Bank statements provide a record of financial transactions made to and from your bank account over a certain period, say one month, six months, or one year. They may reflect a pattern of spending for individuals and help businesses track customer payments or expenditures. You no doubt know the importance of keeping your bank statements. Now the question that may be plaguing your mind is, “How long should I keep my bank statements?”

Get the right answer as per HMRC requirements. You'll also learn about the proper ways to store your bank statements along with applicable rules.

Let's get started:

How long should I keep Bank statements?

The main reason you may be asking, “How long do I have to keep bank statements” may be concerning tax laws. Rules differ based on your tax account:

1. Individuals without a business

If you're an individual who doesn't operate a business, you may only need to keep your bank statements for 22 months after the last tax year. For instance, if you filed for the 2020-2021 tax returns by 5 April 2021, you may keep the bank statements until 5 February 2023.

There are situations where individuals may need to keep their account records for an extended period, including:

- During a tax compliance check

- Filing tax returns late

- Buying, selling or transferring assets such as a home that requires Capital Gains Tax

2. Self-employed

Self-employed persons are mandated to keep their bank account statements longer than individuals without any business interests.

According to the HM Revenue and Customs, if you're self-employed, you must keep records for at least five years after the 31 January submission deadline.

If you are sending tax returns after the deadline, it's necessary to keep the records for at least 15 months after the return.

The HMRC doesn’t always distinguish between bank statements and other records. You must maintain other records partisan in the tax filing.

3. Partnerships

How long should you keep your bank statements for partnership businesses? Partnerships follow the same recommendations as self-employed persons, meaning they have to keep their bank account records for at least five years. For instance, if you filed 2020-2021 tax returns by 31st January 2021, you must keep accounting records until 31st January 2026.

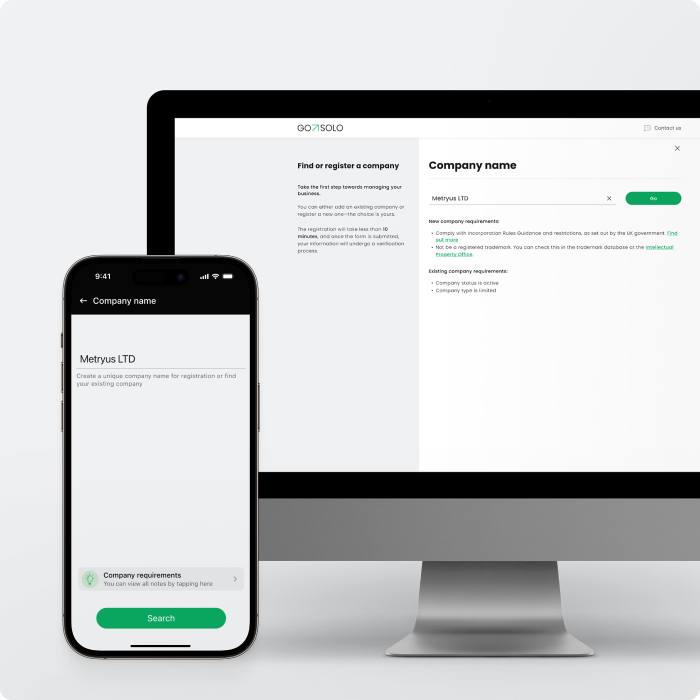

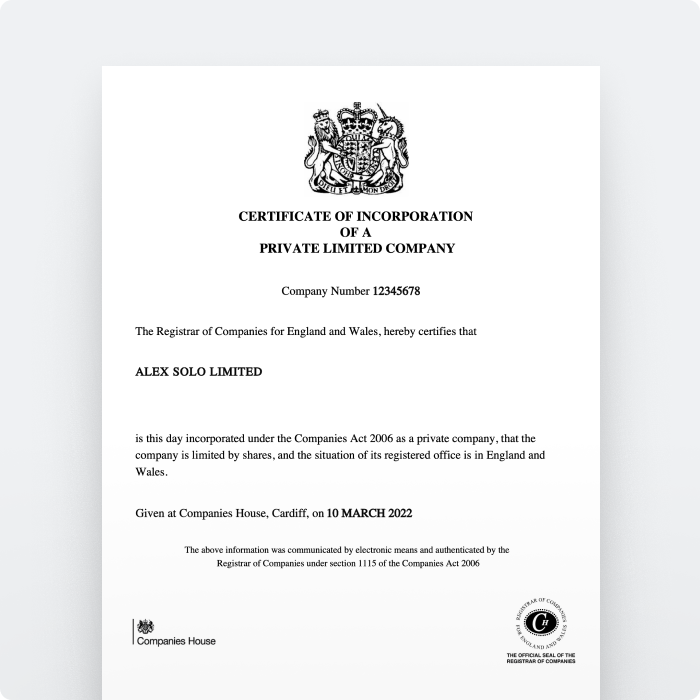

4. Limited company

How long do you keep bank statements if you are running a limited company? The HMRC specifies that limited companies need to keep records for six years from the last financial year, or longer if records:

- Contain transactions spanning more than one accounting period

- Show that the company bought machines or equipment expected to last for more than six years

Similarly, businesses can hold records for an extended time if they’re undergoing a compliance check or sent their tax return late.

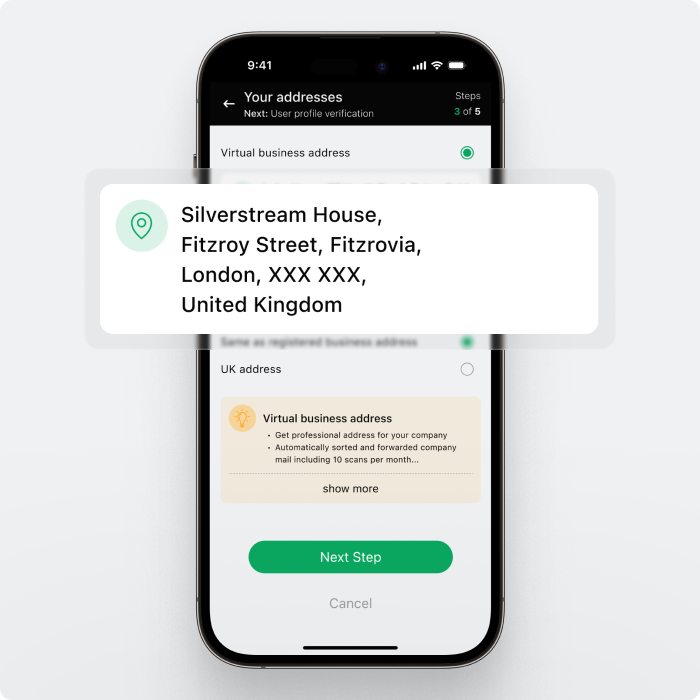

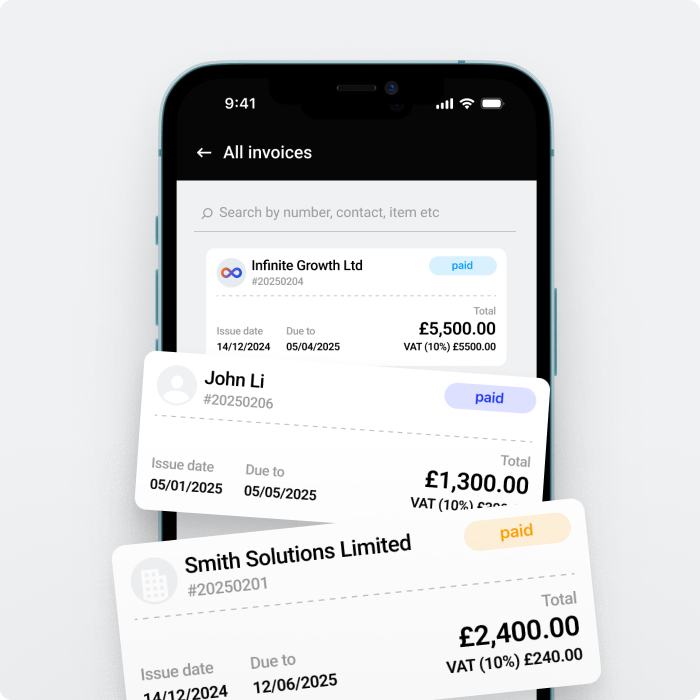

Already running a business? Handle money and accept payments in one app.

Figuring Out How Long to Keep Bank Records

Beyond the recommendations from the HMRC as to how long you have to keep business records, you can make other considerations to figure out how long to keep bank records:

1. Preparing taxes

With the current UK tax year running from 6 April to 5 April, it’s essential to have bank records spanning this period. The timelines may differ if there are differences between your company’s accounting period and financial year.

2. Tax compliance checks

Are you concerned about how long to keep bank statements to avoid penalties or other consequences during a tax compliance check?

For innocent and uncharacteristic errors, compliance checks may go back four years. Checks for careless returns and inaccuracies typically don’t go back more than six years.

Serious investigations into deliberate tax evasion may have a longer lookback period, sometimes 20 years.

3. Applying for mortgages and loans

Mortgage lenders in banks may need to see up to 6 to 12 months of bank account statements during the loan application process. At times, they may only ask for the latest full-month statement.

4. Reconciling accounts, checking for inaccuracies, & tracking spending

You may need bank account statements to reconcile accounts and manage cash flow. It's also important to regularly check for any errors or unauthorised transactions that may indicate fraud.

For individuals, regularly checking bank account statements can offer insights into how you spend your money, which creates opportunities for better financial management.

What to do with old bank statements

There are no specific requirements or rules about storing your bank records. However, the HMRC may impose a penalty if records are not accurate, complete, or readable.

"Will I need to store original paper bank records?"

No, you may store bank statements electronically or in software. Nowadays, it's customary to receive bank records through email or from the online banking portal. You can save the files securely on the cloud or download them for storage on removable storage devices.

While banks store information for a couple of years, it’s recommended to keep your own records to provide them on request. What’s more, there may be delays in retrieving records older than 12 months.

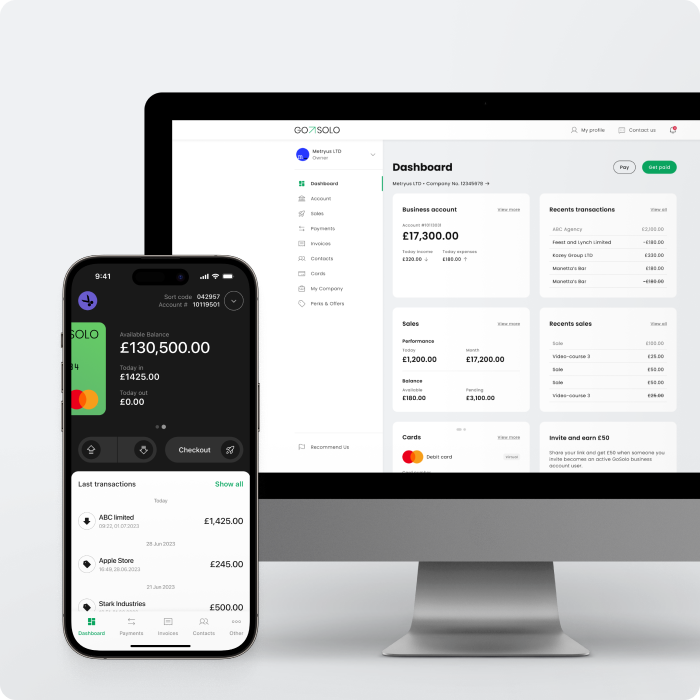

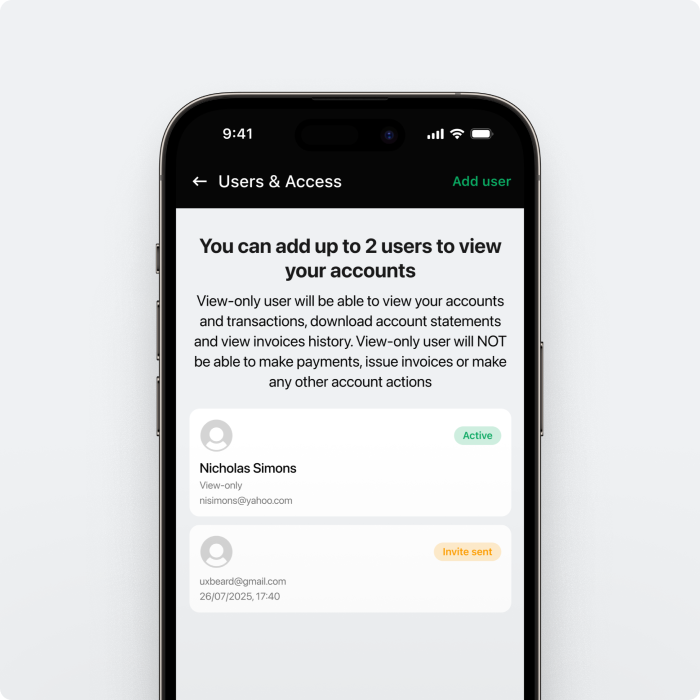

GoSolo’s business banking customers can download account statements or give access to third-party users to view transactions or download statements.

If old bank statements are no longer needed, you may consider destroying them by shredding paper files or deleting electronic copies and backups. Some businesses have their day one files. If statements are only taking a small chunk of your storage memory, you may keep them.

"What if my bank account statements become lost, stolen, or destroyed?"

The HMRC recommends informing your corporation tax office and doing your best to recreate lost records. If provisional figures have been used in the tax return, it's essential to make a notification in the filing.

Back to Blog

Back to Blog