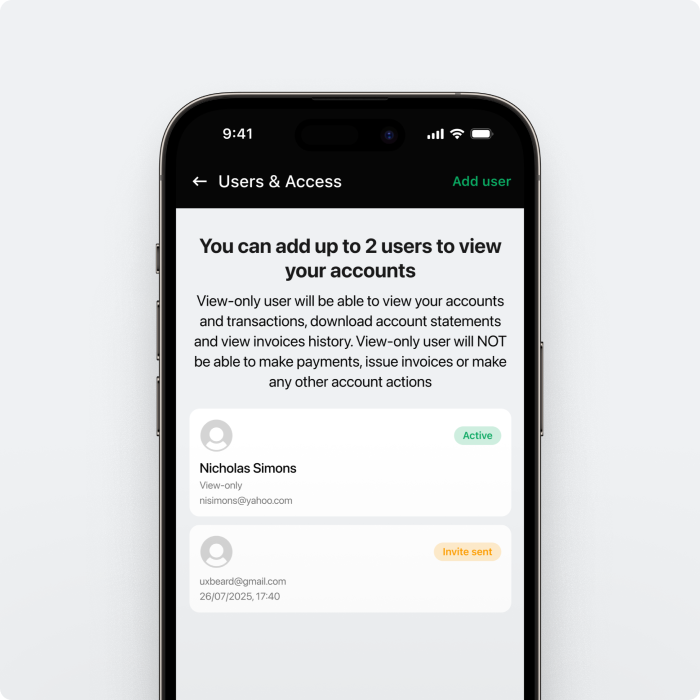

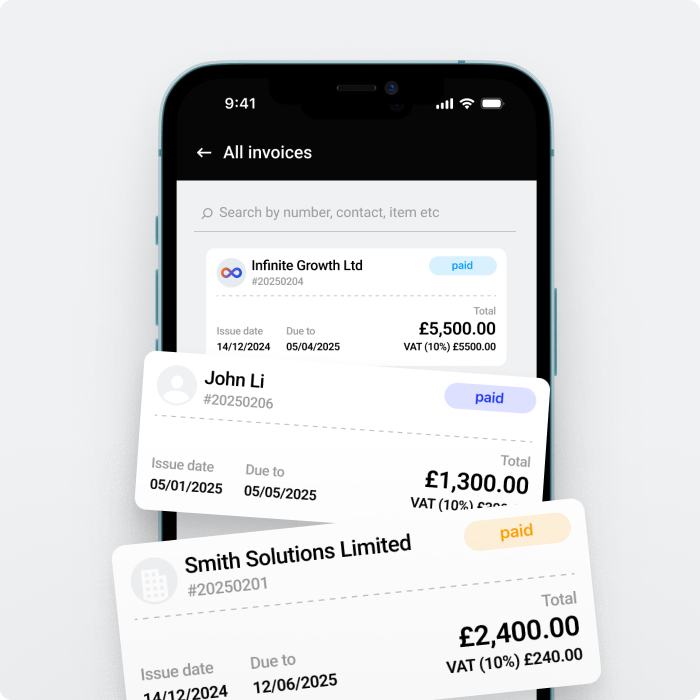

Already running a business? Handle money and accept payments in one app.

July – second business tax payment due

For those completing self-assessments, your second payment on account for the tax year 2022/2023 is due on July 31, 2023. Staying up to date with these payments is important if you want your business to run smoothly.

October – register to pay capital gains tax

If you need to register to pay either income or capital gains tax for the year 2022/2023, the deadline is October 19, 2023.

If you need to make an online payment for CIS, Class 1 B NICs or PAYE, the deadline is October 22, 2023.

If you complete your self-assessment by post, you must submit your returns for the 2022/2023 tax year by October 31, 2023.

December – submit your accounts to Companies House

If you run a limited company, and your year ended on March 31, 2022, the deadline to submit your accounts to Companies House is December 31, 2023.

Keeping track of everything required during the financial year can be difficult, particularly if you don’t have a background in accounting. But with a GoSolo Business Account, you can see all your financial transactions in one place, making it easy to stay up to date.

Back to Blog

Back to Blog