If you've ever purchased a product and noticed a VAT charge on the receipt, you may be tempted to ask, "what is VAT?". VAT (Value-added tax) is a consumption tax added to the original sales price of most products when they are sold; however, not all products and services attract a VAT charge.

VAT-free products are those that should not be taxed in the first place.

In this post, we'll discuss VAT and analyse the pros and downsides of being on the VAT-exempt list, as well as how partially exempt firms might register for VAT.

What does VAT mean, and what is VAT exemption?

VAT is an acronym for Value-added tax, a form of tax that is levied on taxable items and services throughout the supply chain. Some items and services are considered non-taxable or VAT-exempt by the government. Certain things are completely exempt from VAT.

Notably, reduced or zero-rated items are not the same as exempt or out-of-scope things. Even if reduced rate items are charged less or no VAT, they are deemed VAT taxable (VATable) and differ from an exemption.

VAT exemption can apply to either non-taxable goods and services or organisations that are unable to register for value-added tax.

Businesses, nonprofits, and other sorts of organisations may be excused from paying VAT. If your company only sells VAT-exempt items or isn't involved in taxable "business operations", it is VAT-exempt. Similarly, you are partly an exempt business if you sell certain exempt things alongside some taxable items.

The fact that you do not sell any taxable items to your customers means that you will be unable to participate in any VAT schemes. You may still be required to purchase some taxable items to run your business, in which case you will be required to pay VAT on those purchases and will not be eligible to claim VAT credit.

For accountants and tax advisors looking for new opportunities in the UK, Jooble offers a wide range of listings that may be relevant to their specialised skills.

So, what does VAT mean for partially exempt businesses? These businesses can register for VAT and reclaim VAT on any taxable purchases.

What do businesses pay VAT on, and how does it work?

Before finding out what businesses pay VAT on, we'll check if businesses pay VAT. Many small and developing businesses are confused about VAT and are unsure if it affects them. Nevertheless, if you're fairly certain you don't need to sign up for VAT, it's still a good idea to double-check. Failure to register for VAT if your business meets the small business level can result in harsh consequences, including large monetary fines.

VAT (Value Added Tax) is a type of tax imposed on the procurement of some taxable goods. So, if the average customer pays VAT on the products they purchase, what do businesses pay VAT on?

The value-added tax applies to both businesses and customers, whether a business is purchasing raw materials or a buyer is making a direct buy from a shop. A business may pay VAT on certain taxable purchases it makes during production.

VAT-registered enterprises, in essence, collect VAT on the government's behalf and remit these taxes throughout the year. Your preferred VAT scheme and/or your industry rate will determine the exact payment date and amount.

Enterprises that register for VAT are accountable for charging buyers an output tax (equivalent to mailing an invoice) and paying suppliers input tax (comparable to paying an invoice).

If your company has paid more VAT to manufacturers than it has billed to customers, you may be able to recoup the difference from the Tax Authority. If you have received more VAT from purchasers than you have paid to businesses, you are required to reimburse the difference to the tax administration.

Because you're merely collecting taxes for the authorities, the objective is that you return as much as you gather or regain the excess to break even.

If your firm only offers VAT-exempt items or services, as we'll see in the next section, you won't be able to register for VAT because you're a VAT-exempt enterprise. If you satisfy the threshold criteria, you must register for VAT even if you are partly exempt, as you sell certain exempt items or services and others that aren't.

The VAT signup limit or ceiling in the UK is £85,000 at the time of writing, which means that regardless of the business type, if you generate annual sales greater than the amount, you must apply for VAT.

Alternatively, even if you know you won't achieve the threshold, you can willingly apply for VAT so that you can reimburse the VAT you pay to other firms, passing the fee on to your consumers.

If you registered for VAT as a business, you might ask, "how does claiming VAT back work?" the next section explains how you can claim the VAT back in the UK.

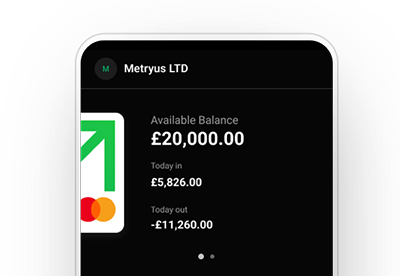

Already running a business? Handle money and accept payments in one app.

Claiming VAT

VAT Refunds: VAT-registered enterprises are entitled to a refund of the VAT they paid on business costs. They may also be able to reclaim part of the VAT they have paid on their earnings. Let's have a look at how to do it.

You can get VAT returned if you do the following:

-

You've bought products or services for your company.

-

When a consumer defaults on a payment, you're left with bad debt.

VAT applied to business expenses

Company VAT is frequently imposed when you acquire something for your business. If you're VAT-registered, you can get a refund. This is done by reporting the amount of VAT you paid over a while. HMRC calculates your refund or bill by balancing the amount you've paid against the VAT you've collected (learn more about working out your VAT).

Stock, computers, phones, work tools, and stationery are all examples of business expenses. Client entertainment is not eligible for VAT reimbursement.

When business and personal expenses are combined

Purchases of goods and services that are used both at home and at work may be eligible for VAT reimbursement. This means you'll have to figure out how much of the purchase is tied to your company and then explain how you arrived at that proportion.

When you do not collect VAT

Even if the ultimate product or service you offer is VAT-free, you can claim the VAT back from suppliers. If the final goods or service is VAT exempt, you cannot claim the VAT back.

VAT Relief on bad debts

You have a bad debt upon sending an invoice to your customer paying the VAT on the expected income and then not receiving payment. In this case, you can seek VAT relief. HMRC will refund the VAT on your next tax return. You can reclaim the VAT if the buyer pays later. You may be tempted to ask, "What is VAT relief?". VAT relief can refer to a lower VAT rate or a reimbursement for value-added tax paid on bad debts.

What items are exempt from VAT?

Even though the vast majority of goods and services in the United Kingdom are subject to a 20 per cent value-added tax, many things are subject to a lower VAT rate or are completely exempt from VAT. If you only trade in exempt or out-of-scope goods or services, you will be considered a VAT-exempt enterprise and will not be able to register for VAT. You will also be unable to claim VAT credit for items acquired for your firm if you are operating as an exempt business.

All health services rendered by dentists, registered doctors, pharmacists, optometrists, and other healthcare providers, for example, are VAT-free. They may need taxable services to run their firm, such as hiring a bookkeeper or accountant for their financial department. In that instance, the healthcare provider will be unable to recoup the VAT paid to their accounting firm.

When a product or service is exempt from VAT, it is usually because it is regarded as a necessary good or service. Every government that supports VAT has a VAT exemption list. In the UK, the following things are VAT-free because they are exempt or "out of scope":

-

Contributions are made to a charity with no expectation of receiving anything in return.

-

Credit loan granting.

-

Sports activities.

-

Educational activities.

-

Certain medical procedures.

-

A fee imposed by law, such as the congestion charge in London.

-

Grants or licences are used to occupy land, buildings, or property.

-

Hobby sales.

-

Insurance.

-

Stamps for postage or services.

Although VAT rules vary by country, the vast majority of countries do not impose VAT on bank transactions. Other fees may apply, but the bank rather than the government imposes them. In the United Kingdom, bank charges are exempt from VAT.

Reduced-rate items

A low 5% VAT is applied to certain goods classed as reduced-rate items. If you offer reduced-rate and exempt items, you must still sign up for VAT once your sales exceed the threshold. Thus, your business is partially exempt.

You are not a partly exempt business if you do not offer any exempt commodities but sell a lot of reduced-rate items. You're just an ordinary company that sells a lot of low-cost items or services.

The following items are frequently discounted:

-

Car seats for children.

-

Energy.

-

Health.

-

Heating.

-

Maternity supplies.

-

Mobility aids.

-

Power for private and residential usage or by a charity for non-commercial use.

-

Products and services that provide protection.

However, VAT on electricity for small businesses that don't consume much power is fixed at 5%.

Zero-rated VAT items

Zero-rated items get a 0% rate attached to them. Zero-rated VAT items are deemed to be crucial components of a supply chain, and hence the zero-rate VAT renders them less expensive to purchasers.

No matter which goods or services you sell, if you don't sell any exempt items but sell a lot of reduced-rate or zero-rate VAT items, you are not considered a partially exempt business. Here, you can recover all input taxes you pay to suppliers.

The goods or services below are zero-rated items:

-

Clothes for children.

-

Books, brochures, leaflets, pamphlets, and other publications.

-

Medications on prescription.

-

With a few exceptions (alcoholic beverages and ice cream), food and drink.

-

Animals, vegetation, seeds, and animal feed, to name a few.

-

Charity shops sell donated items.

Some 0% business VAT items are important for the production of standard-rate things that must be taxed at a higher rate. When it comes to restaurants, this is frequently the case, as raw food and drink components are frequently zero-rated, but ordinary VAT must be applied to the finished product.

It's crucial to understand that zero-rate is not equally exempt. Even though zero-rated items are VAT-free, they are nevertheless a tax rate that must be recorded in VAT accounts and reported in VAT returns.

If you sell a mix of zero-rate and reduced-rate items, for example, you must still include the net value of the transaction in your VAT-taxable revenue.

Available on Web, iOS, and Android.

Difference between VAT exemption and 0% VAT

Exemption from VAT is not the same as zero per cent VAT. There is no additional charge applied to the original sales price of zero-rated or VAT-exempt products, although there are some significant changes.

Zero-rated items are technically still taxable, although VAT-exempt products are not. Taxable turnover, unlike sales of tax-exempt goods, includes zero-rated items and services. The sale of zero-rated goods should also be included in your VAT account, while the sale of non-taxable goods should only be included in your taxable accounts.

Pros and Cons of VAT exemption

The majority of businesses have little control over whether the things they acquire or sell are exempt from VAT. The type of your company has a significant impact on your decision-making process. However, VAT exemption may seem like a win for your customers, but how does VAT affect a business? Below is all you should know about the pros and possible cons of various business types.

VAT-exempt businesses

If you fit into the VAT-exempt class and hence are unable to register for VAT, you will profit from the following:

-

You can save money on the things you buy for your business if your source is also a VAT-exempt company.

-

You don't have to charge your clients VAT, so you can offer lower prices.

-

There is no requirement to keep VAT records.

-

There is no requirement to file VAT returns.

-

There is no effect on cash flow.

There are certain disadvantages to being VAT-exempt:

-

You can only reclaim VAT paid to a VAT-registered business for products or services if the tax is below a specific threshold.

-

Having a VAT registration number can help your business gain credibility, but after you've established that you're VAT-exempt, it's a moot matter.

Partially exempt businesses

If you're partially exempt, things get a little trickier since you market both non-taxable and taxable goods or services. Only exempt or out-of-scope things are taxable; therefore, you must still account for your zero-rated, reduced-rate, and standard-rate items in your VAT records.

The following are some of the advantages that partially exempt firms enjoy:

-

You may be able to reclaim VAT paid to VAT-registered businesses for products or services.

-

When VAT applies to your products, they appear more legitimate and seasoned, broadening your options when it comes to who you may buy from and sell to.

-

Having a VAT ID on your website might help your company stand out, especially to larger companies.

Some of the disadvantages that partially exempt enterprises encounter are as follows:

-

VAT records must be kept, with distinct records kept for VAT-exempt vs. non-exempt purchases and sales.

-

You'll have to file VAT returns, which might wreak havoc on your cash flow.

-

Including VAT in your sales will raise your prices and may repel buyers.

-

If you charge customers more VAT than you pay during purchases, you'll have to remit the difference, which could hurt your finances if it's a substantial lump sum.

Businesses that primarily sell zero-rated items

If you sell mostly zero-rated items and you're over the threshold, you can request a VAT exemption to avoid having to deal with the paperwork. If you assumed you'd briefly exceed the VAT registration limit but remain below it at the end of the year, you are eligible for a VAT exemption.

When compared to the possibility of reclaiming VAT paid on taxable supplies or services, you must decide whether the time spent on VAT documentation is worth it.

How to register for VAT in the UK

In a rolling 12-month period, you must register for VAT if your taxable turnover reaches £85,000. Many businesses can register and sign up for a VAT online account through the Gov.UK website. Other companies need to register through the postal service. To register, you'll need to supply information like your business's activity, bank account information, and revenue. Within 30 working days of registering, you should receive a VAT registration certificate.

How to file for VAT exemption

Before seeking out how to apply for VAT exemption, make sure this is the proper path for your company before you take it. Those who are VAT registered can claim the VAT back on their sale costs. Applying VAT to your sales, on the other hand, may hurt your clients, putting your rates out of their reach. Therefore, VAT-exempt status might be better for your business, depending on its nature.

If you want to apply for VAT exemption, go to the Gov.UK website and fill out the registration form VAT1.

Conclusion

If you run a firm that does not offer any taxable products or services, you can easily claim VAT exemption. Nevertheless, you may have to purchase some taxable items in order to continue your business.

If you are a partially exempt firm, VAT exemption is more difficult and necessitates rigorous record-keeping as well as more complicated techniques for filing your VAT return. You may want to weigh the inconveniences and advantages before seeking an exemption.

If you own a VAT-registered business that primarily sells reduced-rate or zero-rated goods, you can request for VAT exemption and might be given one if your circumstances are judged acceptable.

The pros and downsides of VAT exemption are numerous, and the best option for your enterprise is dependent solely on your specific circumstances. Think about hiring an accountant once you've gone over all of the laws and regulations on your own. A good accountant will help you to verify that you're following the necessary processes and avoiding any penalties.

Back to Blog

Back to Blog