As we let the dust settle following last week’s UK Government mini-budget, we look at how the announcements will affect small businesses working in the UK.

Although much of the budget may not be beneficial for many, one group Chancellor Kwasi Kwarteng has honed in on is business and its economic growth in the UK. With a swathe of measures aiming to boost business growth, although many things are struggling, businesses will receive some benefits over the coming months which we cover below.

Scrapping corporation tax and National Insurance rises

Corporation tax was set to rise to 25% in April 2023, but will now remain at 19% – the lowest in the G20. Although this change will cost around £17billion, Kwarteng is hoping this will make the UK a more attractive place for businesses to invest in.

The interim increase in National Insurance will be cancelled on 6th November, and no planned rises are in place now. This reduction will be marginally better for employees.

Raising the limit on Seed Enterprise Investment Scheme (SEIS) investment

SEIS investment has now been cemented for the future and the amount that can be raised through the scheme increased to £250,000. This is big news for high-growth start-ups and could see some exciting players rising over the coming months.

Abolishing the 45% top rate tax for those earning £150,000 or above

Does exactly what is says on the tin! An attractive offer for high earners considering where to move and invest in, and of use to UK residents who are already at this rate of pay.

IR35 reforms for business contractors

The IR35 tax form meant independent contractors were looked at the same as employees for tax purposes, without other employee benefits. This was used to counter non-compliance but was seen to be damaging and was said to cause many skilled workers to leave the workforce. From April 2023, contractors will be responsible for their tax submissions, so it will be interesting to see what they implement to avoid non-compliance.

Annual Investment Allowance

This is now permanently set at £1million from the start of April 2023. Providing 100% tax relief to businesses on their plant and machinery investments up to that amount, can create huge savings for UK businesses reinvesting in their growth.

These measures, along with the Energy Bill Relief Scheme which runs until (at least) March,9 will help keep the lights on in the office.

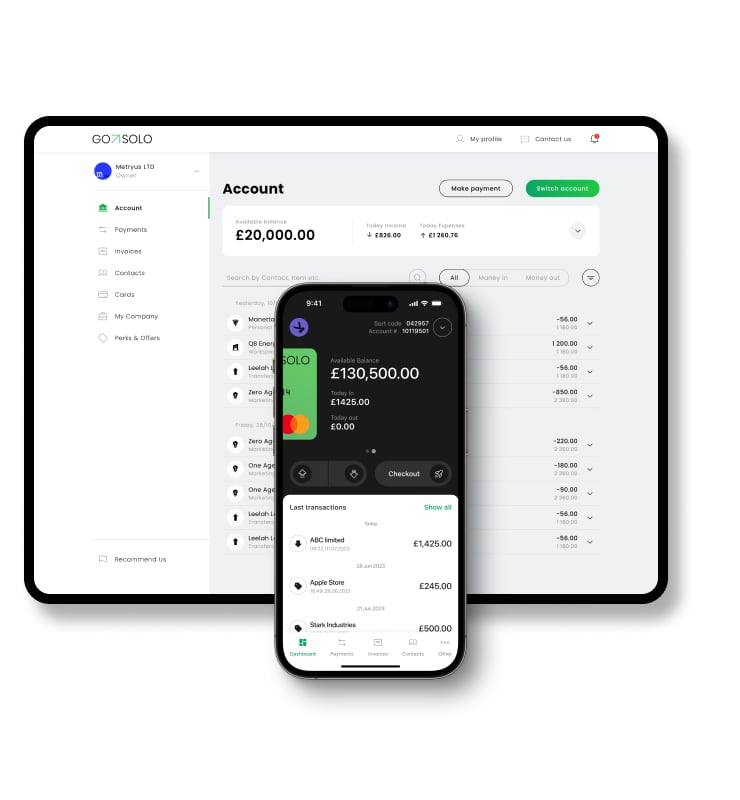

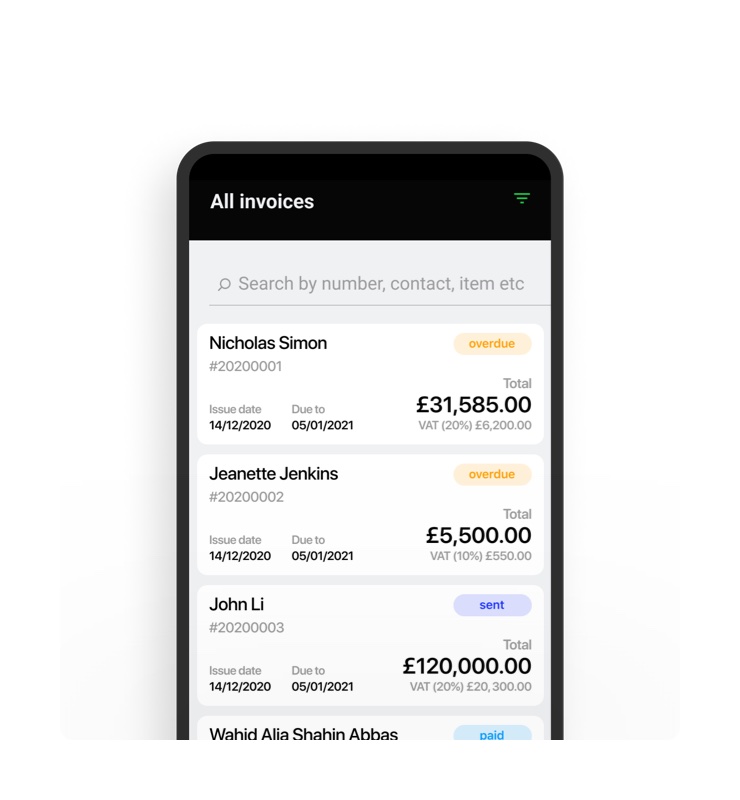

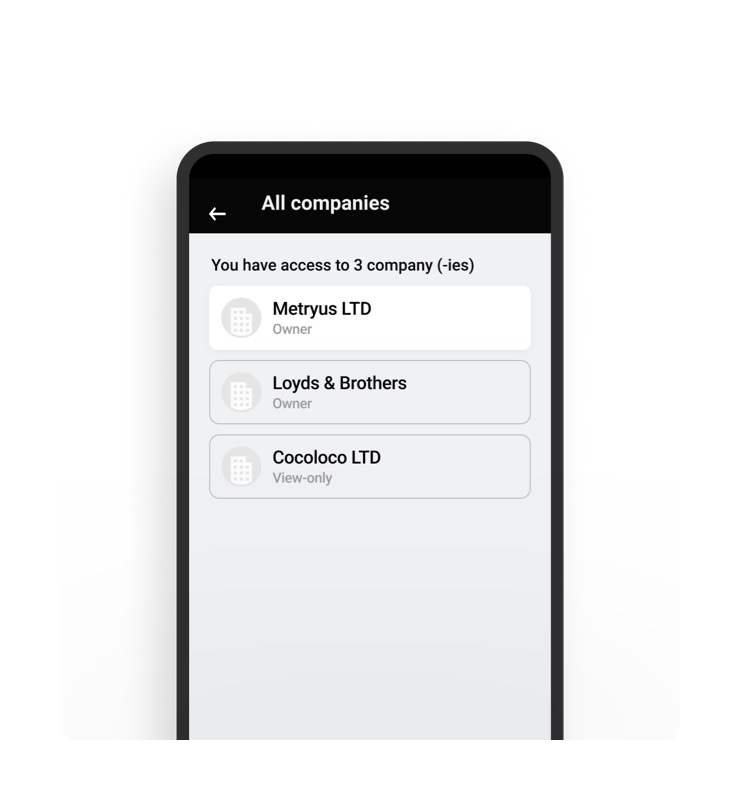

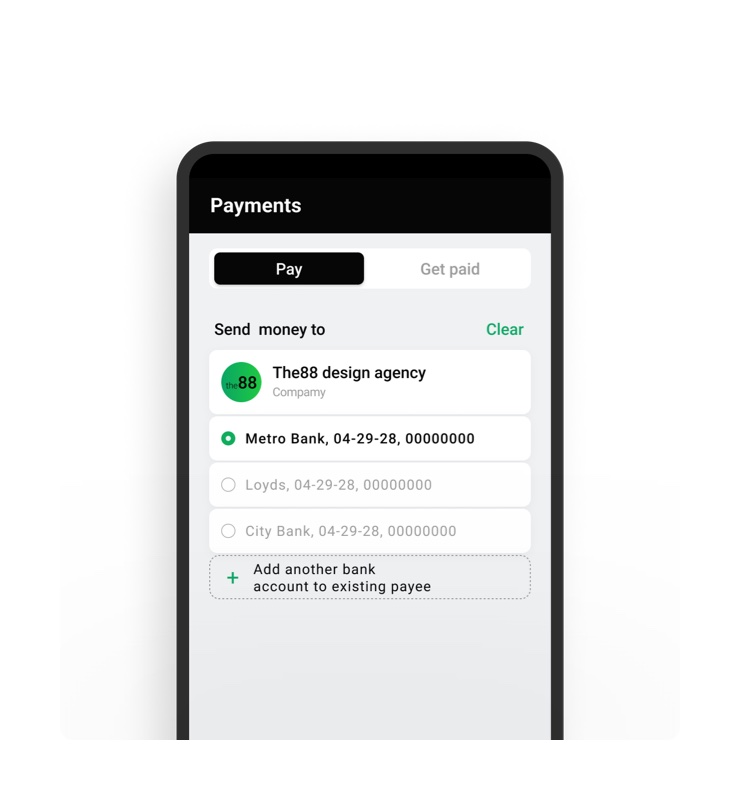

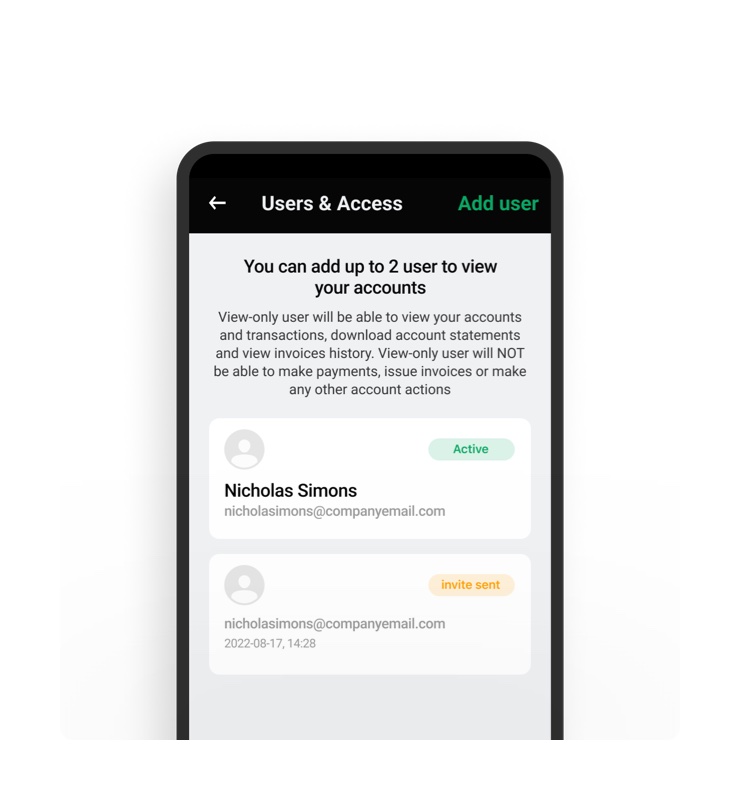

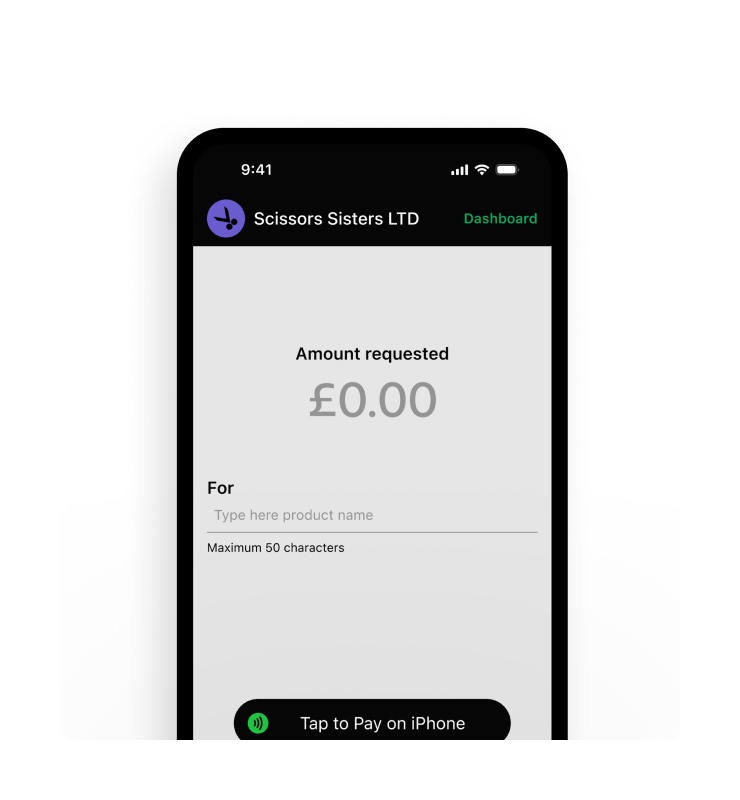

A GoSolo Business Account can help small businesses in the UK manage their finances easily, pay on a Mastercard debit card, and help them save for taxes, invoices, and potential future outgoings. Get your Business Account now:

Already Ltd? Manage your business account + admin in one app.

Back to Blog

Back to Blog