⚡ TL;DR: The 50/30/20 rule is a simple budgeting method that helps you manage your money wisely — by dividing it into needs, wants, and savings. This article explains how it works, why it’s effective, and how small business owners and freelancers can apply it to both personal and business finances.

I'm going to start saving and investing,” you vowed to yourself many moons ago. But it’s still the same old, same old. You catch yourself repeating old financial misdeeds.

Well, humans are terrible at saving and investing for the future. In 2018, Londoners only managed to save 7% of their income on average, with the Scottish putting away 6%.

When the pandemic rolled around, it caught many people unawares. Eager not to repeat the same mistakes, many people have been looking to adopt better financial habits and plans. The future still remains bleak, but the 50/30/20 rule may be the ray of light you need. So, what is it, and how does it work? Let's find out:

What is the 50 20 30 Rule?

When the famous mother and daughter duo sat down to write the New York Times bestseller “All Your Worth: The Ultimate Lifetime Money Plan” they unwittingly invented one of the most famous rules of thumbs. The 2005 book was the brainchild of US Senator Elizabeth Warren and her daughter Amelia Warren Tyagi, who also co-wrote “The-Income Trap.” Pouring over 20 years on personal financial research, they determined that all an individual needs are to adopt the 50/30/20 rule, where they allocate 50% of their income to cover needs, 30% to cover wants, and 20% for debt repayments or savings.

The rule of thumb stood out for its simplicity, giving users only three categories of spending to track. By requiring users to summarise their spending in two major categories, it forces them to discern frivolous and important spending. It does not emphasise savings at the peril of paying off debts but allocates enough to handle crippling debt. Even if the 50 20 30 rule doesn’t quite fit your financial profile, it’s quite easy to personalise the allocations based on your unique situation. So, you'll be managing your spending wisely, saving up for a rainy day, and paying off your debts in one simple financial plan.

How to come up with a 50 30 20 budget

Before you implement the 50-30-20 rule, you first need to understand the categories. Let's go:

Needs – 50%:

Everything that you can't do without qualifies as a need. Or you can think of them as payments that you cannot completely avoid even if you tried cutting them out of your life. Some examples of expenses that qualify as needs include:

- Grocery shopping

- Transport costs

- Insurance costs

- Minimum credit card or loan payments

- Utility payments

- Housing costs

- Mandatory car payments

- Health care premiums

- Child care expenses (If you need to pay for childcare, to work)

You absolutely need these things to survive in the modern world, and that's why they're not optional. But that does not mean that you cannot work out ways to reduce their percentage in your budget.

Wants – 30%:

Wants are items that you can do without. For instance, you don't necessarily have to dine out, but you can opt for the cheaper solution, which is preparing all your meals at home. Entertainment is also optional and qualifies as a want. You can live perfectly without subscribing to streaming services such as Netflix. Examples of expenses that may be classified as wants include:

- Shopping for gifts

- Gym memberships

- Non-essential grocery shopping

- Leisure travel

- Luxury cars

- You can live without the extra luxuries, and this may be the first area to check when you're trying to reduce your spending.

Savings, investments, or debts – 20%:

This spending category is pretty much self-explanatory. You should aim to allocate at least 20% of your income to savings and investments. Aside from the minimum loan repayments, you can increase your debt contributions to pay off your debts more quickly. It’s important to dedicate money towards an emergency fund that can cushion you from an unexpected income loss.

So, how do you implement the 50 30 20 rule? You only need to follow these three simple steps:

Step 1: Determine your actual after-tax income

If you're getting a regular monthly salary, this is fairly easy to calculate. For self-employed persons or freelancers, you will also need to deduct the business expenses and the amount set aside for paying taxes to the HMRC.

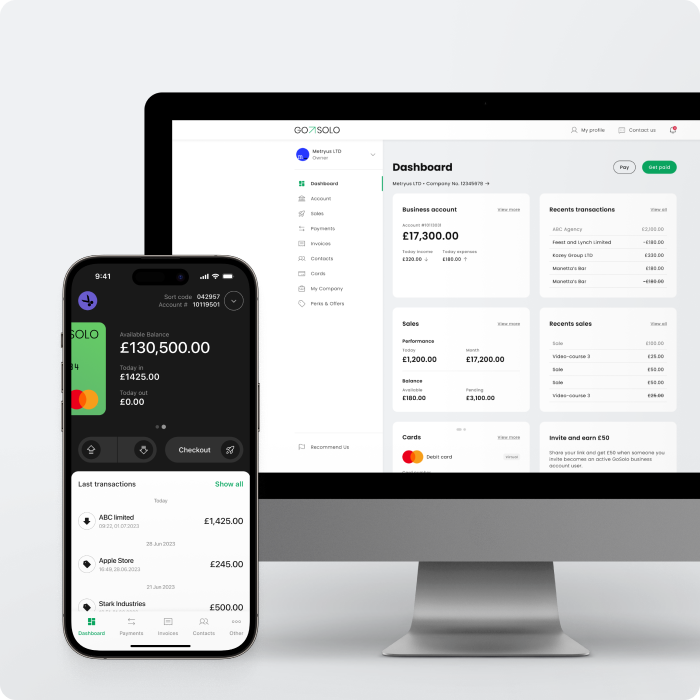

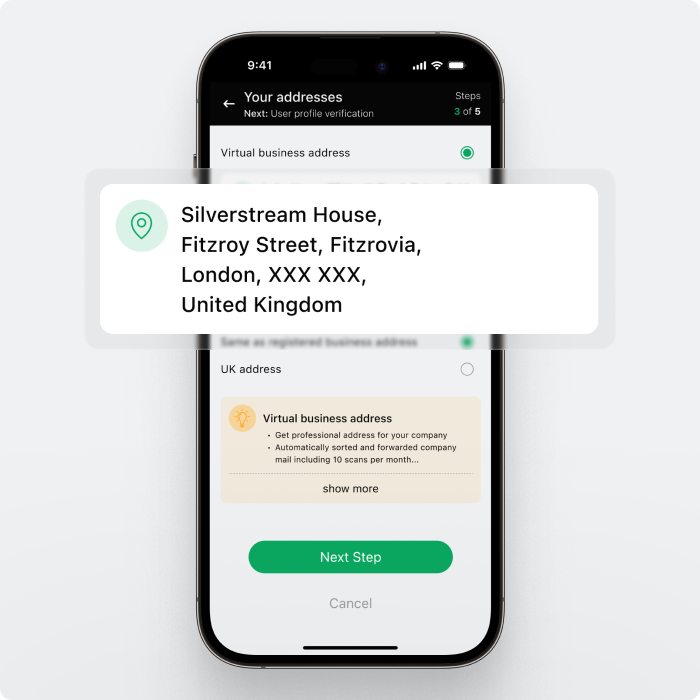

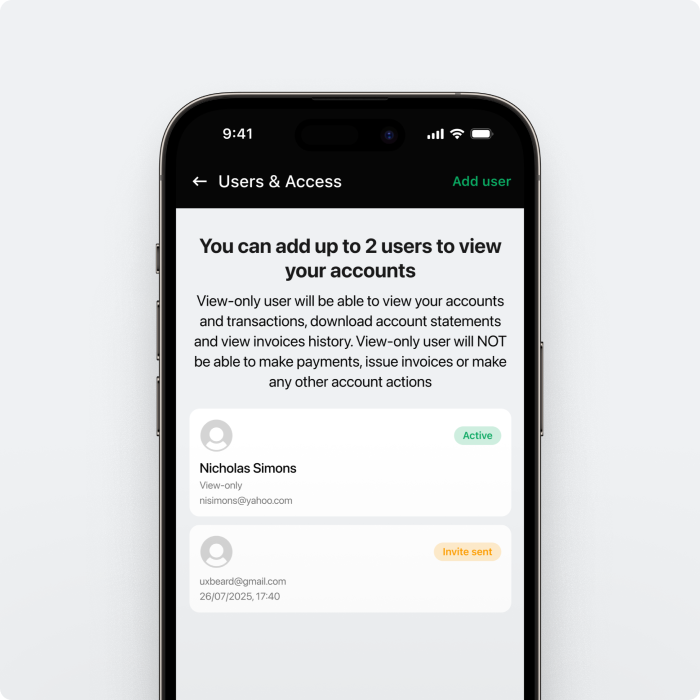

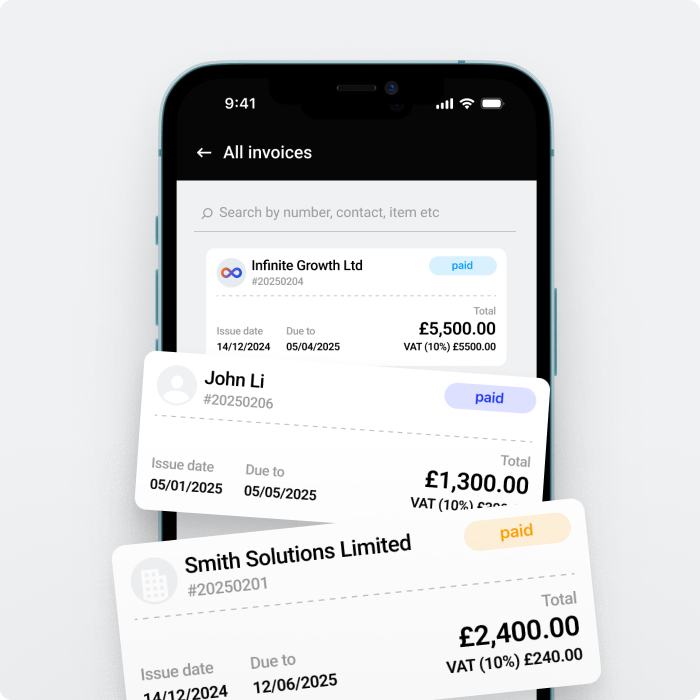

If you're using GoSolo’s online business account, you can download your monthly statements for easier evaluation. Taking an average of three months' income may be a solution if your income changes from month to month.

Step 2: Categorise and calculate finance costs

You may need an app to simplify this process, but it just involves putting all your spending into categories. Some apps can even sort out the categories automatically. You should similarly note the funds you’re spending on debt repayment or setting aside.

Step 3: Make adjustments to match the 50/30/20 formula

The last piece of the puzzle is to make appropriate adjustments to ensure that you are not spending way too much on needs or wants. You should also ensure that you are hitting your savings or debt repayment targets. It’s also important to streamline your spending with monthly budgeting rather than operating without a plan.

Already running a business? Handle money and accept payments in one app.

How to manage money wisely

Before you go, the following tips can further help in managing your finances wisely:

Look for ways to increase your income:

The advice given by most experts is to try and shrink your budget as much as possible. But it's equally important to find ways to boost your income.

Even as your income increases, the money allocated to needs and wants should ideally remain constant. Many people go wrong by increasing their spending without considering their long-term goals of attaining financial freedom.

Cut things you can live without:

It's not all about being frugal but wise with your spending. For instance, you may find that you don't need that HD plan on the streaming service or support for unlimited devices. A basic plan may be just fine.

Build an emergency fund:

With an emergency fund, you’re better prepared for unforeseen situations. You can better avoid high-interest loans or unwanted debt.

Buy a house:

It’s ideal to have long-term goals. One of the goals should be buying a house rather than renting one. In most regions in the UK, it’s cheaper to pay the monthly repayments than paying rent.

Final Advice

Now, you know what the 50 30 20 rule means, and it’s pretty straightforward to implement. Even if you’re not a raving fan of the rule of thumbs, you can easily tailor the plan to match your needs.

Back to Blog

Back to Blog