So you’re ready to get started on your business journey? Whether you’re a resident or a foreign national living abroad, there are plenty of benefits associated with launching your company in the UK. But taking the first steps can feel overwhelming at times. This handy guide will give you an overview of everything you need to know.

Do you have a plan?

Before you start, you’ll need to write a business plan. Essentially, this serves as a sort of ‘road map’ that outlines where your company is headed — and how it’s going to get there. While it’s not a legal requirement to have a business plan in place before you launch, experts strongly recommend that you get the details drawn out first. Plus, if you want to apply for funding or seek investors at any stage, you will need to show proof that your company is built on solid foundations.

The legal structure for your business

Next, it’s time to select a legal structure for your business. In the UK, the options are typically sole trader, limited company, partnership, or limited liability partnership. The first option is ideal for freelancers or anyone setting up on their own, such as tradespeople or small businesses that only require one member of staff. If your business falls into this category, this is the simplest way to set up a company and start trading. Or, if there are two people involved, a partnership is a good way to keep the simplicity of sole trader accounting but split the responsibilities in two.

Division of responsibility

For larger businesses with multiple members of staff, the most common structure is a limited company — a legal entity presided over by owners and directors. In this case, any money earned belongs to the company itself, and individuals will be paid a salary from that pot. Meanwhile, a limited liability partnership operates in the same way, but with responsibilities shared between partners.

Available on Web, iOS, and Android.

It's time to act

Once you’ve decided on your legal structure, it’s time to register your company. If you’re doing this independently, you’ll need to apply to Companies House with the correct legal documents along with details of any directors, shareholders, and guarantors. You’ll also need to prepare a ‘memorandum of association’ and ‘articles of associate’ that will govern how your company is run.

Easy start with the simple GoSolo approach

But if all that sounds like a bit of a headache, don’t panic. Many digital banking services, such as the GoSolo Business Account, will take care of all the details on your behalf. So all you have to do is hand over your details and your business will be registered with Companies House on your behalf. Amazingly, how it works: no need for expensive agencies or in-person meetings, just a simple and easy way to launch your business in the UK.

External funding and investment

Now that you’ve set up your business, you’re ready to get started. If you’re hoping to seek external funding or investment, this is the time to start looking. In the UK, you might want to consider a Start-Up Loan — a government scheme which loans sums of up to £25,000 at a fixed interest rate of 6% per annum. Or you could consult with an angel investment scheme such as the UK Business Angels Association, which connects would-be investors with entrepreneurial projects nationwide.

Conclusion

As you can see, opening a business in the UK is not without its challenges, and there are certain hoops that all entrepreneurs will have to jump through on their way to success. But with robust financial support, generous tax incentives, and one of the strongest start-up communities in Europe on offer, it’s a decision that will pay off in spades.

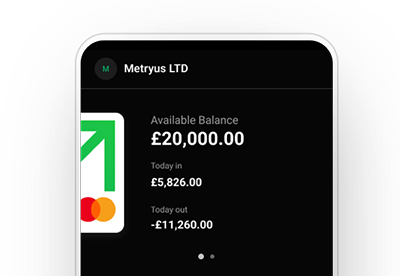

Already running a business? Handle money and accept payments in one app.

A GoSolo Business Account can help small businesses in the UK manage their finances easily, pay on a Mastercard debit card, and help them save for taxes, invoices, and potential future outgoings. Get your journey with us!

Back to Blog

Back to Blog