Perhaps more than ever before, small businesses are looking for ways to cut costs and make savings wherever they can. And when it comes to your expenses, claiming tax relief is a great way to reduce your operational costs.

If you or your employees travel a lot for work-related reasons, mileage allowance relief can make a huge difference to your outgoings overall.

What is mileage relief — and how can you claim it for your business?

In the UK, current regulations state that any costs associated with running a business are tax-free. So if you use your vehicle for work purposes, mileage relief exists to meet these requirements.

Typically, employers make mileage allowance payments, or MAPs, to their employees to offset the costs associated with business mileage.

But if you’re self-employed — or a small business owner using your vehicle for work purposes — you can claim relief at the end of the tax year.

What mileage qualifies for relief?

Of course, not all journeys qualify for mileage relief. According to HMRC guidelines, trips that fall within the following categories count towards your total:

- Journeys to meet with clients.

- Travel from your workplace to another location as part of your working day.

- Travel to a temporary workplace, such as a business event or conference location.

To give an example, if you travel regularly across the country to attend meetings in different locations, you can claim mileage relief on these journeys. But if you commute to work from your home every day, you cannot claim for those trips.

Similarly, if you are asked to complete a work-related task while making a personal journey — and no detours are involved — those journeys will not be eligible for relief.

Your employer and you

In 2022 HMRC’s mileage rates for cars and vans are set at 45p per mile for the first 10,000 miles and 25p thereafter. Of course, employers are not obligated to pay all or even any of these costs, but as they represent a tax-free expense, many choose to factor MAPs into their accounting.

If employees do not receive MAPs from their employer, they can claim the allowance from HMRC instead. But what about small business owners and the self-employed? The good news is that everyone is eligible for mileage relief. And while it might involve some extra steps in your accounting process, it’s certainly worth it — particularly if your work involves a lot of travel.

Include it in your self-assessment tax return

On page 4 of your Self Assessment tax return, you’ll find a section for expenses — this is where you’ll need to enter any claims for mileage relief. It’s worth noting that this negates your ability to claim the £1,000 trading allowance, so you should only submit a claim if the difference makes financial sense.

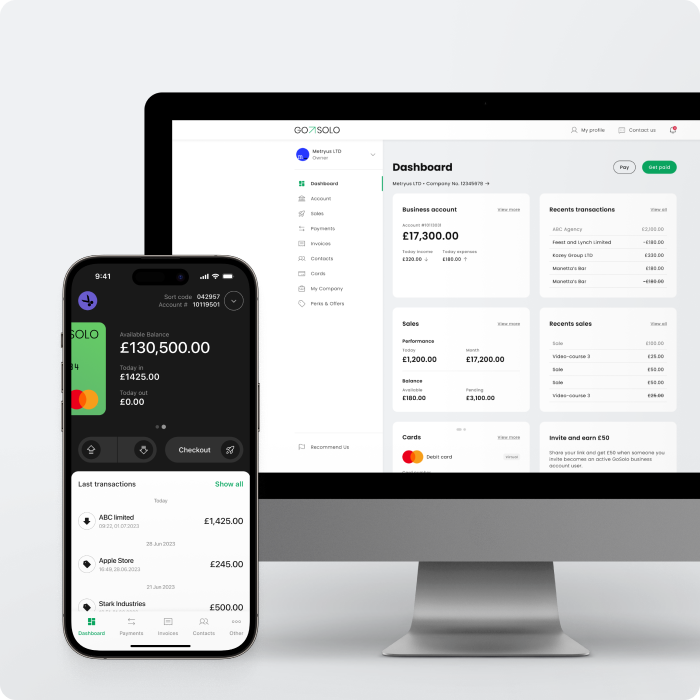

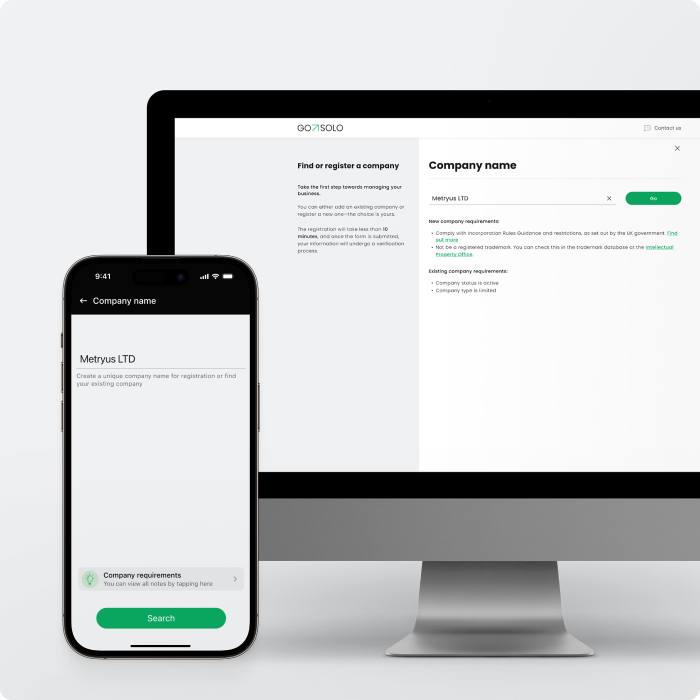

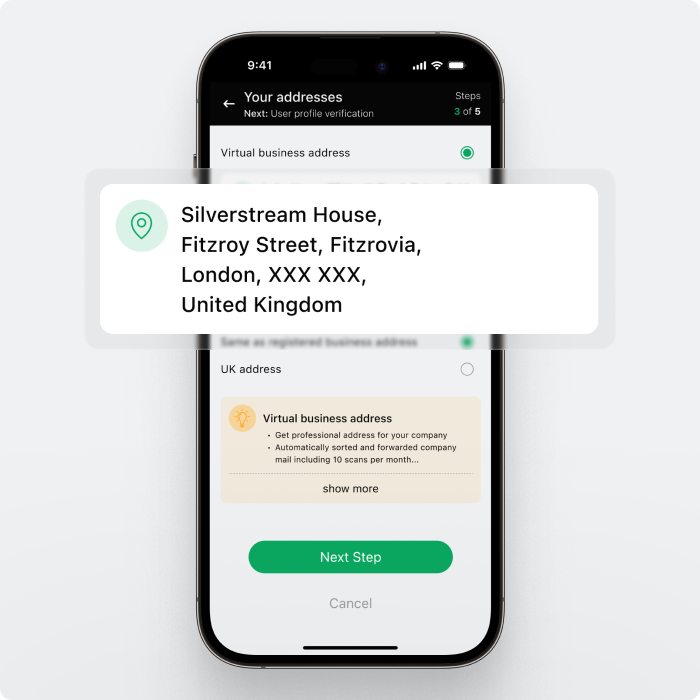

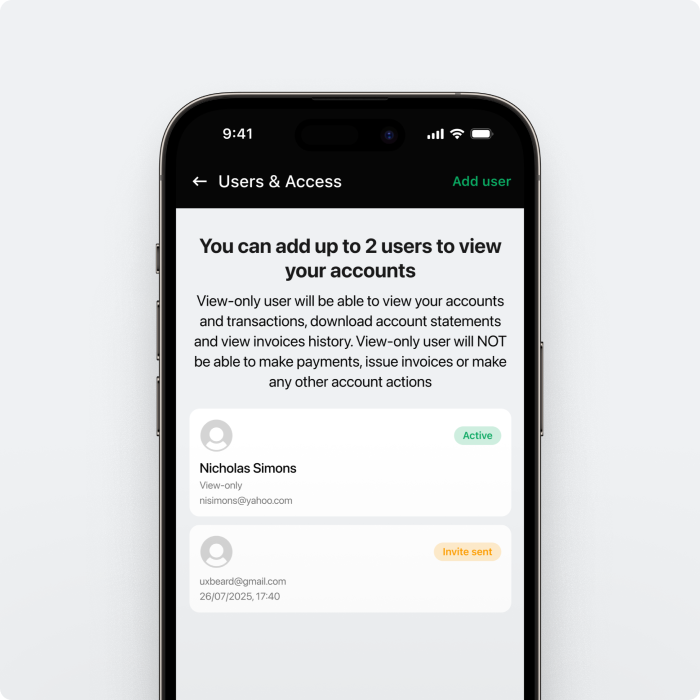

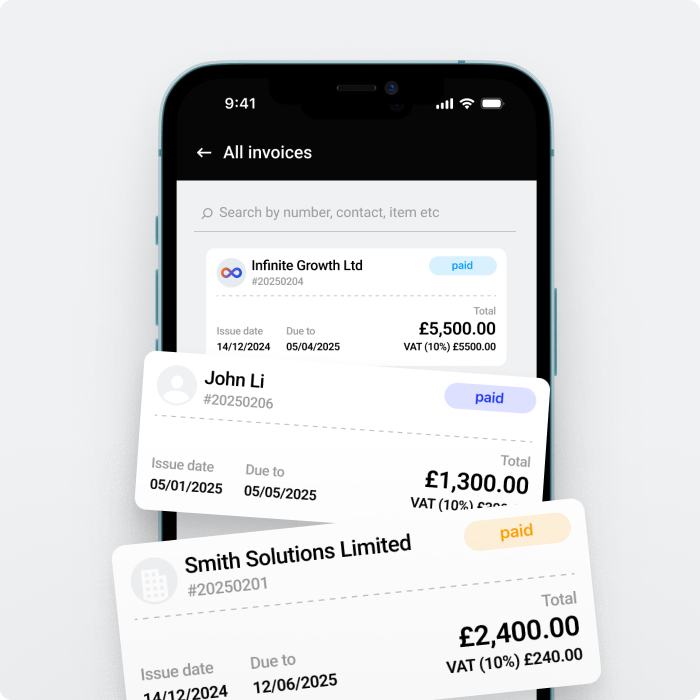

If you struggle to keep track of your expenses, a GoSolo Business Account breaks down the process, offering a simple way to monitor and manage your outgoings — and claim back any relief owed. You’ll also need to keep a record of your journeys, detailing the distance travelled, the dates and locations of each trip, and the total mileage allowance received.

If you’re looking for ways to save money, claiming the right mileage relief is a great place to start. And with the right accounting processes in place, you could slash your tax bills, freeing up more of your income to help your business evolve and grow.

A GoSolo Business Account helps entrepreneurs and small businesses manage their finances easily, pay on a Mastercard debit card, and save for taxes, invoices, and potential future outgoings.

Already running a business? Handle money and accept payments in one app.

Back to Blog

Back to Blog