⚡ TL;DR: Looking for the best Tap to Pay Monzo alternatives for your UK Ltd company? Monzo offers Tap to Pay, but it requires Stripe and extra admin. The strongest alternatives are GoSolo, Tide, Revolut Business, NatWest Tyl, Square and SumUp. GoSolo stands out with built-in Tap to Pay, the UK’s lowest fees, and no third-party accounts.

Running a Ltd company in the UK is already complicated enough — from paperwork to cash flow, directors don’t need extra hassle when it comes to getting paid. Customers today expect to tap their card or phone and be done in seconds. If you can’t offer that, you look outdated.

That’s where Tap to Pay comes in. It turns your iPhone or Android device into a payment terminal. No card readers, no clunky machines, no waiting for deliveries. Just download the app, activate Tap to Pay, and you’re ready.

But not every business account handles this the same way. Some make it seamless, others bury it in third-party setups, and the fees vary a lot. Let’s look at Monzo first, then compare the main alternatives for Ltd companies.

The Catch with Monzo’s Tap to Pay

Monzo does offer Tap to Pay, but here’s the catch: it runs through Stripe. That means opening and maintaining a second account just to get paid. You end up with two dashboards, two sets of fees, and extra admin when it’s time to reconcile transactions.

Stripe isn’t bad — in fact, it’s one of the most respected payment platforms globally. But if you’re a small Ltd business, you probably don’t want another layer of complexity. Fees start at 1.4% + 20p per UK card transaction, and go up for international cards.

In plain English? Monzo gives you the feature, but not in the smooth, integrated way you might expect from your main business account.

Tap to Pay: Monzo Alternatives Worth Considering

Now let’s see how other providers stack up — especially for Ltd companies.

GoSolo

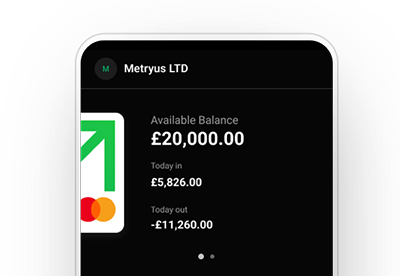

GoSolo is a fintech built specifically for small UK businesses. It’s not trying to be everything to everyone. Instead, it focuses on what new and growing Ltds really need: an account, invoicing, and payments all in one place.

- Tap to Pay: Fully integrated on iPhone. You don’t need Stripe, a card reader, or any extras.

- Fees: Free business account. Transparent Interchange++ + 0.5% + 20p. That’s lower than most providers.

- Why choose it: If you want quick setup (registration takes minutes) and the lowest cost per transaction, GoSolo is hard to beat.

Imagine a freelance consultant finishing a client session. With GoSolo, they can take payment on the spot — no hardware, no fuss, just their phone.

Available on Web, iOS, and Android.

Tide

Tide has grown quickly and is now one of the biggest SME platforms in the UK. It offers extras like accounting integrations and loans, so it’s more of a “finance hub” than just a bank.

- Tap to Pay: Built in for iPhone users.

- Fees: 1.65% per transaction.

- Why choose it: Simple to activate and reliable, but more expensive per payment compared to GoSolo.

Revolut Business

Revolut is a global brand, loved by startups that trade internationally. Its multi-currency accounts and slick app are strong selling points.

- Tap to Pay: Available on iPhone through the Revolut Business app.

- Fees: 0.8% + 10p (Visa/Mastercard) or 1.7% + 10p (Amex). Plans start at £10/month.

- Why choose it: A strong option if you deal with overseas clients, but less cost-effective for UK-only Ltds.

NatWest Tyl

Tyl is NatWest’s answer to fintech challengers. It’s a well-established name, so if you like the security of a big high-street bank, this might appeal.

- Tap to Pay: Directly available on both iPhone and Android.

- Fees: Around 1.39% + 5p (UK/EU) and 1.99% + 5p (other cards).

- Why choose it: Solid and trustworthy, though the fees are higher than fintech rivals.

Barclays (Barclaycard)

Barclays has a long history with business banking and merchant services, but it hasn’t caught up with the Tap to Pay trend.

- Tap to Pay: Not offered. You’ll need a separate card machine.

- Fees: Around 1.6% for SME card machines.

- Why choose it: Reliable brand, but not suitable if you want a hardware-free setup.

Starling Bank

Starling is often praised for its business accounts and integrations, but it doesn’t yet have native Tap to Pay.

- Tap to Pay: Not built in. You’ll need third-party providers like SumUp or Zettle.

- Fees: Around 1.69–1.75% through those providers.

- Why choose it: Excellent banking features, but weak on payments.

Square

Square is globally recognised for making payments easier for small merchants. Its POS software is widely used in retail and hospitality.

- Tap to Pay: Works on iPhone and Android through its app.

- Fees: 1.75% per tap.

- Why choose it: Flexible and easy to use, but pricier than GoSolo.

SumUp

SumUp made its name with cheap card readers for microbusinesses. It now also supports Tap to Pay.

- Tap to Pay: Yes — works on newer iPhones and Android devices.

- Fees: 1.69% per transaction.

- Why choose it: Affordable and simple, but still not as cheap or integrated as GoSolo.

The Best Tap to Pay for Ltd Companies

When you look closely, only a few providers actually deliver hardware-free, integrated Tap to Pay for Ltd companies.

- GoSolo: Lowest fees, no monthly cost, everything in one account.

- Tide: Easy to use but more expensive.

- Revolut Business: Good for international, less for domestic-only Ltds.

- NatWest Tyl: Solid option if you prefer a traditional bank.

- Monzo: Works, but Stripe makes it clunky.

- Barclays & Starling: Outdated — still relying on card readers.

- Square & SumUp: Fine for payments, but higher fees and no banking integration.

Conclusion

For UK Ltd companies, Tap to Pay is quickly becoming the standard. Customers expect it, and businesses that don’t offer it risk being left behind.

While Monzo provides Tap to Pay, the reliance on Stripe makes it less than ideal. Traditional banks are catching up, but often at higher fees. Payment processors like Square and SumUp do the job, but they don’t give you a full banking solution.

GoSolo, by contrast, brings it all together:

- Integrated Tap to Pay inside the free account.

- Registration in five minutes.

- Transparent, lowest-cost pricing.

- A platform built around the needs of UK Ltd companies.

The bottom line? If you run a Ltd company and want to accept card payments the easy way, GoSolo isn’t just an alternative to Monzo — it’s the smarter choice.

Already running a business? Handle money and accept payments in one app.

FAQ about Monzo Alternatives for Tap to Pay

1. Do I need extra hardware to use Tap to Pay?

Not always. Providers like GoSolo, Tide, Revolut Business, and NatWest Tyl let you accept contactless payments straight from your iPhone (and in some cases Android) without a card reader. Others, such as Barclays or Starling, still rely on separate devices.

2. Which Tap to Pay provider has the lowest fees?

GoSolo leads here, with transparent Interchange++ pricing starting at card processing cost + 0.5% + 20p per transaction. By contrast, most rivals charge around 1.6–1.75%. For a Ltd company processing thousands of pounds a month, this difference quickly adds up.

3. Does Tap to Pay in Monzo work without Stripe?

No. Monzo’s Tap to Pay is powered by Stripe, so you’ll need a separate Stripe account. That means two dashboards, two sets of fees, and more admin work.

4. What are the best Monzo alternatives for Ltd companies?

For Ltd companies, the strongest Monzo alternatives for Tap to Pay are:

- GoSolo (lowest fees, fully integrated, no third-party accounts).

- Tide (simple but more expensive per transaction).

- Revolut Business (good for international, less for domestic).

- NatWest Tyl (reliable but higher cost).

Others like Square and SumUp are fine for pure payments, but they don’t combine banking with Tap to Pay.

5. Can I use Tap to Pay if my Ltd trades internationally?

Yes, but costs vary. Revolut Business is strong for multi-currency transactions, though fees are higher. GoSolo and Tide are better if most of your revenue comes from UK customers.

6. Is Tap to Pay safe for Ltd companies?

Absolutely. Transactions are encrypted and comply with PCI DSS standards. Your phone never stores card details. In practice, Tap to Pay is as secure as using a traditional card reader.

7. Which UK banks support Tap to Pay directly?

Currently, GoSolo, Tide, Revolut Business, and NatWest Tyl. Most high-street banks (like Barclays and HSBC) don’t yet offer native tap-to-phone solutions in the UK.

8. How quickly can I start taking payments?

With fintechs like GoSolo or Tide, setup takes minutes. Open an account, activate Tap to Pay in the app, and you’re ready. Traditional providers like NatWest Tyl may take longer due to eligibility checks.

9. What’s the difference between Tap to Pay and payment links?</strong >

Tap to Pay is ideal for face-to-face transactions, turning your phone into a terminal. Payment links are best for remote sales — you send a customer a link and they pay online. Many providers, including GoSolo, offer both.

10. Can I use Tap to Pay on Android?

At the moment, not all providers support Android. GoSolo, Tide, and Revolut Business currently offer Tap to Pay on iPhone only. NatWest Tyl, Square, and SumUp already support both iPhone and Android devices.

If your Ltd company relies on Android phones, check carefully which providers support your device. GoSolo is actively working on adding Android Tap to Pay, so this option will be available soon.

11. Is Tap to Pay available across the UK for business accounts?</strong >

Yes. Tap to Pay is supported across the UK for eligible Ltd business accounts, but availability depends on the provider. Fintechs like GoSolo and Tide roll it out faster, while high-street banks are still catching up.

Back to Blog

Back to Blog