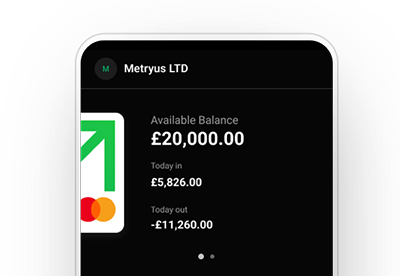

⚡ TL;DR: Opening a UK business account can be time-consuming and complicated — but it doesn’t have to be. GoSolo makes it fast, fully online, and hassle-free. No branch visits, no paperwork — just a simple sign-up, instant account details, and everything you need to get paid as a Limited company.

You've crafted the perfect business plan, identified a lucrative market gap in the UK, and you're buzzing with entrepreneurial energy – only to hit the brick wall of traditional banking bureaucracy.

For many founders, especially those attempting non-UK resident company registration, this roadblock turns dreams into paperwork nightmares.

The UK's business-friendly environment attracts entrepreneurs worldwide, but its banking system hasn't always extended the same welcome mat. Concerns over security, lengthy verifications, and a lack of transparency have made the process feel less like a launchpad – and more like a lockout. Until now.

Available on Web, iOS, and Android.

GoSolo has reimagined the entire process of UK company formation for both foreigners and locals alike – combining digital convenience with bank-grade security and a transparent onboarding system you can trust. From verifying identities to protecting funds and data, GoSolo is built with compliance and credibility at its core – making it not just fast, but safe.

Check out what our customers are saying on Trustpilot.

The Problem with Traditional Business Bank Accounts in the UK

"Sorry, we'll need to see three years of trading history." "Unfortunately, without a UK address, we can't proceed." "Your application is pending further review" – again.

Sound familiar? Traditional UK banking institutions operate on frameworks designed decades before the digital economy existed, creating friction points that particularly impact:

- International entrepreneurs – Often rejected outright without a UK footprint

- First-time business owners – Caught in the paradox of needing business history to start a business

- Digital nomads and remote workers – Unable to attend multiple in-person meetings

Innovative business models – Too novel for conventional risk assessment frameworks - Urgent launches – Throttled by processing timelines stretching into months

The documentation demands can be staggering: comprehensive business plans, projected five-year financials, existing trading records, UK utility bills, physical signatures on countless forms, and reference letters from established UK businesses. Even after providing this mountain of paperwork, approval rates for non-residents hover around a discouraging 20-30%.

For the digital-first entrepreneur of today, this approach is as relevant as a fax machine.

How to Open a UK Business Account Online with GoSolo

GoSolo's process feels like it belongs to this century – because it was actually designed for it:

- Digital application – Complete a streamlined form in approximately 8-10 minutes

- Smart verification – GoSolo's proprietary verification technology accepts international documents and works across the globe

- Automated compliance – AI-powered systems handle the regulatory heavy lifting while keeping you informed at each stage

- Instant approval notification – Receive a definitive answer within 1-2 business days

- Immediate account activation – Start sending invoices, accepting payments, and managing expenses within minutes of approval

The documentation revolution is equally impressive:

- Valid government-issued ID (passport or national ID)

- Personal address (any utility bill or bank statement issued within the last 3 months)

- Basic company information (which GoSolo can help establish if you're just starting)

- Digital signature (no visiting, signing, scanning, or mailing)

Most striking is what's NOT on this list: no proof of UK address for international clients, no existing business history, no in-person appointments, and no printed forms to mail internationally.

The entire process averages 36 hours from application to activation – a timeline that traditional banks measure in weeks or months.

UK Business Account for Non Residents: What You Should Know

UK financial regulations do require thorough identity verification and strict anti-money laundering checks for all account holders. Traditional banks often interpret these requirements as a need for physical presence and excessive documentation.

GoSolo offers modern, legal, and secure digital alternatives that fully comply with regulations, uphold the highest standards of protection, and — most importantly — inspire trust. With transparent processes and reliable identity verification, global entrepreneurs can open accounts knowing their data, funds, and reputation are safe and in trusted hands.

For those pursuing opening a business in the UK for non-resident status, GoSolo offers:

- Virtual business address services – Providing a legitimate UK business address for registration and correspondence

- Remote identity verification – Using advanced biometric technology that satisfies regulatory requirements

- Digital document processing – Eliminating the need for original documents to cross international borders

- Multi-currency capabilities – Handling both GBP and other major currencies seamlessly

International payment optimisation, reducing fees and conversion costs typically associated with cross-border banking.

One Swedish entrepreneur shared her experience: "After three traditional banks rejected my application because I couldn't fly to London for in-person meetings, GoSolo had my business registered and account active within four days, all while I was running my business from Malmö."

Why GoSolo Is One of the Best Business Bank Account Options in the UK

GoSolo distinguishes itself through purpose-built features that address real entrepreneurial pain points:

Truly transparent pricing – Fixed yearly fees with no hidden charges, transaction penalties, or minimum balance requirements

Integrated accounting tools – Seamless connections to popular platforms like Xero, QuickBooks, and FreeAgent

Built-in invoicing solution – Professional invoice generation with automated payment tracking

Multi-user access – Delegate financial tasks to team members with customizable permission levels

Virtual card issuance – Generate unique payment cards for different business purposes

Real-time notifications – Instant alerts for all account activities

Perhaps most valuable is GoSolo's unified ecosystem approach – the ability to handle company formation, address services, accounting, and banking through a single integrated platform rather than cobbling together disconnected services.

Online Business Bank Account UK: How GoSolo Transforms the Experience

The contrast between traditional and GoSolo approaches becomes stark when examined feature-by-feature:

A UK-based startup founder recently noted: "My traditional bank account took 11 weeks to open and still requires me to visit a branch for certain transactions. My GoSolo account took 26 hours to activate and I've never had to leave my laptop for any banking need."

The difference isn't just convenience – it's a fundamental rethinking of how financial services should serve modern business models.

Ready to Transform Your UK Business Banking Experience?

The processes of the non-resident company registration in the UK have historically deterred countless entrepreneurs from accessing the advantages of the British business ecosystem. GoSolo has systematically eliminated these barriers.

Each element of the GoSolo platform is built on a simple premise: entrepreneurs should focus on building their businesses, not navigating financial bureaucracy.

For entrepreneurs ready to establish or upgrade their UK business presence:

- Visit GoSolo's website to explore the specific account features

- Begin your application and experience the difference between hoping for approval and actively building your business

Already running a business? Handle money and accept payments in one app.

The UK remains one of the world's most prestigious and advantageous business jurisdictions. With GoSolo, its benefits are finally accessible to entrepreneurs regardless of passport, location, or business history.

Your UK business banking breakthrough is just days away – not because the regulations have changed, but because GoSolo has finally built the bridge that traditional banks never bothered to construct.

Back to Blog

Back to Blog