“What can I claim as a business expense?” You probably found yourself asking as you prepared tax filing or selected which receipts to toss in the rubbish.

Claiming business expenses is a thorny matter for many founders, particularly when preparing tax filings without the oversight of an accountant.

The HMRC does not explicitly list each allowable expense for ltd companies. When in doubt, founders have to apply reasonableness and fairness to mitigate unfairly lessening their tax obligation.

Still, claiming all allowable expenses is vital. Failure to report on deductible expenses for a limited company can eat into the earnings.

Let’s uncover limited company expenses in the UK. Get an unambiguous answer on items to subtract and not subtract from the earnings.

What are business expenses?

They are charges stemming from the activities of the business.

Aside from necessary expenses, businesses pay for other things that may not be deemed essential by the HMRC. That’s why allowable expenses are costs businesses can deduct from their revenue to arrive at their profit, which they settle tax on. The expenses don’t form part of the taxable profits.

A retail store must purchase supplies from wholesalers. Before reselling the products, the store typically raises the price to make a profit. The store may deduct the merchandise costs when filing taxes, meaning they only pay tax on the generated profit.

What expenses can I claim as a limited company?

The HMRC places exceptions and limits on allowable expenses, and it helps to learn about them. For instance, while a pizza restaurant can deduct expenses associated with delivering pizzas to homes, they can’t claim expenses incurred if their employees rank up motoring fines for traffic offences. Similarly, while a business may claim costs associated with their end-year office party, there is an annual limit of £150 per head.

In some situations, a worker may simultaneously incur individual and business expenses as they discharge their duties. For instance, they may be travelling abroad only to take a detour for a couple of days for leisure activities. In this context, it’s improper to add the employee’s holiday break expenses to the work trip’s accommodation costs.

The basic rule is that businesses are entitled to claim any expenses for required and necessary functions. The money must be exclusive or entirely used for the interests of the enterprise. This distinction is important to remember.

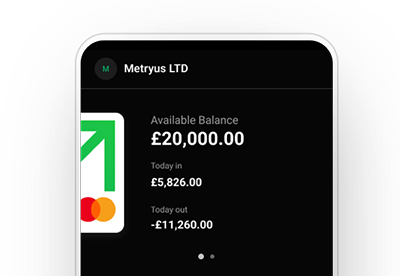

Already running a business? Handle money and accept payments in one app.

9 Common Allowable Business Expenses

Let's pore over 9 LTD company expenses to discover charges that may be deducted when computing the firm’s taxable profits:

1. Charitable donations

One of the most surprising allowable business expenses for limited companies is charitable donations. The HMRC authorizes enterprises to reduce their taxable income on donations such as cash, shares, employees’ time, sponsorships, stock items, equipment, property, or land. Donations must be made to a legally recognized charity.

2. Accountant charges

Accountancy fees are on the list of claimable recurring limited company business expenses. But costs incurred in preparing a personal tax filing may not be exactly claimable. Limited companies can also claim other professional costs for business purposes, such as hiring solicitors, surveyors, and architects.

3. Advertising, PR, and Marketing

When claiming business expenses, it's noteworthy to include costs incurred for promotion, publicity, and marketing. Firms may further claim payments made for their website upkeep, free trial samples, bulk mail ads, directory ads, newspapers advertisements, etc. Costs incurred for public relations services are deductible.

As a side note, sole-proprietors can claim subscriptions to professional journals and membership fees to trade bodies governing their trade.

4. Business travel accommodation costs

As long as the costs are not exorbitant but fitting, the HMRC allows enterprises to list accommodation expenditures for the employee’s company travel.

5. Insurance policy costs

Limited companies can claim expenses for maintaining insurance policies as long as they shield business operations. Some insurance covers include indemnity, equipment breakdown, product liability, employer’s liability, public liability, and more.

6. Mileage

Employees can claim mileage allowance for using their vehicles for business trips. The costs incurred for reimbursing employees for the use of their cars for business purposes may be claimed.

For the 2021/2022 tax year, the HMRC has set the allowance rate at 45 pence for cars and cargo vehicles max 10,000 miles and 25p for additional miles past the 10,000 mark. Fully electric cars qualify for an allowance rate of 4p, 24p for motorcycles, and 20p for bikes.

Note that workers can’t request mileage allowance for commuting to their primary office. For company-owned cars, the limited company can claim expenses incurred for insurance, servicing, fuel, and repairs.

7. Expenses for staff events and Christmas parties

Companies that host annual events such as Christmas parties may enjoy tax-free benefits under certain conditions. Workers may attend with an extra partner, but expenditure per attendee should be fair, not exceeding £150 per person + VAT.

Now, this limit applies for the entire year and can be split between various events. It covers any costs associated with the party, such as accommodation or conveyance. Businesses can also claim the cost of the entire party provided that it’s predominantly meant for staff, not just senior fellows. Should the £150 limit be exceeded, the entire benefit is taxable.

8. Equipment costs

When claiming expenses as a limited company, it’s permitted to claim equipment costs incurred to purchase furniture, scanners, computers, software, etc. Personal use of the equipment must be kept to a minimum.

9. Medical insurance, dental, eye tests

What rules apply to medical treatments?

Only one medical check or health screening per employee is exempt once a year.

Additional medical treatments and insurance payments are exempt for diseases or injuries that result from the employee’s work. Businesses can claim not more than £500 for medical treatment costs incurred in helping their employees return back to work.

If the health and safety legislation requires eye tests for employees who use screens, they are exempt only if prescribed during working time.

Contact lenses and glasses may be part of the limited company expenses list if the employer avails them for screen use. Treatments for overseas employees working outside the UK are exempt too.

If the limited company reaches into a salary sacrifice arrangement with employees, they may not report on the employee’s medical insurance or dental treatments.

Learn more about HMRC claimable expenses

Other common expenses on the allowed business expenses list not covered here include:

- Capital allowances (Enterprises may deduct all or part of the costs for purchasing equipment, machinery, and vehicles).

- Regular office purchases, e.g., stationery

- Non-cash gifts worth less than £50

- Start-up/formation expenses

- Clothing outlays for uniforms, costumes, and PPEs excluding daily wear

To learn about more costs from the HMRC, consider referencing their A to Z limited company expenses list and their guide on expenses for the self-employed.

All in all, keep accurate records of all business expenses. If you’re using GoSolo’s business bank account, it’s easy to go over your account history from the app or download the statements

Available on Web, iOS, and Android.

Frequently Asked Questions

Here are some FAQs on company expenses:

1. What are examples of non-claimable costs?

Businesses may not claim payments to purchase business premises. They can’t further deduct charges associated with event hospitality meant for entertaining customers, potential prospects, and suppliers.

Other routine non-claimable costs include:

- Remittances to political parties

- Charity donations

- Gym membership costs even as personal medical deductions

2. What is working from home expenses for a limited company?

The HMRC discloses that persons working from home may claim some portion of their costs on electricity, council tax, mortgage interest, rent, internet costs, telephone, and heating charges. But the costs need to be computed reasonably.

For instance, assume that the electric bill for a five-room home is £500 per year. What should be the allowable expense a director working from home should deduct?

All rooms may be assumed to have used the same electricity. That works to £100 in energy costs per room.

Next, the director should consider the number of chambers allotted for company use and hours spent working from home.

If they worked two days a week from one room, it’s only plausible to claim £28.58 in electric costs.

Back to Blog

Back to Blog