If you’ve ever wished you could get paid just by sharing a simple link, you’re already thinking about payment links for business. In plain terms, payment links let you request and collect money without a card machine, custom checkout, or complex development work. You send a link, your customer taps it, pays, and you’re done.

In this guide, we’ll demystify payment links for business, walk through the main types available, and map which UK business account providers offer each type. You’ll see where you can create payment links that customers can pay once, reuse multiple times, or even enter their own amount. We’ll also share use cases, tips to generate payment links smoothly, and a side‑by‑side view of provider support based on the information available. Finally, we’ll highlight why GoSolo stands out if you want all payment link types in a single account.

What are payment links?

Payment links are short, shareable URLs that take a customer to a secure checkout page. You can paste them into email, text, a chat app, social media, your website, or a QR code. Your customer clicks the link, confirms details, and pays. You get notified, and the funds are processed into your business account according to your provider’s settlement timelines.

Why businesses use payment links

- Fast to set up: You can create payment links without building a website checkout.

- Frictionless: Customers don’t need to call you, share card details over the phone, or log into a special portal.

- Flexible: Great for invoices, one‑off jobs, pop‑up sales, on‑site services, and remote or hybrid businesses.

- Trackable: You see who paid and when, and you can match payments to requests without manual reconciliation.

Common ways to create payment links

- One‑off payment links: Good for individual invoices or one‑time jobs; each link expires after payment.

- Reusable (permanent) links: A single link you can share multiple times, often useful for recurring donations, repeat customers, or social media profiles.

- Open‑amount links (customer‑entered amount): The customer chooses how much to pay (for example, pay‑what‑you‑want, variable service callouts, tips, or donations).

Note: These are industry‑standard patterns for payment links. Specific availability varies by provider; we’ll detail which UK business accounts support each type below.

Business accounts that offer payment links in the UK

Here’s a quick directory of UK business account providers that offer payment links, followed by a short bio for each. Capability specifics (like one‑off vs reusable) are covered in later sections using the provider details available.

- GoSolo: A UK business account platform focused on helping small businesses and entrepreneurs run finances simply. Offers payment links with multiple options in its free plan, with one of the lowest payment processing fees in the UK.

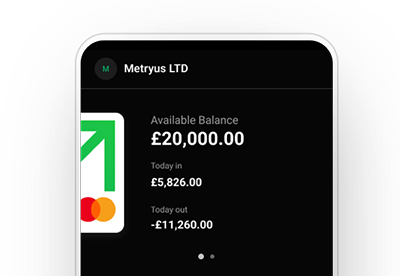

- Starling Bank: A UK digital bank known for app‑based business accounts and real‑time notifications.

- Monzo Business: A UK digital bank offering business current accounts, tools, and integrations suited for SMEs and sole traders.

- Revolut Business: A global financial platform offering multi‑currency business accounts and cards for startups and SMEs.

- Tide: A UK business finance platform providing accounts, invoicing tools, and payment features for small businesses.

- Mettle (by NatWest): A UK business account brand from NatWest aimed at sole traders and small businesses.

- Wise Business: A platform for international banking needs, known for multi‑currency accounts and transfers.

- Airwallex: A global payments platform offering business accounts, international transfers, and online payment acceptance for SMEs and scale‑ups.

- ANNA Money: A UK business account app with invoicing and admin tools aimed at freelancers and small businesses.

- Zempler Bank (formerly Cashplus): A UK bank delivering business current accounts for SMEs with digital onboarding.

- HSBC Kinetic: A mobile‑first business banking experience from HSBC for small businesses.

- Countingup: A UK business account that combines banking with bookkeeping tools for freelancers and micro‑businesses.

How payment links typically fit your workflow

You can integrate payment links into your day‑to‑day in several practical ways:

- Estimates and invoices: Send a one‑time link with each invoice. Once paid, the link expires.

- Quick jobs and callouts: Generate payment links on the spot and text them to customers.

- Online and social selling: Place a reusable link in your bio or on product posts; customers click and pay.

- Donations and tips: Share an open‑amount link so supporters can enter any amount.

- Subscriptions or repeat purchases: Some businesses use reusable links for repeat customers if they don’t need full subscription tooling.

We’ll now break down the main types of payment links for business, share common use cases, and show which providers support each type based on the information available.

Payment links for business explained (with provider support)

Type 1: Open‑amount payment links for business (customer enters the amount)

What this is

Open‑amount payment links let the customer enter the amount they want to pay. This is useful when the total varies, you offer pay‑what‑you‑want pricing, or you want to collect tips or donations without creating a separate link every time.

Common use cases

- Service callouts and variable jobs: Charge the exact time/materials after work is done.

- Donations, tips, and pay‑what‑you‑want: Let the payer choose what feels right.

- Flexible quotes: Send a single link, then agree on the amount over chat or on site without reissuing the link.

How this helps you create payment links

- You can create payment links once and share them quickly without recalculating totals.

- You can generate payment links that work for multiple scenarios and still capture the right amount.

Providers offering open‑amount payment links

Based on the provider details available, here’s who supports open‑amount links (where the customer can enter the amount directly):

Provider | Support | Notes

- GoSolo | Yes | Provides a unique pay link tied to your business account that customers can enter an amount into.

- ANNA | Yes | Offers a payment link with an open amount.

Key takeaways

- If you need customer‑entered amounts, GoSolo supports this use case directly.

- You can suggest payment amounts and set limits for your payment links.

Type 2: One‑off (single‑use) payment links for business

What this is

One‑off payment links are created for a single payment. After your customer pays, the link expires. These are ideal when you want precision and control: one link, one payment, no confusion.

Common use cases

- Traditional invoices: Share a link specific to an invoice; once paid, it can’t be used again.

- One‑time project fees or milestones: Collect staged payments as projects progress.

- Event tickets or bookings: Use a unique link per order to prevent duplicate usage.

How this helps you generate payment links

- It’s clear and tidy: every link maps to a specific payment.

- It’s easy to reconcile: your accounting process benefits from clear one‑to‑one matching.

- It helps prevent accidental duplicates: single‑use links reduce the chance of a customer paying twice on the same URL.

Providers offering one‑off payment links

Here’s who supports one‑time, single‑use links based on the available provider details:

Provider | Support | Notes

- GoSolo | Yes | Supports one‑off payment links for single payments.

- Monzo Business | Yes | One‑time payment links expire after payment.

- Countingup | Yes | Quick payment link requests can be created instead of invoices.

- Airwallex | Yes | Can generate individual checkout links for customers.

- Tide | Yes | Each invoice can include a one‑off payment link; also supports one‑time quick links for individual jobs.

- Revolut Business | Yes | Can generate single-use links; you may set link to expire after one use.

- Wise Business | Yes | Offers one-time payment links that expire after use.

- ANNA | Yes | Can generate one-off payment links for specific amounts via the app.

- Zempler | Yes | Supports adding a payment link to invoices – e.g. via partner integration – for one-off payments.

Key takeaways

- One‑off links are widely supported across providers here, making them a safe default.

- If your workflow revolves around invoices, you’ll likely use single‑use links most of the time.

Type 3: Reusable or permanent payment links for business

What this is

Reusable payment links are designed for multiple payments. You can keep the same URL in your email signature, social accounts, website, or QR code. Customers can return to the same link and pay again (subject to how your provider handles tracking and amount settings).

Common use cases

- Repeat customers and subscriptions: Let returning customers pay through a familiar link.

- Social media selling: Put one link in your bio and use it across posts.

- Events and classes: Share one link that works for every participant or session.

How this helps you create payment links

- You create a link once and reuse it, cutting admin time.

- You can scale simple online selling without a full e‑commerce build.

- You can pair a permanent link with a reference system (like an order number) to keep records tidy.

Providers offering reusable payment links

Based on the available details, these providers support permanent or universal links:

Provider | Support | Notes

- GoSolo | Yes | Can generate permanent/reusable links for repeated use.

- Monzo Business | Yes | Offers reusable “universal” links for multiple uses.

- Revolut Business | Yes | Links can be reused or have a limited number of uses.

- Wise Business | Yes | Offers reusable payment links that don’t expire for charging the same fixed amount repeatedly.

- Airwallex | Yes | Multi-use payment links are available.

- ANNA | Yes | A permanent ANNA payment link/QR can be reused anytime.

Key takeaways

- For permanent, multi‑use links, GoSolo, Monzo Business and many other providers support this pattern.

- If your provider doesn’t support reusable links, you can still use one‑off links, but you’ll need to create a new link for each payment.

Choosing the right payment link for your business

A helpful way to decide is to anchor on your most common scenarios:

- Mostly invoice‑driven? One‑off links keep reconciliation neat and clean.

- Selling via social or repeat customers? Reusable links are a time saver.

- Tips/donations/variable jobs? Open‑amount links reduce back‑and‑forth and let customers enter the right figure.

If you need to cover all of the above, choosing a provider that supports every type gives you the flexibility to create payment links for any situation and generate payment links fast when plans change.

How to use payment links in your business

These practical tips help you get more out of payment links for business, no matter which type you prefer:

- Add context to the link: Always include what the payment is for, the amount (unless it’s an open‑amount link), due date, and who to contact for questions.

- Use references: Ask customers to add a reference (order number, invoice number, or name) to help you match payment to records.

- Standardise your templates: Save boilerplate messages you can paste with each link (email, SMS, WhatsApp, or DM). It saves time and reduces typos.

- Share QR codes: Turn reusable links into QR codes for on‑site payments—great for pop‑ups, events, or tip jars.

- Set expectations: If a link expires after payment, say so. If a link can be reused, specify whether customers should choose their amount or use a fixed figure.

- Keep records organised: Even if your provider syncs with accounting tools, keep a simple log of when you create payment links and why. It helps during reconciliation and audits.

Deep dive: provider support by payment link type

Below is a consolidated view for the providers where details are available, grouped by type. Use this to cross‑reference your needs.

Open‑amount links (customer enters amount)

- Supported: GoSolo, ANNA.

- Not supported (requires fixed amount): Monzo Business, Revolut Business, Countingup, Airwallex, Tide, Starling, Mettle, Zempler, HSBC, Wise Business.

One‑off (single‑use) links

- Supported: GoSolo, Monzo Business, Revolut Business, Countingup, ANNA, Airwallex, Tide, Starling, Mettle, Zempler, HSBC, Wise Business.

Reusable (permanent) links

- Supported: Monzo Business, GoSolo, ANNA, Wise Business, Airwallex.

- Not supported: Starling, Mettle, Zempler, HSBC, Countingup, Tide.

Scenarios: choosing payment links for your business

To make this concrete, here are a few day‑in‑the‑life stories that show how each type shines and how you might create payment links in practice.

- The mobile service professional. You run a plumbing business. Jobs vary wildly. Your best fit is an open‑amount link so customers can enter the final total after you confirm it on site. If you also invoice for planned work, keep using one‑off links alongside your open‑amount link. GoSolo supports both approaches, so you can mix and match from a single account.

- The freelancer with clear deliverables. You’re a designer billing per project milestone. One‑off links are your friend: one per invoice, each expiring after payment. This keeps your accounts tidy. GoSolo, Countingup, Airwallex, and Tide all support single‑use links, so you can choose based on the rest of the account features you prefer.

- The community organizer or creator. You collect donations and tips. Open‑amount links reduce friction because donors can choose what to give. For recurring campaigns or a “support me” button, a reusable link saves time. GoSolo supports both. Monzo Business supports reusable links for multiple payments, though open‑amount links are not supported there based on the available details.

- The pop‑up seller. You hold temporary stalls and want a simple “pay here” QR code. A reusable link printed on a sign or sticker is perfect. GoSolo and Monzo support reusable links. If you also take custom orders, having open‑amount support (available with GoSolo) can be handy for deposits or special requests.

How to communicate payment links clearly to customers

- Use friendly, plain language: “Tap this link to pay securely. If you have any questions, reply to this message.”

- Confirm the details: Specify what the payment is for, the amount (unless it’s an open‑amount link), and any deadline.

- Provide a backup: Offer an alternate method (bank transfer, for example) if they prefer.

- Thank them: A quick “Thanks for your payment!” message goes a long way in maintaining good relationships.

Security and trust best practices

- Share links from official channels: Email addresses and phone numbers that customers recognise.

- Keep links consistent: Reusable links should match your brand or business name where possible.

- Avoid sensitive data in messages: Let the secure payment page handle card details.

- Encourage questions: Make it easy for customers to reach you if they’re unsure whether a link is genuine.

GoSolo at a glance for payment links

GoSolo offers all types of payment links in its free business account:

- Open‑amount links: Yes (customers can enter an amount).

- One‑off links: Yes (one‑time payment links for single payments).

- Reusable links: Yes (permanent links you can share repeatedly).

That range means you can generate payment links for every scenario from a single account and switch between one‑off, reusable, or open‑amount as your needs change.

Ready to streamline how you get paid? Try payment links for business with a setup that matches how you actually work—invoice by invoice, link by link, or one reusable link across your channels.

If you want the freedom to create payment links in all three formats from a single account, GoSolo makes it simple. Generate payment links in seconds, share them anywhere your customers are, and keep the money side of your business as effortless as the work you love doing.

Available on Web, iOS, and Android.

FAQ: payment links for business

- Do I need a website to get paid via payment link? No. That’s the beauty of payment links—you can create payment links and start getting paid without a website checkout.

- Can I track who paid? Yes. Providers typically show you which link was used and when. One‑off links make this particularly clear because each link ties to a single payment.

- What if the amount changes? Use an open‑amount link if supported, or generate a new one‑off link with the updated figure. GoSolo’s open‑amount support is useful here.

- How do I share payment links? Email, SMS, WhatsApp, social DMs, QR codes, website buttons—anywhere your customers are.

Back to Blog

Back to Blog