If you’re a small business with big ambitions taking steps to improve your business credit score is a must as you’re likely to need financial support at some stage in your journey. Whether in the form of loans, financing or other lines of business lending. But if you’ve got a low credit rating, you might find that some doors remain closed.

What counts as a good business credit score?

To future-proof your business, it’s a good idea to keep a close eye on your business credit score, even if you’re just in the early stages of a start-up. Typically, you will be assigned a number between 1 and 100 which designates your value — or potential risk — as a loan candidate. Those with low credit scores are seen as having ‘bad’ credit and will find it difficult to secure financial support. On the other end of the scale, those with high or ‘good’ business credit scores will find more opportunities available to them.

So what counts as a good business credit score? Well, the exact bracket will vary between vendors, but most experts suggest that those in the top 20% — a score of between 80 and 100 — will be able to access the best deals. With a good score, you won’t just be able to borrow more money, you’ll also be able to negotiate more favourable terms for your loan, such as lower interest rates.

What is the difference between a personal and business credit score?

To begin with, it’s important to understand the difference between personal and business credit scores. If you’re a sole trader, a potential lender will likely want to study your personal credit history before agreeing to a loan. Similarly, if you’re a small business owner starting from scratch, you might find it difficult to secure initial funding if you have a low personal credit score. Typically, though, your business credit is a separate entity, and you’ll need to take certain measures to build up your score.

Several factors will affect your business credit score, including but not limited to length of time in business, size of company, industry and location, annual revenue, company accounts, and repayment history. But thankfully, it’s not a figure set in stone. There are many steps that you can take to improve your credit score and get a better deal on finance for your business.

How to improve your business credit score

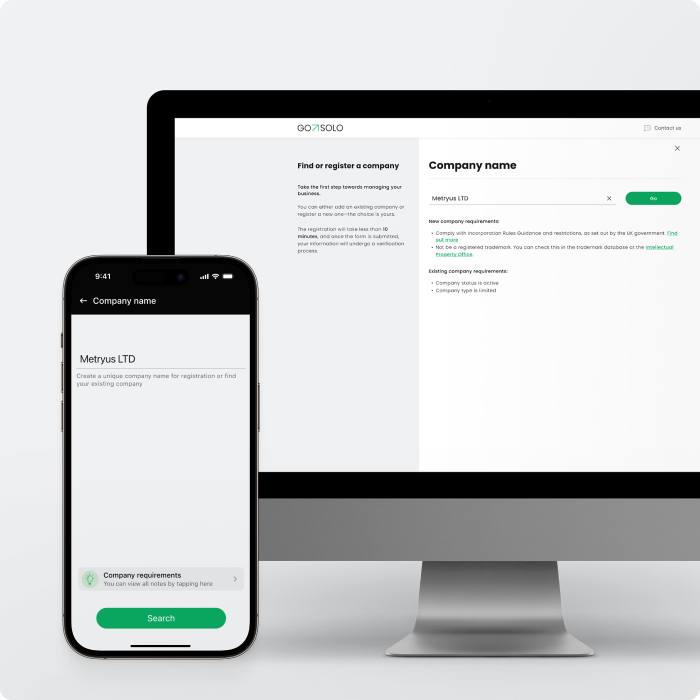

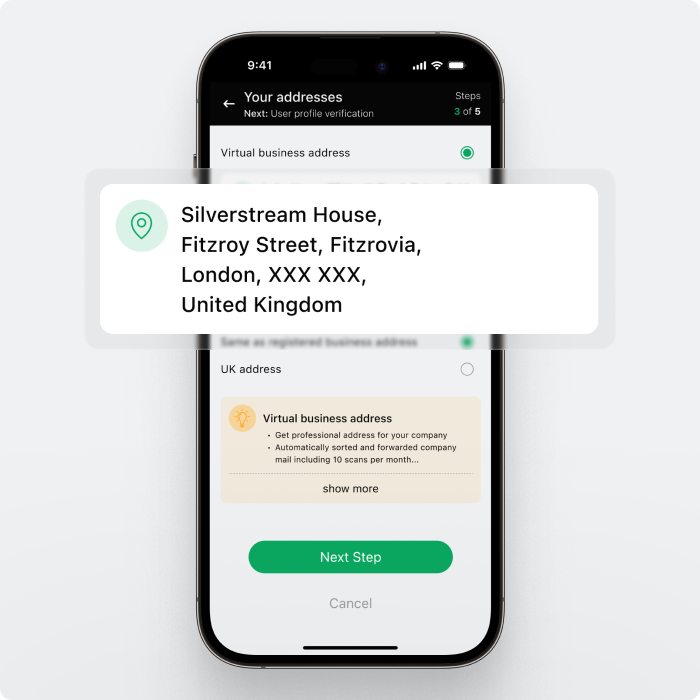

The first step to improving your business credit score is to ensure that your business and personal finances are kept separate from each other. Having a GoSolo Business Account means you can set up a Limited Company and have a separate Business Account quickly and easily, which enables separation. You should make sure that there is no crossover between the two types of records, and try to avoid financing options that require your credit score wherever you can. Although this won’t always be possible — particularly if you’re just starting — you can still minimise the relationship between your business and personal finances by keeping detailed, separate records.

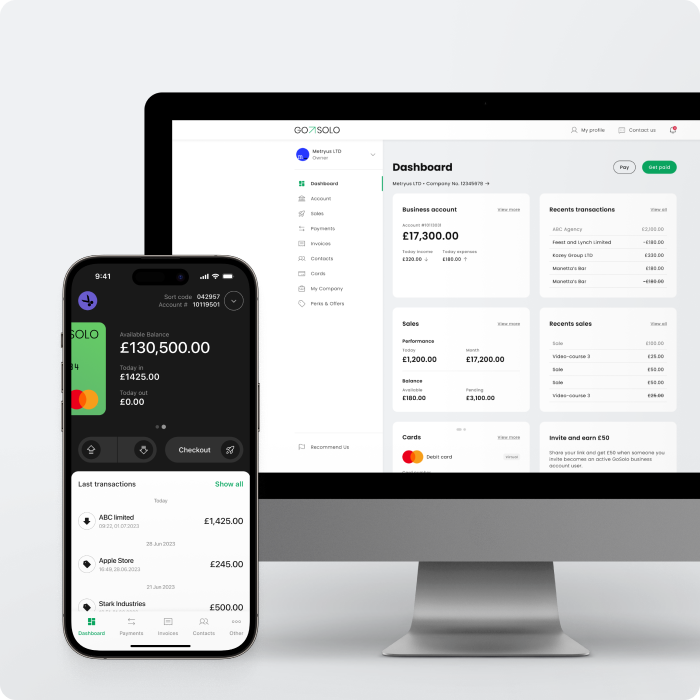

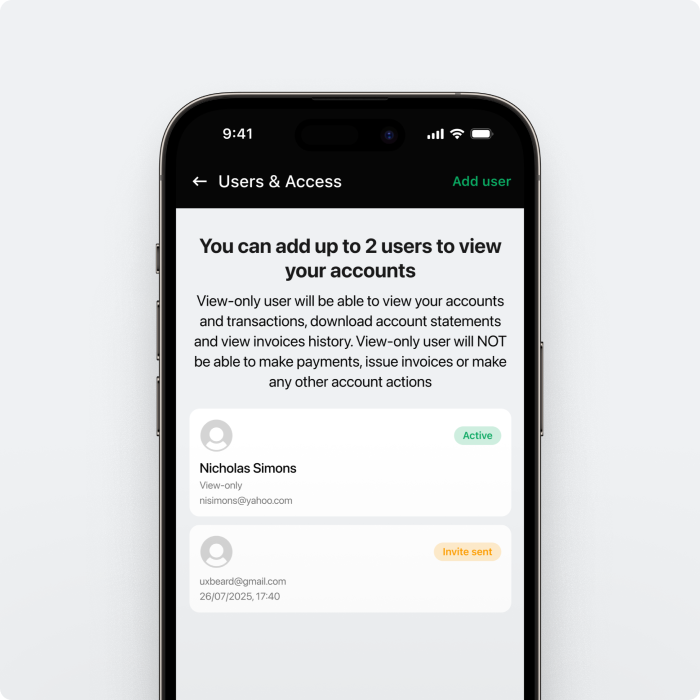

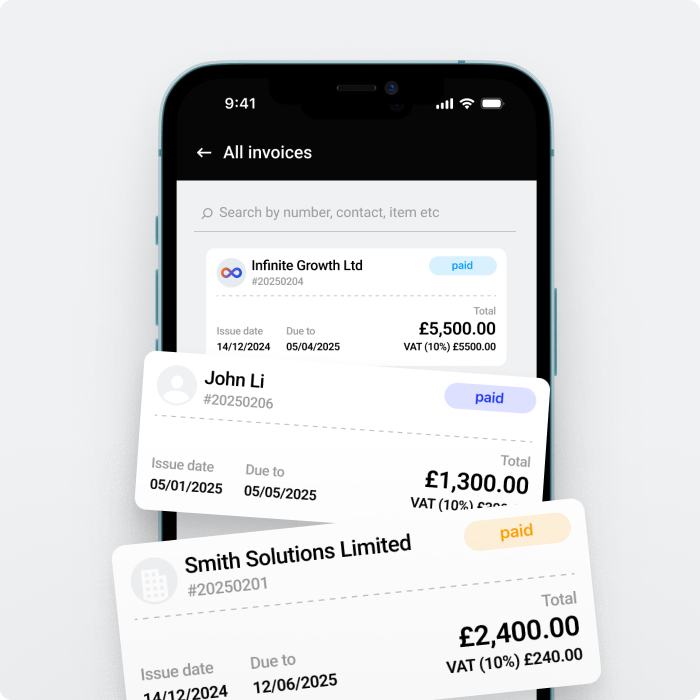

The next step is to make sure that your accounts are always kept in good order, and that bills and invoices are always paid on time. Maintaining a history of timely payment is one of the best things that you can do to improve your credit score, making you an appealing prospect to potential lenders. A GoSolo business account can help you keep track of your outgoings, and it’s easy to grant third-party access to an accountant to manage things on your behalf.

Another great tactic is to take out a small loan — or a business credit card for small expenses — and ensure that any debt is settled swiftly and with minimum fuss. Over time, this will build up your repayment history and improve your credit score. But be sure not to apply for too many different lines of credit — a history of excessive loans can reflect badly as well.

Be careful who you do business with

Finally, remember that your business credit score isn’t just about your company — the individual scores of any partners, vendors, or suppliers will also have an impact on your overall credit report. So make sure that you do plenty of research and try to minimise contact with companies which might reflect badly on your business as a whole.

The right financing can make or break any business, and you might one day find yourself in a situation where the fate of your company hinges on your credit score. But with these tips, you can take steps to ensure that bad credit will never stand in your way.

A GoSolo Business Account helps solo entrepreneurs and small businesses manage their finances easily to help ensure their credit score stays high.

Already running a business? Handle money and accept payments in one app.

Back to Blog

Back to Blog