Corporate Terms and Conditions for Business Mastercard Debit Cards issued by Payrnet Limited.

Business Debit Card Terms & Conditions

These terms and conditions apply to your business debit card. You accept these terms and conditions by activating your debit card. You should read them carefully before activating your debit card. In these terms and conditions “you” means the Business and/or the named debit Cardholder authorised by the Business to use the Card. “We”, “us” or “our” means Payrnet Limited.

Version date 16 March 2022

1. Definitions

In these terms and conditions the following words and expressions have the following meanings:

|

“Account”

|

means the electronic money account associated with the Card;

|

|

“Agreement”

|

means this Agreement of open-ended duration between you and us incorporating these terms and conditions, as amended from time to time;

|

|

“Authorised” and “Authorisation”

|

mean the act of authorising a payment transfer by using the Card together with (i) the PIN code; or (ii) the CVV code and Expiry Date; or (iii) the use of contactless technology; or (iv) the signature of the Cardholder or

|

|

“Available Balance”

|

means the value of unspent funds in the Account which are available for a Cardholder to spend;

|

|

“Business”

|

means the party authorised to fund the Account and to whom the electronic money is issued;

|

|

“Business Day”

|

means a day other than a Saturday or Sunday on which banks are open for business in London;

|

|

“Card”

|

means a Card, which is a Mastercard debit card, provided by us to a Cardholder whereby the Cardholder can spend Available Balance;

|

|

“Card Distributor”

|

means GoSolo Financial Limited, being your first point of contact if you have an issue with the Card or this Agreement, the contact details of which are set out in clause 2.

|

|

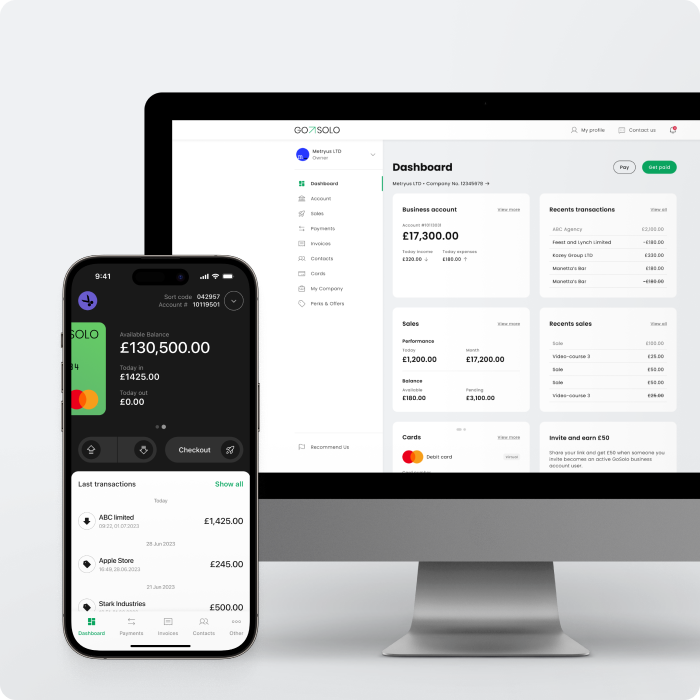

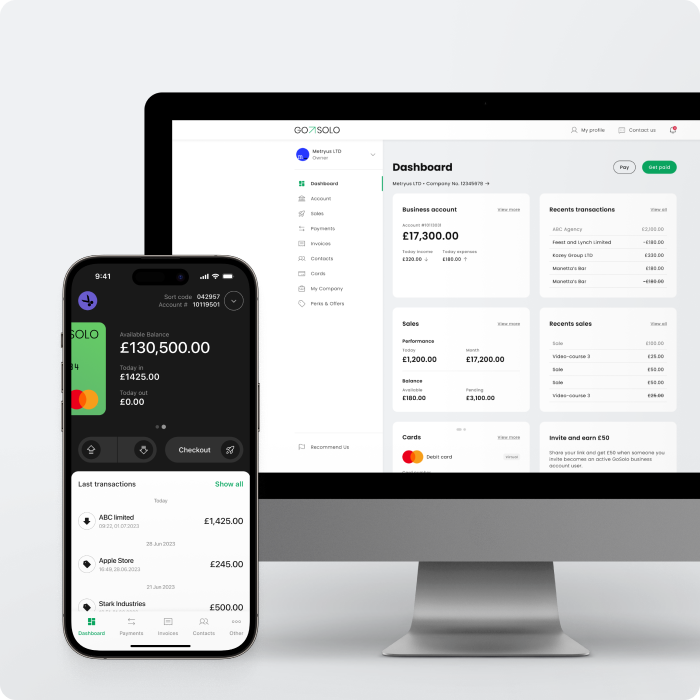

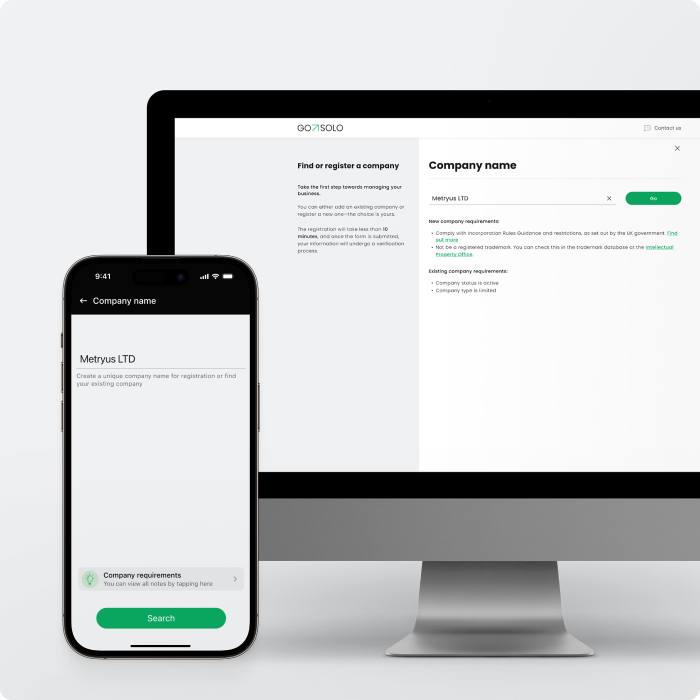

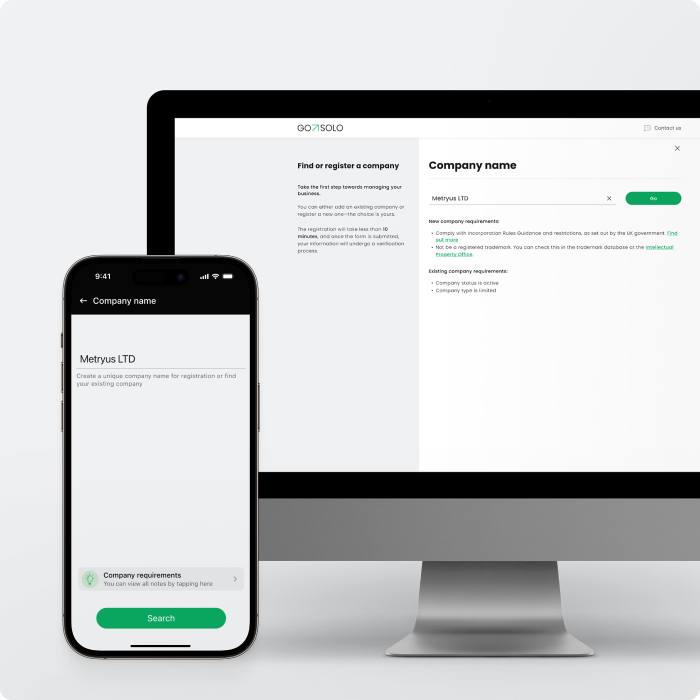

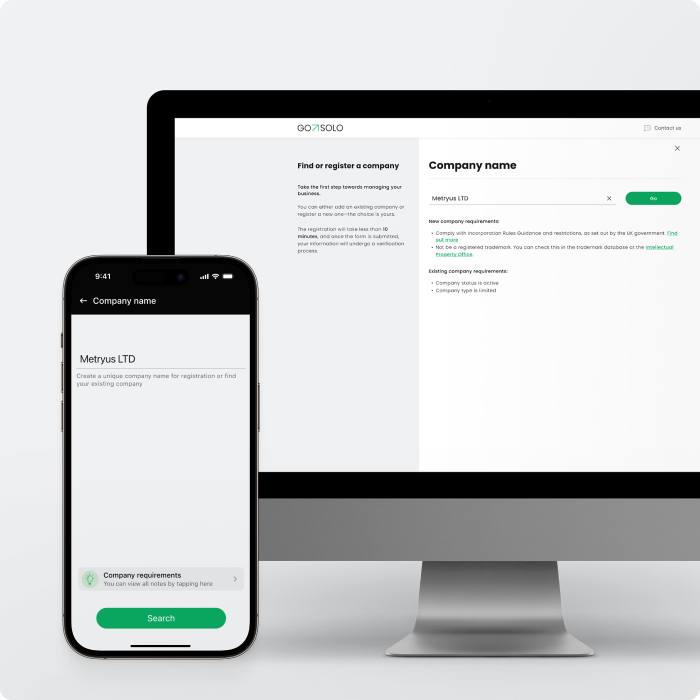

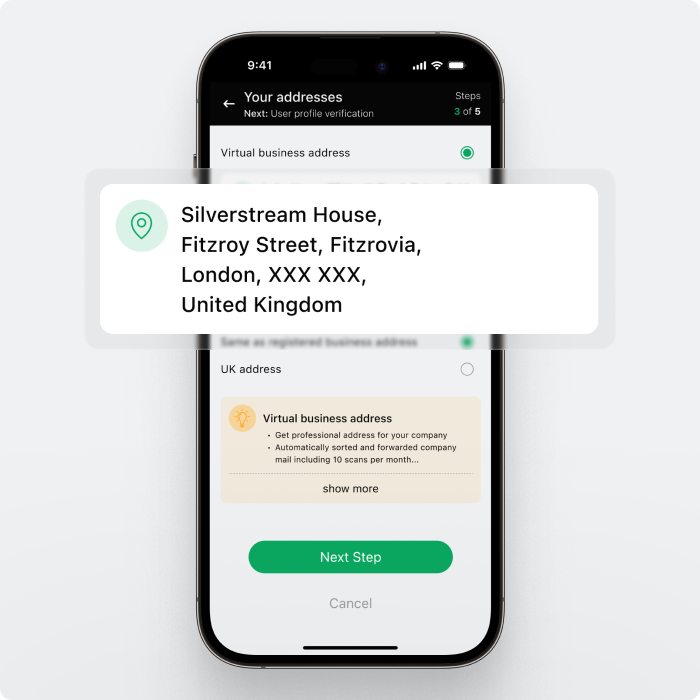

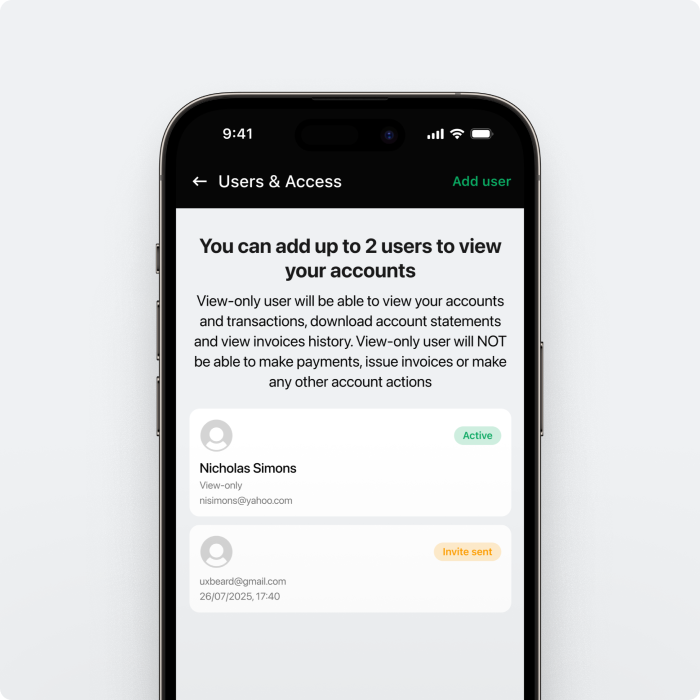

“Card Distributor’s App”

|

Means the Card Distributor’s mobile and web applications relating to the Account and the Card.

|

|

“Card Distributor’s Contact Details”

|

Means the email address we@gosolo.net and/or the Card Distributor’s Website

|

|

“Card Distributor’s Website”

|

means https://gosolo.net/ , being the website belonging to the Card Distributor.

|

|

“Cardholder”

|

means the person authorised by the Business to use the Card to spend Available Balance in the person’s capacity as a representative of the Business and not in its own personal capacity. For the avoidance of doubt a Cardholder is not acting as a consumer for the purposes of this Agreement;

|

|

“Expiry Date”

|

means the expiry date of the Card, which will usually be printed on the Card.

|

|

“Fee”

|

means any fee assessed against a Card, as referenced in the Fees Schedule;

|

|

“Fees Schedule”

|

means the fee schedule which may be updated from time to time. The current version is available on the Card Distributor’s Website or Card Distributor’s App;

|

|

“Issuer”

|

means Payrnet Limited, further details of which are set out in clause 30.

|

|

“KYC”

|

means ‘know your customer’ which means the requirements for knowledge of and information on customers of regulated entities in order to comply with anti-money laundering and counter-terrorist financing law;

|

|

“Merchant”

|

means a retailer or any other person that accepts Cards;

|

|

“Micro-Enterprise”

|

means an entity which is engaged in an economic activity of any form which employs fewer than 10 people and whose annual turnover and/or balance sheet total that does not does not exceed €2 million;

|

|

“PIN”

|

means the personal identification number associated with a Card which can be used as one method of Authorising Transactions;

|

|

“Shortfall”

|

means when the balance of Available Balance is negative for whatever reason, including when a Transaction has been Authorised when there was not a sufficient Available Balance;

|

|

“Transaction”

|

means: (i) paying a Merchant for goods and/or services through Authorising the Card; and (ii) obtaining cash from an ATM or bank by Authorising the Card;

|

|

“Virtual Card”

|

means where applicable a non-physical Card.

|

|

“you”

|

means the Business and/or the Cardholder, as the context may require.

|

2. Contact Details

The Card can be activated and managed online via the Card Distributor’s Website and/or via the Card Distributor’s App.

The Card Distributor should be your first point of contract if you have any issues with the Card or this Agreement. The Card Distributor can be contacted using the Card Distributor’s Contact Details.

3. This Agreement

This Agreement governs the relationship between you and us for the provision of the Card by us to the Cardholder. This Agreement also contains important warnings and information that may affect your rights. By using your Card, you will be deemed to have accepted and fully understood the terms and conditions set out in this Agreement and you agree to comply with these by your use of the Card and/or by indicating your acceptance. The Card remains our property. The Card is not transferable.

4. The Card

The Card is a debit card; it is not a credit, charge or pre-paid card. The Business will not earn any interest on any funds sent to the Account.

You must ensure that there is sufficient Available Balance to enter into each Transaction that you enter into using the Card (including value added tax and any other taxes, charges and Fees that are applicable).

Depending on your program you may receive a Virtual Card. In such cases we will provide You with the number of the Virtual Card, the Expiry Date of the Virtual Card and the CVV2 code.

If for any reason a Transaction is processed and the Transaction amount exceeds the Available Balance, the Business must repay us the amount of such excess immediately and we will be entitled to stop any existing or subsequent Transactions from proceeding.

5. KYC

We require evidence of who you are and your address for our KYC procedures. We may ask the Cardholder or the Business to provide some documentary evidence to prove this and/or we may carry out checks on you electronically.

The files of credit reference agencies may be searched to assist in the identity verification process. This is not a credit search and does not have a detrimental effect on an individual’s credit score/rating or influence an individual’s ability to obtain or raise credit. The credit reference agency will keep a record of any search and this will show as a ‘soft footprint’ on your credit record to alert you that a search was conducted.

6. Funds in the Account

Only the Business can add money to the Account. The Cardholder will not be able to add money to the Account.

We reserve the right to suspend or terminate the right add money to the Account at any time without notice.

The Business solely owns the funds representing the Available Balance and is the beneficial owner of these funds.

7. Service limits

Transactions may be restricted by Card type, individual usage patterns and payment risk profiles. For anti-money laundering and anti-fraud reasons, we reserve our right to change particular payment restrictions (including from those published or included herein) without notice and to the extent required to meet our regulatory obligations.

8. Use of the Card

To activate the Card you will need to log onto the Card Distributor App or Card Distributor’s Website and use the activate card function.

We will be entitled to assume that a Transaction has been Authorised by You where (i) the magnetic strip on the Card was swiped by the Merchant; (ii) the Card was inserted into a chip & PIN device and the PIN was entered; (iii) relevant information was supplied to the Merchant that allows them to process the Transaction, for example, providing the Merchant with the 3-digit security code on the back of the Card in the case of an internet or other non-face-to-face Transaction; or (iv) the Card is tapped against a contactless-enabled reader and accepted by such reader.

The Cardholder should only use the Card as permitted by the Business. If the Cardholder uses the Card, we are entitled to presume that the Cardholder has the Business’ permission to spend the Available Balance until notified to the contrary by the Business. The Cardholder can use the Card up to the amount of the Available Balance for Transactions (i) via the Internet, (ii) at Merchants and (iii) to make cash withdrawals from ATMs, provided that such application is included in the card program.

We will deduct the value of the Transactions from the Available Balance in the Account. We will also deduct any applicable Fees as soon as they become payable by the Business based upon the Fees Schedule.

ATM withdrawals may also be subject to fees, foreign exchange rates, maximum withdrawal limits, rules and regulations of the relevant ATM operator or bank. It is your responsibility to check whether any such additional fees apply, as they cannot be refunded once the cash has been withdrawn.

Like other card issuers, we cannot guarantee a Merchant, an ATM operator or a bank will accept the Card.

We may at any time suspend, restrict or terminate the Card and/or the Account, refuse to issue or replace a Card or refuse to authorise a Transaction for reasons relating to the following:

- if we have reasonable grounds to believe that the Card is being in a way which is not approved by the Business;

- if we have reasonable grounds to believe that the security of the Card has been compromised or suspect that the Card is being used in an unauthorised or fraudulent manner;

- if there is insufficient Available Balance in the Account at the time of a Transaction to cover the amount of the Transaction and any applicable Fees;

- if there is an outstanding Shortfall in the Account;

- if we have reasonable grounds to believe that you are acting in breach of this Agreement;

- if we have reasonable grounds to believe that a Transaction is potentially suspicious or illegal (for example, if we believe that a Transaction is being made fraudulently) or because of errors, failures (whether mechanical or otherwise) or refusals by Merchants, payment processors or payment schemes processing Transactions, or

- if we need to do so in order to comply with the law.

If we do this, we will inform you of the action taken and its reasons in advance or, if that is not possible, immediately after, unless to do so would compromise reasonable security measures or be otherwise unlawful. We will reactivate the Account and where appropriate issue you with a replacement Card if after further investigations we reasonably believe that the reasons for the action no longer apply.

The Business will remain responsible to the Issuer for the use of the Card. Your ability to use or access the Card may occasionally be interrupted, for example, if we need to carry out maintenance on our systems. Please contact us using the contact details set out in clause 2 to notify us of any problems you are experiencing using the Card or Account and we will endeavour to resolve any problem.

You can manage the Card and view your e-statements by accessing the Account online via the Card Distributor's Website or Card Distributor App. You may at any time view the details of the Transactions in the Account using the relevant credentials. You must keep your credentials safe and not disclose them to anyone. The Account will include all Transactions notified to us up to the evening of the previous Business Day.

Your transaction information (“e-statement”) will contain: (i) a reference enabling you to identify each Transaction; (ii) the amount of each Transaction; (iii) the currency in which the Card is debited; (iv) the amount of any Transaction charges including their break down, where applicable; the exchange rate used in the Transaction and the amount of the Transaction after the currency conversion, where applicable; and (v) the Transaction debit value date.

9. Conditions of use at certain Merchants

In some circumstances we or Merchants may require you to have an Available Balance in excess of the Transaction amount.

Some Merchants may not accept payment using the Card. It is your responsibility to check the policy with each Merchant. We accept no liability if a Merchant refuses to accept payment using the Card.

10. Keeping the Card secure and liability

You are responsible for the Card, Account and PIN. Do not share the Card or Account security details with anyone.

You must take all reasonable steps to keep the PIN safe and separate from the Card or any record of the Card number and not disclose it to anyone else. This includes:

- not keeping your PIN with the Card;

- not storing the PIN on a device which is not password protected;

- never sharing your PIN with anyone;

- when entering your PIN, taking all reasonable steps to ensure it cannot be observed by others;

- not entering your PIN into any terminal that appears to be modified or suspicious, and

- if you believe that anyone has gained unauthorised access to your PIN, notifying us without undue delay following the procedures in clause 16.

You will need a PIN in order to make payments at a Merchant or cash withdrawals (from an ATM or a bank) with the Card. If you forget your PIN, you may retrieve the PIN or request a replacement PIN by using the contact details set out in clause 2.

We recommend that you check your Available Balance in your Account regularly on the Card Distributor’s Website or Card Distributor’s App. You will be provided with your Available Balance and a statement of recent Transactions on the Account either by electronic means or on the Card Distributor’s Website or on the Card Distributor App at any time. We also recommend and instruct you to go thoroughly over all the Transactions on a regular basis on the Card Distributor’s Website or Card Distributor’s App.

The Business will be liable for all losses, including any related fees and charges, for any unauthorised Transaction if we can show that you have (i) acted fraudulently or (ii) failed with intent or gross negligence to use and keep safe the Card, Account or PIN in accordance with this Agreement.

The Business will also be liable for all losses, including any related fees and charges, for any unauthorised or incorrectly executed Transaction if you fail to notify us without undue delay on becoming aware of the Transaction, and in any event within 30 days of the Transaction debit date.

In all other circumstances the maximum liability will be as set out in this clause 10 and in clauses 16 and 18.

If you believe that someone else knows the Account or Card security details, you should contact us without undue delay.

Once any Card on the Account has expired or if it is found after you have reported it as lost or stolen, you agree to destroy it by cutting it in two through the magnetic strip.

The Business agrees to indemnify and hold us harmless from and against all reasonable costs of any legal action taken to successfully enforce this Agreement arising out of a material breach of any of the terms and conditions of this Agreement by you or by your fraudulent conduct.

11. Authorising and executing Transactions

Once a Transaction is Authorised, it cannot be withdrawn or revoked.

Within the European Economic Area (EU countries plus Iceland, Liechtenstein and Norway) we will usually execute the Transaction by transferring the amount of the Transaction to the payment service provider of the Merchant by the end of the next Business Day following the receipt of the instructions to transfer the amount. If we receive the instructions after 4:30 pm, they will be deemed received by us on the following Business Day. If the payment service provider of the Merchant is located outside the EEA, we will execute the Transaction as soon as possible.

12. Communications regarding the Account

You can check the Available Balance and Transaction history at any time by logging onto the Card Distributor’s Website or Card Distributor’s App.

13. Cancelling the Card and terminating the Agreement

If you wish to terminate this Agreement at any time, you must request cancellation or termination by contacting us using the contact details set out in clause 2 informing us of your wish to terminate. The Agreement also terminates upon Card expiry subject to clause 14.

Once we have received all the necessary information from you and we have completed and are satisfied with the outcome of applicable anti-money laundering, fraud and other illegal activity checks (including KYC), and once all Transactions and applicable fees and charges have been processed, we will send any Available Balance to the Business’s designated payment or bank account less any fees and charges payable to us, provided that no law, regulation, law enforcement agency, court or regulatory authority requires us to withhold the Available Balance. If we are not able to send the Available Balance for whatever reason, it will be safeguarded pursuant to clause 30 for a maximum period of twenty (20) years, after which time it will become our property. A fee will be charged during this period until either the Available Balance is sent to the Business or it is exhausted. The Available Balance will be sent as soon as it is possible to do so.

A Fee may be charged for cancellation (see clause 20 below) unless you have arranged to transfer any unused funds to another Card managed by us for the Business.

If, following distribution of the Available Balance to the Business, any further Transactions are found to have been made or charges or fees incurred using the Card or we receive a reversal of any prior Transaction, we will notify the Business of the amount and the Business must immediately repay us such amount on demand as a debt.

14. Expiry & redemption

The funds on the Account will no longer be usable following the Expiry Date of the most recent Card that was issued under the Account until a replacement Card is issued.

The Card and this Agreement will terminate on the Expiry Date unless you are issued a renewal Card prior to the Expiry Date. You may not use the expired Card after the Expiry Date. If a Card expires before the Available Balance is exhausted, the Available Balance on the Expiry Date will be returned to the Business as set out in and subject to clause 13.

We will have the right to set-off, transfer, or apply part or all of the Available Balance to satisfy all or any liabilities and fees owed to us by the Business that have not been paid or satisfied when due.

Authorisation will be requested for a Transaction at the time of the Transaction. In the unlikely event, for any reason whatsoever, a Transaction is completed when there are insufficient funds on the Account for that Transaction which results in a Shortfall, the Shortfall will be repaid by the Business unless it is due to:

- an error on the part of the Merchant to which the Card was provided by you as the means of payment, or

- an error on the part of the Issuer.

Should the Business not repay this amount immediately after receiving an invoice or notification from us or the Card Distributor, we reserve the right to take all steps necessary, including legal action, to recover any monies outstanding.

15. Termination and suspension of Card and Account

We may terminate the Agreement for any reason by giving you at least 30 days’ notice.

We may terminate the Agreement without prior notice if:

- you breach an important part of this Agreement, or repeatedly breach the Agreement and fail to resolve the matter in a timely manner;

- we so agree with the Business;

- the Business fails to pay fees or charges that you have incurred or fail to cure any Shortfall, or

- we are required to do so by law or by the card scheme (for example, where the provision of the Card to you becomes unlawful).

We may also terminate this Agreement or suspend the Card or Account without prior notice if:

- we reasonably believe the Card is deliberately being used by you to commit fraud or for other illegal purposes, or

- we discover that any of the information you provided us with when you applied for the Card was incorrect.

If we terminate the Agreement without prior notice, we will tell you as soon as practicable afterwards unless we are prohibited by law from doing so.

16. Lost and stolen Card and the right to a refund for unauthorised Transactions

If you know or suspect that the Card is lost or stolen, or that the PIN code is known to an unauthorised person, or if you think a Transaction has been unauthorised, you must tell us without undue delay by calling us using the number set out in clause 2 of this Agreement.

A Transaction will be considered to be unauthorised if you have not given your consent for the Transaction to be made by Authorising it. In order for any unauthorised Transaction amount to be refunded to the Account, you must report the Transaction without undue delay upon becoming aware of it. A refund cannot be made for any unauthorised Transaction reported after 30 days have passed following the debit date of the Transaction.

Despite the possible 30 day’s refund period, a refund cannot be made for an unauthorised Transaction if the Transaction was correctly displayed in the Account activity online and you failed to inform us about the Transaction being unauthorised without undue delay upon seeing the Transaction in the Account activity online. In this respect we urge you to check the Account activity online on a regular basis and review the Transactions carefully.

When you call using the contact details set out in clause 2, you will be asked to provide us with the Card’s number where possible and some other identifying details. If there is an Available Balance remaining in the Account, we will replace the Card for the Account. Alternatively, the Available Balance can be redeemed to the Business. If we replace the Card, the Card will be delivered to the registered address subject to possible Fees.

We will refund as soon as possible, and no later than by the end of the day on which the unauthorised Transaction is reported by you, the full amount of any unauthorised Transaction reported by you, including any associated Fees and charges, provided you notify us of the Transaction in accordance with this Agreement except that:

- we will refund at the beginning of the next Business Day any unauthorised Transactions reported on a day that is not a Business Day or reported after 4:30 pm on a Business Day;

- if there is evidence that you acted fraudulently or have with intent or gross negligence failed to comply with the Agreement in relation to the use of the Card and safety of the Card’s security details, we will first carry out a prompt investigation to determine whether the Transaction was Authorised by you and will only refund if the investigation shows that the Transaction was not Authorised by you, and

- if the Card was lost or stolen or you have failed to keep your PIN or other security details safe from misappropriation, the Business will be liable for losses up to a maximum of 35 GBP (or equivalent in another currency) per instance of loss, theft or misappropriation.

The Business will be liable for all losses incurred in respect of an unauthorised Transaction where you have acted fraudulently or have with intent or gross negligence failed to comply with the Agreement in relation to the use of the Card and safety of its security features.

Except where you have acted fraudulently the Business will not be liable for any losses incurred in respect of an unauthorised Transaction arising after you notify us of the Transaction in accordance with the Agreement. The Business is not liable for any losses that occur where the Card has been used in a ‘card not present’ environment except where you have acted fraudulently or with intent or gross negligence.

If there is evidence that you checked the online Account and did not notify us of the unauthorised Transaction without undue delay, we may not refund the Account.

We reserve the right to investigate any disputed Transaction or misuse of the Card before and after a refund. In order to do so we may need more information and assistance from you and you are required to reasonably cooperate with any investigation by us or any law enforcement agency or other competent authority. If we make a refund following the claim and subsequently establish that the conditions for the refund have not been met, we may deduct it from the Available Balance after notifying you. If there is no sufficient Available Balance, the Business must repay us the amount immediately on demand.

17. Our liability

We will not be liable for any loss arising from:

- your inability to use the Card as set out or for any reason stated in clauses 10 and 13;

- any cause which results from abnormal or unforeseen circumstances beyond our control, consequences of which would have been unavoidable despite all our efforts to the contrary, including but not limited to fault in or failure of data processing systems, lack of funds, maximum withdrawal limits set by ATM operators;

- a Merchant refusing to accept the Card;

- any issue with the goods or services that are purchased with the Card;

- any loss or theft that is reported later than 30 days following the debit date of the Transaction in question;

- our compliance with legal and regulatory requirements;

- our suspending, restricting or cancelling the Card or refusing to issue or replace it in accordance with clause 8 above, or

- loss or corruption of data unless caused by our wilful default.

From time to time, your ability to use the Card may be interrupted, e.g. when we carry out maintenance to improve and keep the service running for our customers. If this happens, the Business may be unable to add funds to your Account, and/or you may be unable to:

- use the Card to enter into a Transaction, and/or

- obtain information about the funds available in your Account and/or about the recent Transactions.

We will not be liable for any loss arising from such interruptions.

We are also not liable for:

- business interruption, loss of revenue, goodwill, opportunity or anticipated savings, or

- any indirect or consequential loss arising from your total or partial use or inability to use the Card, or the use of the Card by any third party.

To the fullest extent permitted by relevant law, and subject to clauses 16 and 18, our total liability under or arising from this Agreement will be limited as follows:

- where the Card is faulty due to our default, our liability will be limited to replacement of the Card; and

- where sums are incorrectly deducted from the Available Balance due to our fault, our liability will be limited to payment to the Business of an equivalent amount, and

- in all other circumstances of our default, our liability will be limited to repayment of the amount of the Available Balance.

No party will be liable for, or be considered in breach of this Agreement on account of, any delay or failure to perform as required by this Agreement as a result of any causes or conditions which are beyond such party’s reasonable control and which such party is unable to overcome by the exercise of reasonable diligence.

The above exclusions and limitations set out in this clause 17 will apply to any liability of our affiliates, such as Mastercard or other suppliers, contractors, agents or distributors and any of their respective affiliates (if any), to you, which may arise in connection with this Agreement.

18. The right to a refund for Authorised and incorrectly executed Transactions

A refund may be made for an Authorised Transaction if (i) your Authorisation of the Transaction did not specify the exact amount at the time of the Authorisation, and (ii) the amount exceeded what you would have reasonably expected taking into consideration your previous spending patterns and other relevant circumstances. A claim for a refund of such a Transaction must be made within 30 days from the date on which the funds were deducted from the Available Balance. We may require you to provide us with such information as is reasonably necessary to ascertain whether the conditions for the refund are met. Within ten (10) Business Days of receiving (i) the claim for a refund or (ii) where applicable, any further information we requested from you, we will either refund the full amount of the Transaction to the Account or provide you with justification for refusing the refund.

In order to receive a refund to the Account for an incorrectly executed Transaction (including non-executed or defectively executed Transaction), you must report the Transaction without undue delay upon becoming aware of it. A refund will not be made for any incorrectly executed Transaction reported after 30 days have passed following the debit date of the Transaction.

Despite the possible 30 days refund period a refund will not be made for an incorrectly executed Transaction if the Transaction was correctly displayed in the Account activity online and you failed to inform us about the Transaction being incorrectly executed without undue delay upon seeing the Transaction in the Account activity online. In this respect we urge you to check the Account activity online on a regular basis and review the Transactions carefully.

As soon as practicable after you have notified us of a disputed Transaction in accordance with this Agreement, you must confirm the disputed Transaction in writing by email or by post, setting out full details of the Transaction and your reason for disputing it. You must provide us with all receipts and information that are relevant to the claim.

Where we are liable for an incorrectly executed Transaction, we will without undue delay refund the amount of the Transaction to the Account, restore the Account to the state it would have been had the defective Transaction not taken place and refund any charges and interest that have arisen as a consequence of the non-execution or defective execution of the Transaction provided you notify us of the Transaction in accordance with this clause 18.

If we make a refund following a claim and subsequently establish that the conditions for the refund have not been met, we may deduct it from the Available Balance after notifying you. If there is no sufficient Available Balance, the Business must repay us the amount immediately on demand.

If you are not satisfied with the justification provided for refusing the refund or with the outcome of the refund claim, you may submit a complaint as described in clause 25.

19. Changes to this Agreement

We may change the Agreement by notifying you by e-mail or other agreed means 2 weeks before the change is due to take effect. You will be deemed to have accepted the notified change unless you tell us that you do not agree to the change prior to the change being effective. In this case, the Agreement will terminate upon expiry of the notice. You also have a right to terminate the Agreement immediately and without charge at any point during the notice. In such circumstances we will refund the Available Balance on the Account in accordance with clause 13 and you will not be charged a Fee for closing the Account.

We may make immediate changes to the exchange rate used to convert money from one currency to another as part of a Transaction.

20. Fees and limits

We may charge Fees in connection with any of our services and facilities that you have made use of or requested based on our Fees Schedule. The Fees Schedule is subject to changes. The most recent update of schedule will be available on the Card Distributor’s Website or Card Distributor’s App.

We may charge you an administration charge as set out in the Fee Schedule in the following circumstances:

- in the event that you make any payment to us that is subsequently reversed after sixty (60) days due to inadequate account information or inadequate KYC documentation, and

- to cover our reasonable costs and expenses in providing you with manual support on the Account not otherwise required under the Agreement (e.g. a request for legal, police, court or other judicial support).

We may charge you a Fee for chargebacks as set out in the Fees Schedule where a receiving bank declines receipt of a payment following a request to transfer the funds from the Card.

We have the right to review and change the amount of Available Balance you are able to have in the Account and the spending limits on the Card at any time and will notify you accordingly.

21. Cardholder and Business details

You must let us know as soon as possible if you change your name, address, phone number or e-mail address. If we contact you in relation to the Card or the Account, for example, to notify you that we have cancelled the Card, we will use the most recent contact details you have provided to us. We will not be liable to you if your contact details have changed and you have not informed us.

22. Data protection

You agree that we can use your personal information in accordance with our privacy policy which is set out at https://www.railsbank.com/privacy-policy. The Card Distributor may also use your personal information in accordance with its privacy policy which is set out on the https://gosolo.net/privacy-policy. Please note that us and the Card Distributor are each independent data controllers. Each privacy policy includes details of the personal information collected, how it will be used, and who it is passed onto. You can tell us if you do not want to receive any marketing materials from us.

To comply with applicable KYC-and anti-money laundering rules and regulations our bank, the Issuer, the Card Distributor and the relevant programme manager and/or any other business partner (all together a “Partner”) who will introduce the Cardholder to the Card Distributor and the Issuer, shall be entitled to carry out all necessary verifications regarding the Cardholders identity. The abovementioned Partner and the Card Distributor may use a recognised agency for this verification purposes (details of the agency used will be provided to you on request). In this respect, the Cardholder’s personal data will be transferred to the Card Distributor and the Issuer and will processed also outside the United Kingdom.

23. Payment disputes with Merchants

In relation to any dispute between you and a Merchant, provided you are able to satisfy us that you have already made all efforts to resolve the dispute with the relevant Merchant, we will attempt to assist you so far as is reasonably practicable. We may charge you a Fee as referenced in the Fees Schedule for any such assistance we may give you with any such dispute. If there is an irresolvable dispute with a Merchant in circumstances where the Card has been used for a Transaction, you will be liable for the Transaction and will have to resolve this directly with the relevant Merchant.

24. Communication

Unless required otherwise by other provisions of this Agreement, if you have an enquiry relating to the Card, you can call us using the contact details set out in clause 2.

This Agreement is concluded in English. All communications with you will be in English.

We may contact you by e-mail, text message or post unless provided otherwise under the Agreement. You must maintain a valid e-mail address, a valid mobile telephone number and a valid address registered with us and must notify us of any changes in your registered details without delay. You agree to check for incoming messages regularly.

Any e-mail will be deemed received as soon as it is sent unless within 24 hours the sender receives a failure notice indicating that the email has not been transmitted. Any e-mail will be deemed received by the recipient on the day it is received in his e-mail inbox if received before 4.30 pm on a Business Day. If received at any other time, it will be deemed received on the next Business Day.

Any communication or notice sent by post will be deemed received three (3) days from the date of posting for UK post or within five (5) days of posting for international post. Any communication or notice sent by text message will be deemed received the same day.

25. Complaints

If you are not satisfied with the Card or the way it is managed, tell us by contacting us using the contact details set out in clause 2 so that we can investigate the circumstances for you. You may also request to be provided with a copy of our complaints procedure at any time. Any complaints you have will be dealt with quickly and fairly and you agree to cooperate with us and provide the necessary information for us to investigate and resolve the complaint.

We will endeavour to handle your complaint fairly and quickly, however, if you are not satisfied with the outcome, you may contact the Financial Ombudsman Service at Exchange Tower, London E14 9SR; telephone: 0800 023 4567 or 0300 123 9 123; website: http://www.financial-ombudsman.org.uk; and e-mail: complaint.info@financial-ombudsman.org.uk.

The European Commission’s online dispute resolution (“ODR”) platform is at: https://ec.europa.eu/consumers/odr/main/?event=main.adr.show. The ODR platform can be used to resolve disputes between the Issuer and consumers.

26. Assignment

We may assign this Agreement to another company at any time. If we assign the Agreement to another company you will be given prior notice of this. Unless you tell us within 2 weeks that you do not want to continue with the Agreement after the assignment, you agree that we can assign the Agreement in this way. Your rights will not be affected by such assignment should it happen. You may not assign the Agreement to a third party. Your right to terminate the Agreement under clause 13 is not affected.

27. Governing law

This Agreement will be governed by English law and the English courts will have exclusive jurisdiction regarding any legal proceedings between us.

28. Protection of funds

We ensure that once we have received the funds they are deposited in a secure account, specifically for the purpose of redeeming Transactions made by the Card. In the event that we become insolvent, funds against which the Issuer has already issued electronic money are protected against the claims made by creditors.

29. Business opt-out

Pursuant to regulations 40(7) and 63(5) of the Payment Services Regulations 2017 (“PSR”) the parties agree that: (i) Part 6 PSR does not apply to the Agreement; (ii) the obligations set out in regulations 66(1), 67(3), 67(4), 75, 77, 79, 80, 83, 91, 92 and 94 of Part 7 PSR do not apply to the provision of services under this Agreement; and (iii) that a different time period applies for regulation 74(1) of Part 7 PSR.

30. The Issuer of the Card

The Card is issued by Payrnet Limited. whose company number is 09883437 and whose registered office is Kemp House, 152 City Road, London, United Kingdom, EC1V 2NX. Payrnet Limited is an electronic money institution authorised and regulated by the Financial Conduct Authority with register number 900594.

Payrnet Limited. can be contacted by email – support@payr.net. Payrnet Limited’s web address is https://www.railsbank.com/payrnet.

31. Third Party Payment Service Providers

This section 31 applies when you use the services of an AISP (or PISP). We may deny an AISP (or PISP) access to the online account connected to the Card for reasonably, justified and duly evidenced reasons relating to unauthorised or fraudulent access to the online account by that AISP (or PISP, including the unauthorised or fraudulent initiation of a transaction.) If we do deny access in this way, we will notify you of the denial and the reason for the denial in advance if possible, or immediately after the denial of access, unless to do so would compromise reasonably justified security reasons or is unlawful. We will allow AISP (or PISP) access to the online account once the reasons for denying access no longer apply.

Fees Schedule

You can find our fees for GoSolo business account here. You may be required to pay other costs, taxes or charges in relation to your GoSolo business account, which are outside of our control and not charged by us. For example, you may be charged by other banks for sending money to a GoSolo account.