An accountant has always been an essential part of any business, even before the inception of the Internet. These individuals were professionals who handled every financial activity of small and large businesses.

Irrespective of the size of your business, financial records and reports can be overwhelming. As such, accountants improve your workflow, dealing with financial aspects, including income and tax management.

When the internet emerged, so did the concept of online accountants. Instead of working with these individuals physically, they handle your financial affairs from a remote location. This does not impede their functionality; if anything, they function better.

Online accounting services now make it easier for you to focus on other aspects of your business. Even better, you can easily find an accountant for small businesses or those that can handle heavier workloads.

Accountants might handle every situation involving finances, but there are different types with different specialities. For instance, while a business accountant monitors the general income and expenses, a business tax accountant handles only task-related issues.

However, the question remains, "Should you find an online accountant for your small business?" This article shall answer this and give extensive information on finding an accountant online.

Online Accountants for Small Businesses

Accounting involves the process of analyzing, interpreting, organizing, computing, and reporting the financial status of your business. However, many associate this with larger corporations where funding is complicated.

The truth is, that financial records are complicated even for small businesses. You have to be vigilant, keeping tabs on every penny that comes in and goes out of your business. There is also the issue of tax to handle.

The combination of these can result in an overwhelming report which you can easily lose track of. So, why not hire the services of any of the online accountants for small businesses on the Internet?

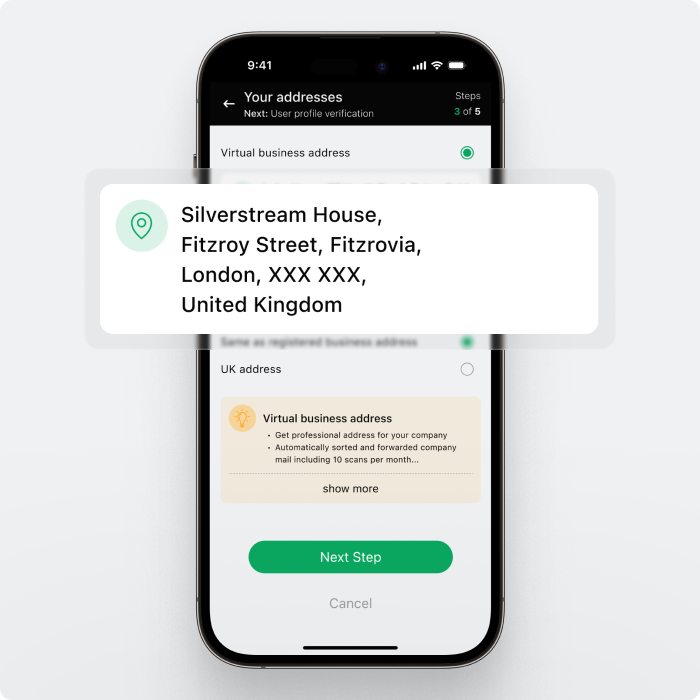

An online accountant does not require a physical meeting or presentation. Instead, your transactions occur on the internet, making it easy to compute and track your financial progress. You can also give access to your business banking so that an accountant can keep track of all the data and transactions.

Roles of Online Accountants in Small Businesses

An online accountant performs the same duties as a physical accountant would. Their function ranges from collecting financial information to providing advice on how to improve your finances. That said, here are the basic roles they play in developing your business.

Managing financial data

The financial structure of a business is an essential factor in its operations. The primary role of an accountant is to study this structure to collect and maintain your financial data. Following your rules and procedures, they compile the information into a functional system for easy management.

Online accountants are also responsible for developing computing strategies and controlling procedures over financial matters.

Financial Analysis and Advice

Accountants function as analysts, using every available tool to inspect your finances. After the study, they provide the best strategies to improve your financial decisions. Based on your preference, they can handle every income and expenditure the business makes daily.

With their result analysis, online accountants advise on the generation of revenue and future financial commitments. Their job also entails detecting irregularities or discrepancies in your cash flow. If there are any, you get advice and recommendations on how to handle them.

Preparation of financial reports

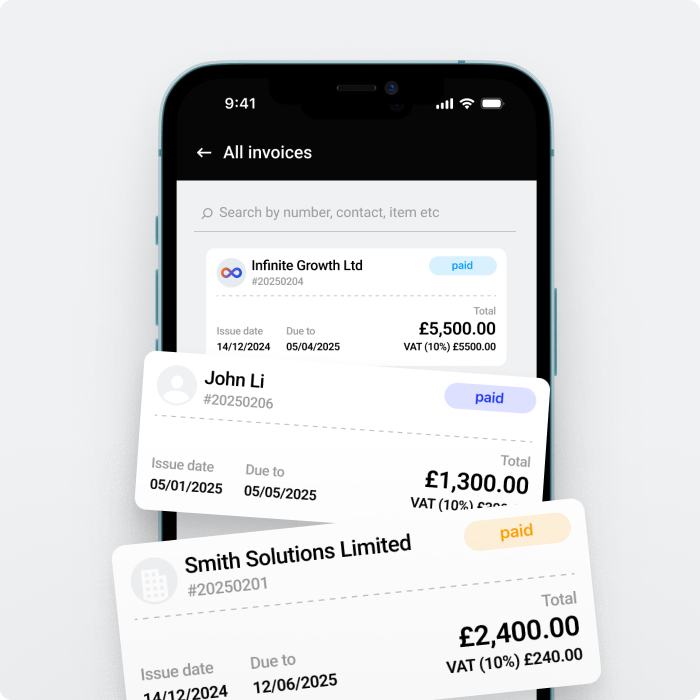

Even with an accountant, a financial report is necessary. An online accountant performs this duty based on your specifications. In other words, you'll get a financial report weekly, monthly, or annually based on your agreement.

A financial report gives comprehensive details on every impactful financial decision you made during that period. A comprehensive report will also outline the lapses and corrections to make in your business.

Regulatory Compliance

An accountant ensures that your business meets every financial deadline, including tax. With this, you take advantage of every opportunity that could contribute to your growth positively.

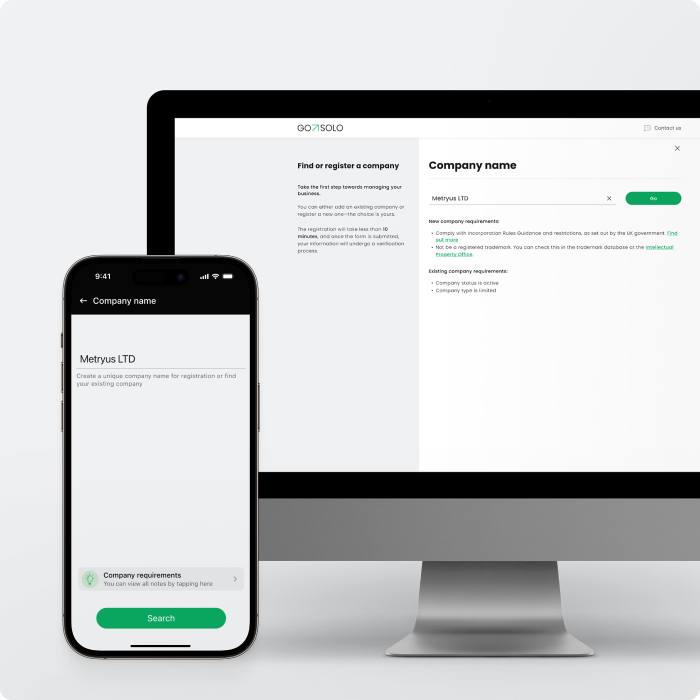

Already running a business? Handle money and accept payments in one app.

Do You Need an Accountant for a Limited Company in the UK?

The general management of a limited company includes handling all accounts and financial responsibilities. Knowing how daunting it could be, this responsibility is not a director's favourite. An online accountant for a limited company will perform the same functions for smaller businesses.

In other words, they handle financial assignments and task-related issues for the company. While no law stipulates the need for an accountant for limited companies, there are several benefits to having one. We will explain these benefits as you read further.

Types of online accountants for limited companies

While you are wondering how to find an accountant who can handle all accounting duties, you should note that there are a plethora of online accountants. To find an accountant in your area of specialization, you must understand the duties of each one.

Financial accounting: The main purpose is to track, record, and provide reports on financial transactions. This accountant will provide these reports in the form of comprehensive financial statements.

The accountant works following the guidelines and rules in the Generally Accepted Principles. These rules, set by the Financial Accounting Standards Board, aim to improve consistency. It also serves as a general platform that sets a universal method for giving reports.

A financial accountant notes your past performance but has nothing to do with future management. However, they monitor your account performance for an agreed duration of time.

Tax accounting: Tax accounting comprises all duties involving tax. These specialists follow set rules by your resident tax bodies to ensure accuracy in calculation. Tax accountants must be familiar with these tax laws which change every year.

With this knowledge, calculating tax payments, liabilities, and tax returns is easy. Tax accountants use digital methods to compute necessary tax information. They go further to provide tax strategies that can minimize taxes when due.

Cost accounting: It deals with financial details concerning the cost of running businesses. It is usually for manufacturing companies and other service businesses. A cost accountant will evaluate both fixed and variable costs a business incurs.

These cover labour, materials, production costs, maintenance, and so on. After an assessment, they provide business owners with essential information like break-even points.

Public accounting: This field covers a bit of everything as it includes providing accounting services to businesses and individuals. A public accountant focuses on tax preparation and advisory, financial consultation, auditing, and report preparation. Online firms that offer these services could handle other financial aids like bookkeeping, account management, payroll services, and others.

Management accounting: Specialists in this field provide the management with information that enables them to make better decisions concerning the business. Management accountants share private information; thus, they only share it with the members of the board. But, when researching financial and management accounting, they inform every member associated with the firm.

Management accountants also devise means for companies to work with. If these strategies are not enough, they recommend tools and other resources that will aid its procedures.

Auditing: Auditing is a branch of accounting that analyzes every financial activity of a business to ensure that it meets the required standards. An accountant can perform an audit for investigative purposes or under the HMRS to obtain tax information.

Accounting is a field that sometimes requires the application of more than one of its types. As such, some accountants can perform multiple functions depending on your agreement.

The Benefit of an Accountant for Limited Companies

As earlier mentioned, an online accountant can benefit a limited company in several ways, all of which we discuss below

Time-saving

Have you thought of the amount of time it takes to go through financial records and try to sort them out? Well, you could expend much time on performing other functions that could be helpful to your business. An online accountant relieves you of this by handling all the stressful financial activities on your plate.

VAT and Tax returns

If a limited company does not need an accountant for any other purpose, it's necessary to have one that handles tax. Not only are tax-related matters confusing, but the laws also change every year. As such, an online accountant has to be dynamic, following these rules and bringing your company up to date with them.

Your accountant will oversee your VAT obligations and decide on the right payment method that suits the company. They also monitor your VAT returns, ensuring that there are no unexpected charges.

Record-keeping

One of the most difficult aspects of running a business is keeping track of every activity. For smaller businesses, this could be easier; however, larger corporations find it difficult. Irrespective of your business size, online accounting follows every transaction and financial dealings, which makes it easy to keep records.

Financial planning

Business owners tend to be so occupied with other operations of their business that they fail to craft future financial strategies. A skilled accountant can help assess a business's current condition, research business trends, and suggest ways to capitalize on them. They also help forecast future business outcomes and make decisions that will best influence the business's financial position.

Increasing profit

One of the reasons you need an accountant is to minimize losses and maintain a steady profit record. An online accountant will analyze the conditions surrounding your business and propose the best methods to make profits. They also identify potential problems and act to prevent them from affecting your business.

Peace of mind

There is nothing more assuring than knowing that your financial tasks are in safe hands. However, ensure you get an accountant who is trustworthy, reliable, and well-versed in the field of study.

How Much Does an Online Accountant Cost for a Small Business in the UK?

Before considering the cost of an accountant for a small business, here's a little tip. An online accountant could be a simple bookmaker or a financial manager, and the costs of their services vary accordingly. Therefore, the rate of a local online accountant for small businesses differs from more experienced accountants.

In the same vein, the accountant fees for small businesses UK that owners pay depend on the costs incurred. However, on a general note, online accountants charge by the hour or per project. This arrangement is best if you are looking for a one-time service.

But, if you want something long-term, you should hire full-time. The cost of an accountant for small businesses could range from as low as £24 to as high as £120 per hour.

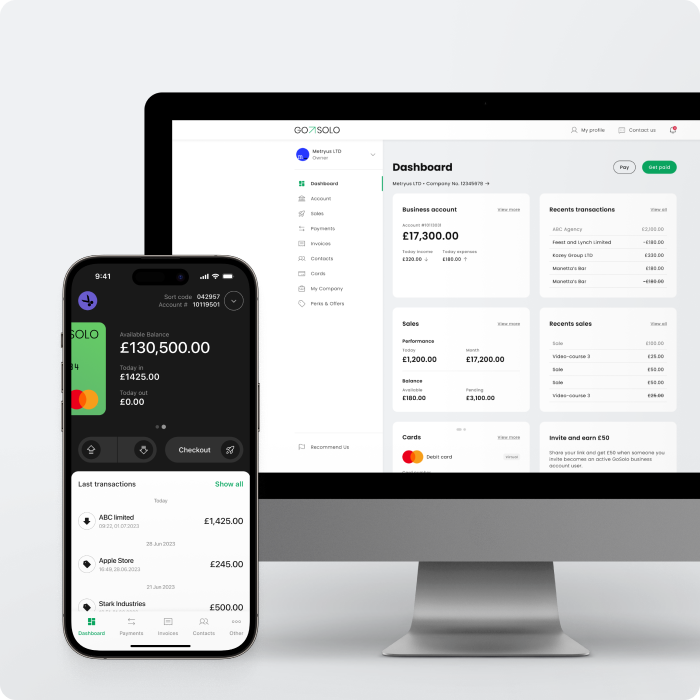

Available on Web, iOS, and Android.

How to Find a Good Accountant

Finding an online accountant in business management is relatively straightforward once you employ the right method of approach. For one, you're searching online, which makes it easier and narrows your search according to your specifications. But before proceeding, note that account fees for small business UK owners depend on the service they render.

Below, we look at a few steps to finding an online accountant for a small business.

Use your business influence

Before scouting the internet for accounting services, it's best to first search in your professional niche. Individuals and other businesses in the same network could recommend an online accountant to serve your purpose. This is beneficial as it saves you the time and effort of searching for candidates.

A recommendation also spreads to the risk of hiring accounting services online. Despite this, do research and study any online accountant, even with a recommendation. Remember that a recommendation cannot guarantee spectacular delivery. For instance, an online accountant who worked with only marketing companies might not be fit to handle manufacturing enterprises.

Thus, ensure that they understand the workings and operations of your business and are capable of handling it. In addition to this, you should request certification from a previous job experience to aid your selection process.

Search on the right internet platforms

Google is a universal search engine that compiles millions of results related to your search. You could narrow your search with specific keywords, but there'll still be several results. Aside from this, several online accountancy offers will attract your attention. While some might be genuine, others might be a scheme for fraudulent activities.

So, if you're thinking of using Google as your only search tool, you should reconsider it. Instead, search for legal and authentic platforms that offer online accountancy services. Fortunately, there are reputable platforms to serve this purpose.

-

AccLocal: It connects you with qualified accountants or firms that specialize in handling financial tasks. If you're looking for a simple bookkeeper, an auditor, or a financial planning specialist, AccLocal has the right person for you. The site makes your search easy as it requires just your postcode and the maximum distance preferences to begin its search.

-

Institute of Chartered Accountants in England and Wales (ICAEW): ICAEW is a European platform that supports and promotes professionals in accounting. Its members stand out as some of the best in the field with adequate training and skills to handle any financial responsibility. If you choose to employ any of their services, simply search and browse through their available options.

-

Upwork: It is a freelance platform where you find several online services, including accountants. The online space is quite broad, with its members from several parts of the world. Thus, you have several alternatives of individuals, locations, and rates to work with.

Shortlist qualified applicants

If you decide to go for recommended online accountants, all applications from the internet, you will have several options. Therefore, you shortlist your best candidates before the screening. These candidates should be those who have met the required qualifications and possess skills related to what you seek.

Interview shortlisted candidates to select the best

There are no specifications for conducting an online interview, but it's best to have a guideline. Guidelines will streamline your questions and direct interviews. Your questions should cover their experience in accountancy, their grasp of accountant laws, and their work ethics. You should also have an idea of their coping mechanisms with challenging situations.

You should run background checks before singling out a finalist once you have narrowed your search to only a few. Performing background checks online simply entails reading reviews, and references and checking credibility.

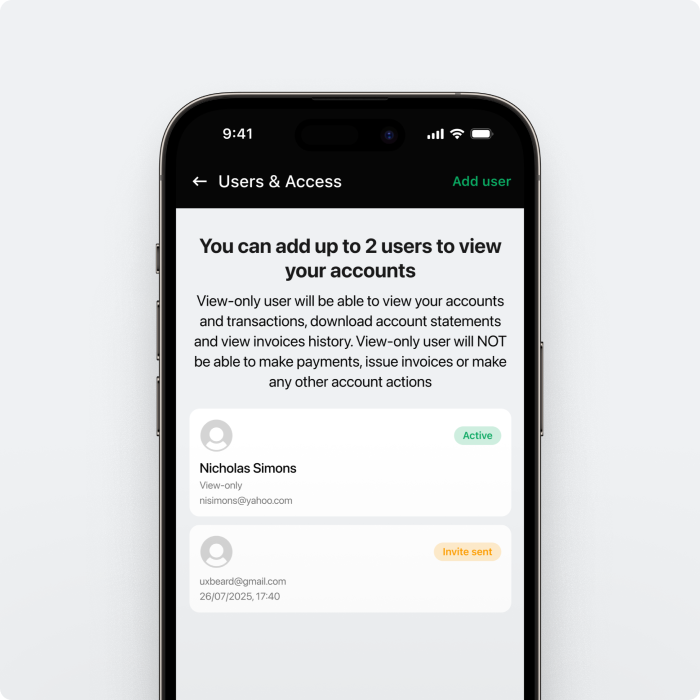

Can I Provide My Accountant with Access to View My Business Account?

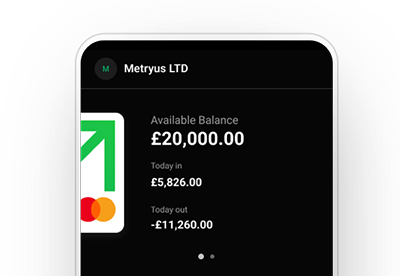

Using GoSolo allows you to add up to two people to view your business account. People who have access to your GoSolo account can view your contacts, transactions, invoice history, and even download bank account statements. If at any point, you decide to revoke a person’s access to your GoSolo account, you can easily do so.

Conclusion

Online accounting has made it easy to have your financial duties carried out from any location. It saves time, stress and allows you to plan your business' growth effectively. Aside from small businesses, online accountants play a significant role in the growth of limited companies.

Most times, the question "do I need an accountant for a limited company?" stems from not understanding the duties of an accountant. Thankfully, we have outlined and explained why you do need someone to handle finances in a limited company.

While there are several benefits to online accounting, do remember that you must hire the best for maximum results. For this, make use of your influence and other internet platforms. Here, you will find accountants willing to work part-time or full-time, depending on your choice.

On a final note, your business might start small, but you must have the right financial strategy to grow further. Thus, seek and implement their financial strategies from a professional online accountant.

Back to Blog

Back to Blog