If you’re looking into launching a company in the UK, you’re probably beginning to learn the many advantages that this process can offer.

From talent pools of the best and brightest in their industries to grants and funding to get your business off the ground, there are lots of reasons to go down this route.

Here, we’ll look at the various tax incentives available to startups registered in the UK.

Tax credits

For starters, there’s the R&D tax credits scheme, a government initiative that rewards businesses engaging in research and development projects.

So if you’re just starting out, or you’re an established business looking to launch a new service or product, you can claim 225% tax relief on all related costs.

Launched as an initiative to boost the UK’s business economy, these tax credits are available to any companies developing innovations within the fields of science and technology.

Investing in small businesses

Wherever you are in the world, though, launching a startup is considered high-risk, and attracting investors can often be a challenge. Luckily, in the UK, there are a whole host of tax incentives that make investing in small businesses a more attractive proposition.

Like the Enterprise Investment Scheme, or EIS. Launched back in 1994, this scheme encourages investors to buy shares in startups, allowing them to offset 30% of the cost against their income tax liability. There’s no minimum amount required to invest, and any company with less than £15 million in assets is eligible for the scheme.

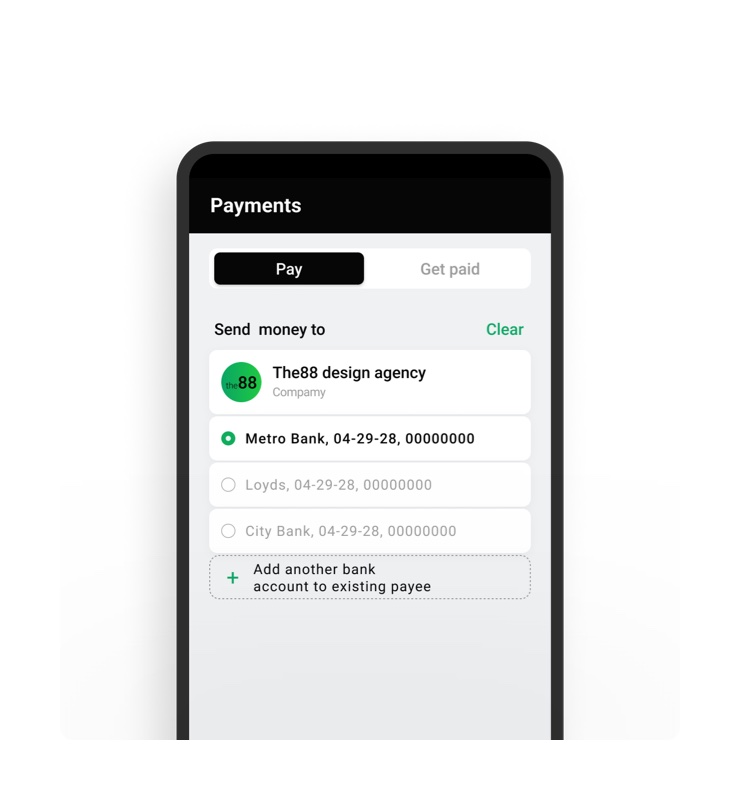

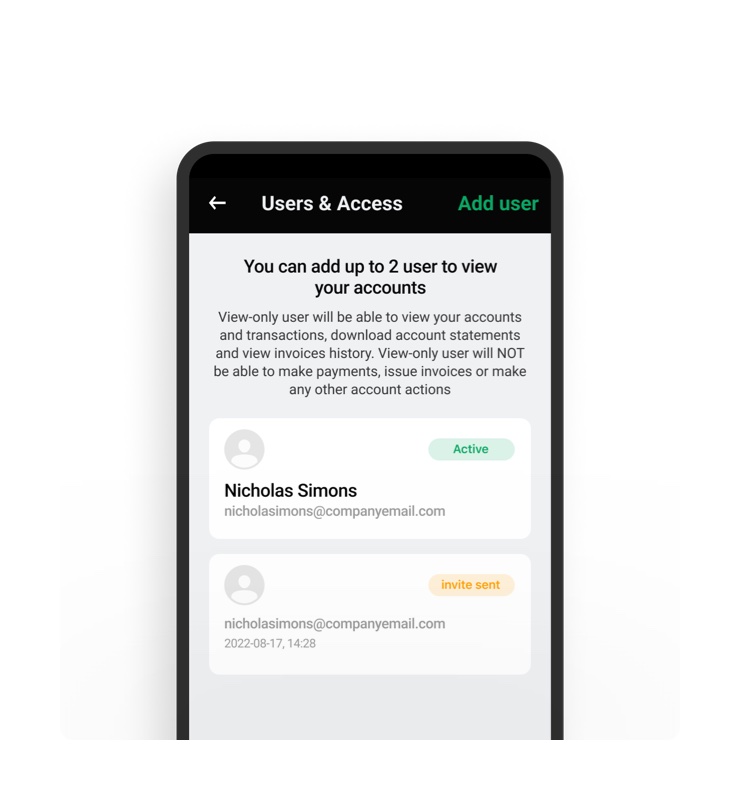

Already Ltd? Manage your business account + admin in one app.

Seed Enterprise Investment Scheme

There’s also the Seed Enterprise Investment Scheme, or SEIS, another incentive designed to boost the startup economy in the UK. Under this scheme, investors enjoy a generous 50% tax relief on any investments of up to £100,000 a year. Aimed at startups in the early stages, the SEIS is only available to companies with less than £200,000 in assets and no more than 25 employees.

SITR investments

For charities and social enterprises, the Social Investment Tax Relief, or SITR, the scheme also offers 30% tax relief for investors backing eligible companies.

To qualify, businesses need to meet specific criteria in terms of legal structure and activity, but for those that tick the right boxes it can provide a lifeline in a challenging industry. SITR investments raise millions for startups within the charitable sector every year.

Enterprise Management Incentives program

Meanwhile, companies struggling to attract the right talent can offer shares to potential employees under the Enterprise Management Incentives, or EMI, scheme. Available to startups with less than 30 million in assets, it’s a tax-efficient way to reward the people who make your business work.

In the UK, the government recognises the benefits that startups bring to the economy, which is why there are so many schemes designed to help those looking to start their own business. But in order to take advantage of these, you need to register your company in the UK.

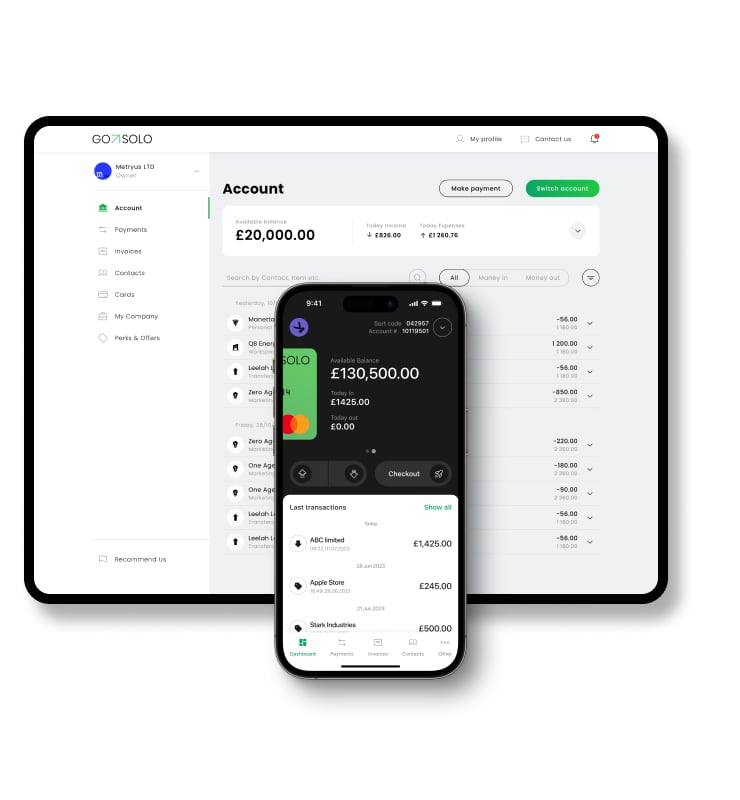

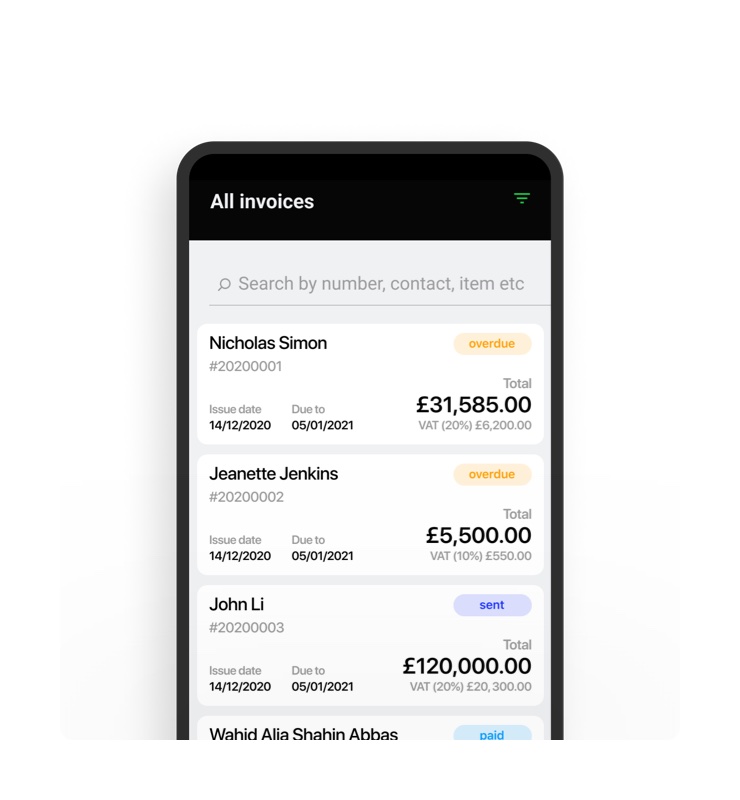

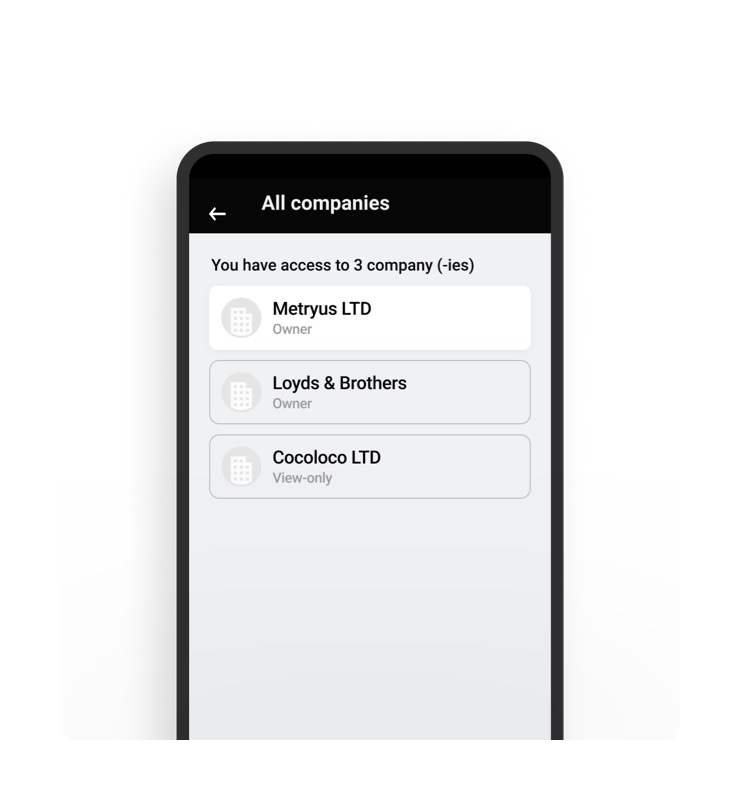

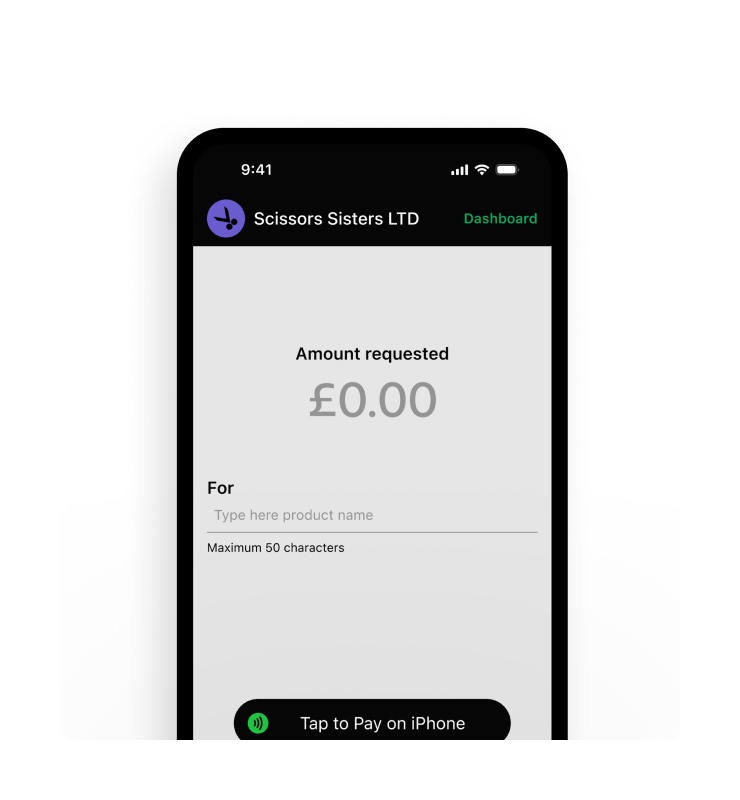

Of course, you could hire an expensive agency to help you with the process. Or, you could open a GoSolo account, which comes with everything you need to launch your company in the UK.

Sign up to get your GoSolo business account now to start your UK startup journey.

Available on Web, iOS, and Android.

Back to Blog

Back to Blog