One of the biggest mysteries for new entrepreneurs is how much they need to kick off their ventures. Failing to reasonably predict startup costs can have far-reaching consequences. Because many entrepreneurs rely on personal savings, you may end up saving less money than needed.

Poor budgeting can leave you with a funding deficit if you’re borrowing the funds. It may expose business owners to predatory and high-interest loan options.

With over 82% of small businesses failing because of cash flow problems, overlooking the cost of starting a business in the UK can contribute towards premature closure.

We’ll be taking a look at the cost of starting a business by going over key expenses. You’ll get all the best money-saving tips for each business cost. Our guide also covers the cost of registering a new business and how to save on registration costs with GoSolo.

Are you setting up a small business in the UK? Begin on the right foot

Before buying your first office desk, you must perform crucial pre-opening activities. The first thing is to come up with a business plan.

It’s a detailed document that should describe your long-term goals, business model, market research, products, services, company background, sales plan, and financial plan. The document lays out all activities before and post-launch, serving as a compass on which costs to anticipate as you start a small business.

You can come up with a custom business plan without any help. Using templates from the following resources can help:

“Can I hire someone to prepare the business plan as I set up a small business?” Yes, you can hire CPAs, business plan consultants, or crowdsource on freelancing sites. The complexity of the startup may influence the final cost, with BrainHive Consulting putting the figure between £500 to £4000.

One key aspect of coming up with a business plan is conducting market analysis and research. It’s also entirely possible to research on your own. (P.S. Talking to friends and family to test out your idea is not enough)

Now, if you decide to hire a professional consulting firm, the costs can vary depending on their preferred research method. Some research methods include online panels, questionnaires, telephone questionnaires, on-the-street questionnaires, focus groups, or published results.

Expert Marketing Companies, a business solution matching service, estimates the cost of online surveys from £750 to £1000. Focus groups can cost anywhere from £500 to £700. You’ll generally get a more accurate quote by speaking to a research company directly.

All in all, make sure that you’re starting a company on the right foot.

How much does it cost to set up a Limited Company?

The first thing to know as you progress towards your launch date is how the whole process of company formation works. Go.UK describes a seven-step process that begins with:

- Determining the best business structure;

- Choosing a name;

- Appointing directors and a company secretary;

- Deciding shareholders or guarantors;

- Preparing company documents: “Memorandum of association and Articles of association”;

- Figuring out company and accounting records to keep;

- Registering a new company with Companies House.

The most straightforward limited company formation is a sole shareholder and director setup. Depending on the business activity, you may not need additional help from an accountant or legal professional.

So, how much does it cost to set up a limited company? Costs vary depending on the registration method:

- Registering by post costs £40 and takes 8 to 10 days

- Web incorporation costs £12

- Incorporation by software costs £10

You can visit the following Go.UK link for further guidance on Companies House fees.

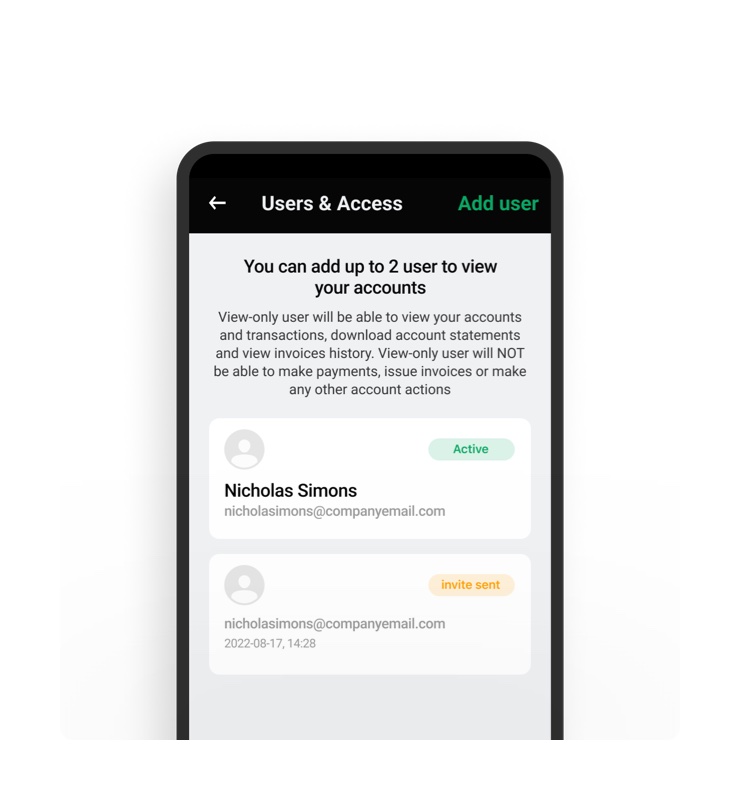

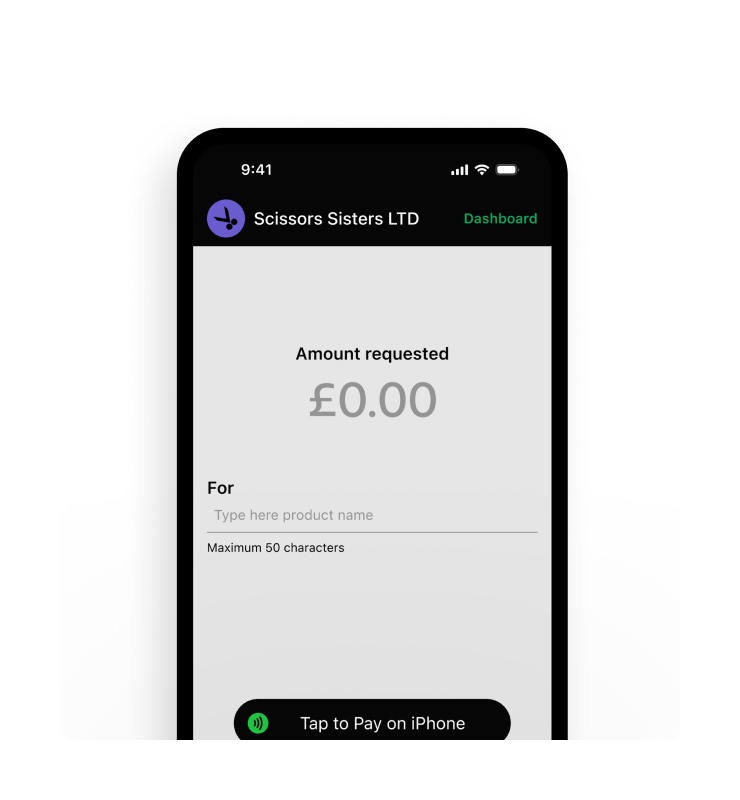

Do you know you can entirely save on the cost of registering a single-shareholder limited company through GoSolo? Learn more about our registration process.

The reality is that many businesses end up spending more than the £12 Companies House fee. It’s often necessary to hire startup lawyers or Certified Public Accountants (CPAs). For instance, lawyers can help with property purchases, reduce claims risk, draft contracts, or set up joint ventures.

Registering a business often entails enrolling for Corporation Tax. An accountant can offer crucial advice about setting up accounting systems to track expenses and payments, making it easy to make calculations come tax time.

The costs for legal and accountancy services are quite variable. If a lawyer charges a reasonable fee of £200 per hour and puts in four hours of work, you may end up paying £800 for their time.

According to Unbiased, accountants may charge as much as £125 to £150 per hour for tax planning and business planning advice. Charges for basic services are cheaper at about £25 to £40 per hour.

It never hurts to speak to professionals. They can help shed light on things to consider when setting up a business. Even one or two hours of their time can prove invaluable.

Registering a company is the first phase of setting up a small business. The next series of costs are business-related. You may need to pay for business premises, office supplies, inventory, payroll, etc.

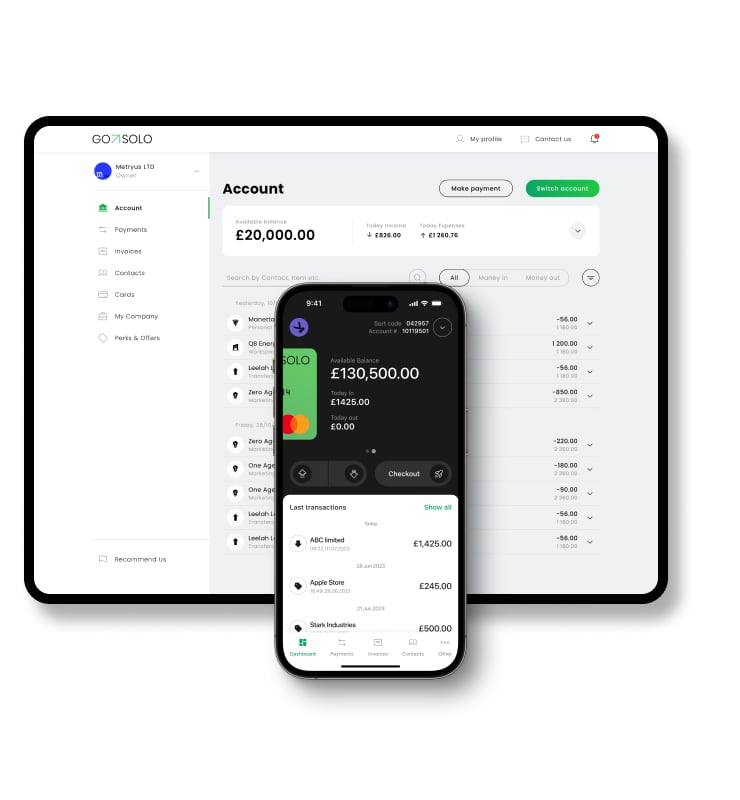

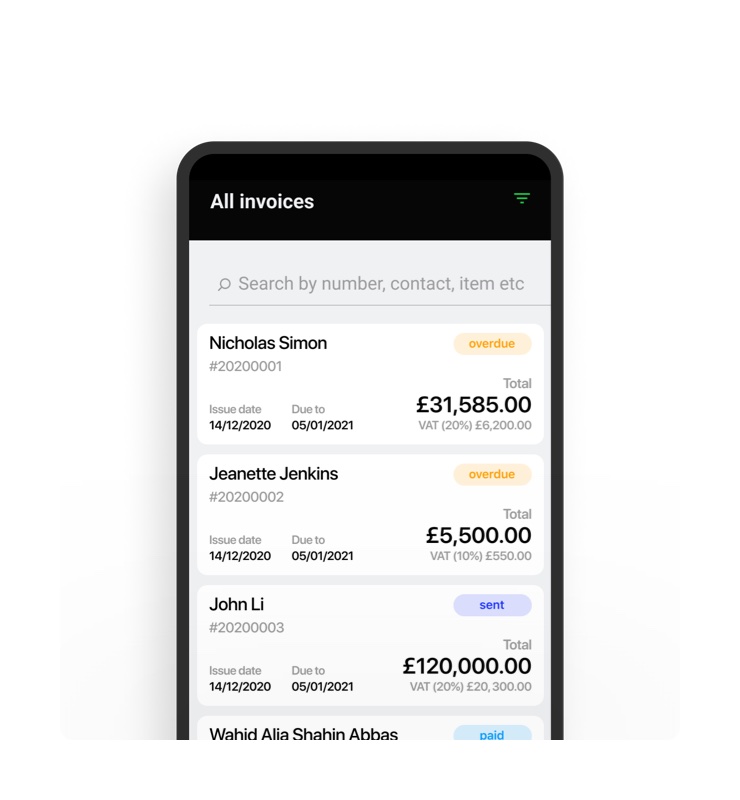

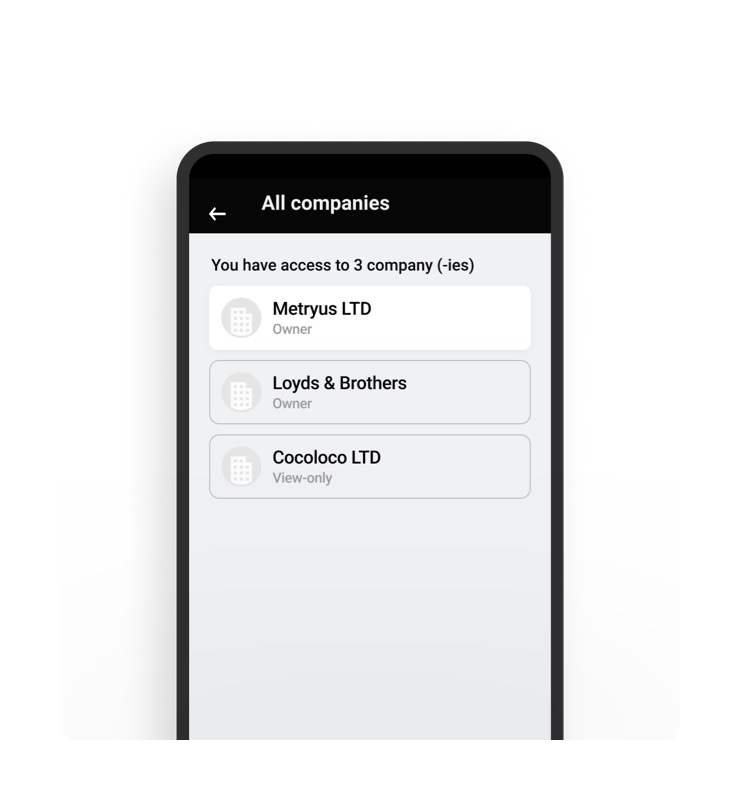

Already Ltd? Manage your business account + admin in one app.

Major business setup costs to consider as you start a small business

As you set up a small business, you must accurately source quotes for the following major costs:

1. Business consultancy

You can hire consultants to help manage all aspects of your business, including IT, marketing, security, and HR. Consultants give crucial management and business advice, accumulated from working with similar businesses. They can review internal mechanisms and offer advice on increasing efficiency. You can even consult at the initial setup of your business.

How much will it cost?

Consultants may use an hourly, project-based, or value-based method to calculate their fees. According to ConsultancyUK, hourly rates may range from £50 for an intern consultant to £300 for more experienced consultants.

How to save on business consultancy

It’s possible to save on consulting fees by being clear about your expectations. You must have a budget in place. Look into the possibility of hiring remote accountants. You can also negotiate the fee down or ask for a trial run before fully committing.

2. Licenses

As you figure out how much it costs to register a company, you should not forget to calculate the costs of business licenses. Local councils award licenses to authorise various business activities. You can use the License Finder to determine the required licenses based on your business type, activities, and location.

How much do licenses cost?

Businesses pay an annual fee that’s dependent on the rateable value of their property. The Valuation Office Agency (VOA) calculates the value by determining the property’s annual market rent. You can use the online VOA service to find property information.

Once you know the rateable value, you can counter-check your local government’s website for the business rates (application and annual fees).

Here is an example of the fee structure provided by the Newport City Council.

How to save on license cost

Receiving a lower evaluation from the VOA may contribute towards paying lower licensing fees. For instance, if you opt for a business premise with lower rents, it may contribute to a lower business rate.

3. Technology & Software

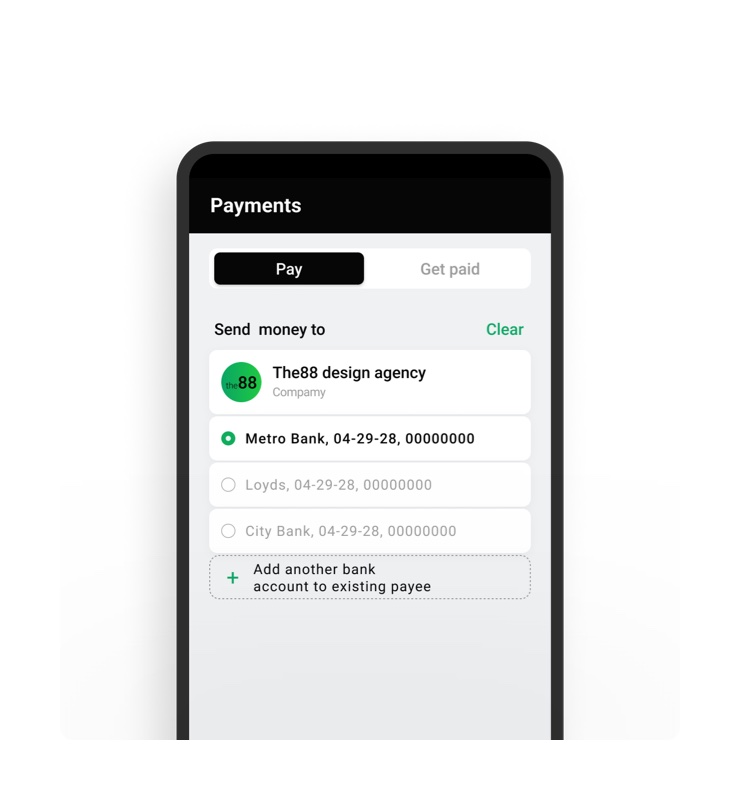

Unless you’re running your business the old-school way, you must account for technology and software when figuring out how much money you need to start a business. For instance, most stores have to invest in a POS system. Additionally, small businesses may need productivity, accounting, payroll, marketing, collaboration, and customer service tools.

How much will technology and software cost?

With most online tools for small businesses, you pay a flat monthly rate. For instance, prices for accounting software start at about £12 per month. With some productivity and collaboration tools, the cost may be zero.

Setting up a point of sales software with all the required hardware may cost about £1000 to £1500 for each till. Complex configurations may cost more. You may also pay a monthly fee for the POS software starting from £20.

It may be handy to set aside a budget of at least £100 for ongoing monthly software subscriptions.

How to save on technology and software costs

- Use all-in-one platforms that provide a lot of features in one place;

- Compare pricing plans for platforms that share the same functions;

- Leverage free resources and open software;

- Negotiate a lower rate for a customised setup.

4. Business Insurance

Insurance provides coverage over unexpected costs arising from unforeseen events. The nature of your business may determine the type of mandatory insurance required.

If your shop has employees, it’s compulsory to have employers’ liability insurance. Owning commercial vehicles means that you also have to pay for motor insurance.

Professional bodies and regulators often require some professions to have indemnity insurance, including lawyers, architects, doctors, and engineers.

How much does business insurance cost?

According to NimbleFins, the average employee’s liability insurance for a single office worker was £61 per year and £213 for trade workers. Businesses paid an average of £118 for public liability cover and £132 for cybercrime cover.

Commercial property insurance may vary depending on the rebuild costs. You may pay about £218 to cover a £200,000 rebuild. Indemnity insurance may range from £45 to £1500 per year.

How to save on business insurance costs

Shop around and compare quotes for each insurance type. You can reduce coverage or work with brokers to find cheaper plans. Companies may offer discounts for insurance bundles.

5. Raw materials, inventory, or equipment

If you’re starting a manufacturing or production business, you will need to invest in raw materials and machinery. Acquiring inventory is necessary if you plan to resale items. Service-based businesses may also need to acquire various equipment and additional supplies.

How much do inventory and equipment cost?

It’s quite difficult to give a baseline value of how much it may cost to invest in the initial equipment, supplies, or raw materials. The cost may highly vary depending on the business type.

The best recommendation is to take into account everything that you may need. Find a supplier and get market quotes.

How to save on inventory and equipment costs

You can follow the following recommendations to save on the costs of raw materials, stock, machinery, and equipment:

- Don’t buy what you don’t need at the moment;

- Compare quotes and try to find the best offer;

- Consider if hiring is a better option than purchasing the equipment;

- Don’t buy the most sophisticated equipment if a basic model can perform the task;

- Check if it makes sense to buy in bulk;

- Start with a low inventory volume to account for low sales during the early month;

- Be willing to negotiate and seek discounts.

6. Office and shop setup

You will need office furniture and supplies if you’re operating from an office location. It’s also necessary to have a dedicated work computer and phone.

If you’re trying to open a shop, you also have to think of all the furniture with any interior decor expenditure.

How much will it cost to buy office supplies or set up a shop?

You can get a decent desk for about £80 to £200. An office chair may set you back about £50 to £250. A completely new monitor and PC bundle may go for £400 to £600. Renewed options may cost as low as £140 on Amazon.

You may need to work with an interior designer if you’re outfitting a pub, coffee shop, office, etc. Interior designers may charge an hourly rate between £30 to £50. You will need to pay extra for design, supply, and installation. Getting a quote is highly recommended as the costs are quite variable.

How to save on office supplies costs

The best advice when it comes to saving on furniture and supplies is to go for mid-range items. Set a budget when working on interior décor projects, or take a DIY approach.

7. Website setup

As you launch a new startup, you may find it necessary to maintain a digital presence. That means that you will need a website.

How much does it cost to set up a company website?

Small business websites with basic functionality may take anywhere from £1000 to £5000 to build professionally. Custom feature websites may cost anywhere from £3,000 to £25,000, based on estimates by Design Box.

Once the website is up and running, you may need to invest in SEO services for a chance to get featured on search engine results. SEO services from small agencies may go for about £500 to £2000. There will be annual domain renewal and website hosting costs.

How to save on website costs

Finding someone to do it at a cheaper rate is not the best advice when it comes to building a website. However, you may cut costs by hiring a quality web developer through a freelancing platform.

8. Rent & Utilities

Your business setup may influence whether you need a retail, office, or industrial facility. The shop location may have a significant influence on the cost of setting up a business. For instance, London (West End) is the most expensive region for prime retail space, with Leeds, Birmingham, and Cardiff coming across as less expensive cities. Additionally, you must account for the cost of utilities and any additions.

How much will it cost to rent a business location?

The best advice when it comes to figuring out rent prices is to start identifying potential business locations. You can do this yourself on sites such as Rightmove or with any local agent.

Reports such as the Annual Rental Cost by Statista provide estimates for the price of high street retail locations. But it may be perilous to use such estimates when figuring the cost of a shop.

The location, business size, and energy use may determine utility costs. UK Power estimated average electricity prices to be £650 — £2,900 for micro and small businesses.

Your business broadband may cost anywhere from £10 to £30.

How to save on rent and utilities

There are several strategies for reducing rent. You can negotiate with the property owner or begin small. It may be worthwhile to consider other ways to sell, such as online or through the phone. You can also start with a pop-up shop or test out your business idea from home.

9. Hiring new staff

SMEs account for about 60% of private-sector jobs. Your business may need new employees too. The startup budget should include the salaries for new staff and account for any costs incurred during the hiring process.

How much will it cost to hire new staff?

You may spend 10 to 30% of the new hire’s base annual salary if you decide to hire a recruitment agency. Hard-to-fill positions tend to cost more, but you’ll either pay 10% or 15% in most cases, which works to a fee of £3,000 to £4500 based on the annual UK salary. The agency performs tasks such as carrying out pre-hiring assessments and interviews.

Even if you are conducting the hiring process by yourself, you may need to pay a cost to publish on job boards. A single post can cost anywhere from £70 to £180.

How to save on hiring costs

You can reduce recruitment costs by leveraging referrals, taking advantage of social media, and posting on free job boards. Many businesses also save by hiring remote and part-time employees.

10. Branding, logos & signage

As you figure out the cost of setting up a company, don’t forget branding expenditure. Branding entails coming up with a brand identity. It establishes brand guidelines such as the communication framework. It further entails creating visual symbolism through logos and custom signage.

How much will branding and signage cost?

Coming up with a professional logo alone may cost anywhere from £500 to £2000. If you need a professional framework that includes other assets and a strategy, you may pay upwards of £4000.

The costs maybe more if you’re working with highly-experienced and top-tier branding agencies.

Now, signage costs vary based on the design and type. On the UK Sign Shop, prices for wall-mounted banners start at £129, £94 for hanging signs, and £396 for projecting wall signs.

How to save on branding and logo creation

You can opt for freelancing platforms to find online freelancers to create a logo and other branding assets. Choose quality professionals and make sure they have an innate understanding of your business.

Available on Web, iOS, and Android.

Additional costs of running a business

Although it may be entirely impossible to list all the costs of running a business, here are more additional costs for your consideration:

- Marketing & advertising expenses;

- National Insurance and pension contributions;

- Stationery;

- Postage;

- Business cards and flyers;

- Travel and accommodation;

- Phone bills;

- Car expenses & mileage;

- Bank fees;

- Training and educational courses;

- Shipping costs;

- Receiving costs & unloading of goods;

- Cleaning costs;

- Complimentary gifts;

- Work uniforms and PPEs;

- Equipment repair and maintenance costs;

- Petty cash fund;

- Food and beverage expenses;

- Property Finder fees;

- Parking fees;

- Employee medical insurance and benefits;

- Business finance fees.

How much money do you need to start a business in the UK - additional considerations

As you strive to calculate how much money you need to start a business in the UK, there are further considerations you should make and helpful things to know:

- You can claim capital allowances up to the allowable annual investment allowance (AIA) for items purchased to start the business;

- As a good rule of thumb, make sure you can cover at least six months of operational expenses upfront;

- There are certain exceptions to paying business rates for home-based businesses, for instance, if you use a small part of the home, such as a bedroom, as an office. However, you must contact the VOA for further advice;

- It’s essential to categorise costs as essential or optional, and make sure that you’re giving priority to expenses necessary to keep your business running;

- Don’t be afraid to ask for estimates to figure out how much everything will cost;

- It’s always essential to overestimate your final calculation, for instance, by 20% more.

You should also overestimate the cost by some percentage points. Always look for opportunities to save money, such as choosing GoSolo as your preferred platform for registering a new limited company in the UK. Aside from free company registration, we also give you a business bank account and a MasterCard for business spending.

Final words

Opening a small business takes a lot of patience, dedication, and hard work. Ensure that you have worked out accurate business setup costs by sourcing for estimates and checking prices for equipment, software, etc.

Back to Blog

Back to Blog