⚡ TL;DR: Tap to Pay lets small businesses accept contactless card payments directly from a smartphone — no card reader needed. It’s fast, secure, and perfect for freelancers, market sellers, and service providers. With GoSolo, you can start accepting Tap to Pay instantly through your mobile app, with no setup fees or hardware.

Tap to Pay on iPhone is an innovative way for businesses to accept contactless card payments using a regular smartphone. Your phone replaces a traditional terminal, making it especially convenient for UK small businesses, as customers prefer contactless payments.

Unlike traditional POS terminals, Tap to Pay requires no extra hardware or complex setup. This technology became available to UK entrepreneurs fairly recently but has already proven effective.

How Does Tap to Pay Work on iPhone or Android?

How does contactless work on modern devices? Functionality relies on integrated NFC technology to facilitate payment processing. The customer holds their card or device to your smartphone and a secure data exchange takes place, instantly processing the payment.

To install an app from a payment provider to accept payments, you need an iPhone model XS or newer. For Android, there are no such limitations. Transaction processing takes a few seconds, which is convenient during peak traffic times.

The solution integrates seamlessly with various digital wallet services, including Apple Pay and Google Pay. The customer taps their smartphone or smartwatch against your iPhone or Android phone and the payment will be processed. The technology uses strong data encryption and protection against unauthorised access — the same level of security as standard terminals.

The UK's transaction amount limit for contactless payment has been increased to £100, which covers most everyday purchases. For transactions exceeding £100, customers must enter their PIN.

Benefits for Small Businesses

Card payment with phone offers small businesses a number of advantages:

- Savings on the purchase of payment terminals

- Quick start of accepting payments without lengthy preparation

- Mobility — accept money anywhere

- Convenient accounting of transactions and automatic reporting

It is especially important for seasonal businesses that there are no subscription fees during idle periods — you pay only for actual transactions. In addition, paying by phone reduces customer service time compared to cash payments.

Small shop owners have noticed an increase in the average cheque after the introduction of contactless payments: with cashless payment, customers are less restrictive in their purchases compared to using cash.

Choosing an App for Contactless Payment

When choosing an app for contactless payment, pay attention to:

- Data security and PCI DSS compliance

- Intuitive interface and ease of use

- Transparent commission system

- Availability of support for UK users

- Speed of funds transfer

- Additional features (analytics, integrations with accounting systems)

Make sure to account for all potential expenses when choosing a service. Some contactless payment apps have low transaction fees, but may charge for withdrawals or include hidden costs. Always check the full agreement details prior to signing up.

Pay attention to the speed at which funds are credited. For small businesses with limited working capital, it's critical to receive revenue as quickly as possible. The best services offer crediting on the next business day or even the same day for a small additional fee.

Additional features will make doing business much easier:

- Generation of QR codes for payments

- Ability to send invoices by email or SMS

- Automatically update product balances in your accounting system after each sale

Prior to full implementation, conduct several trial payments through your selected application. Make sure the interface is user-friendly, and the system works correctly before you start using it.

Try Tap to Pay with GoSolo

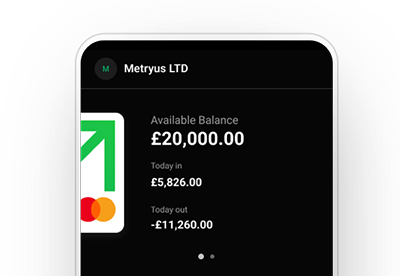

GoSolo offers one of the best options for small businesses in the UK. The company has developed an easy-to-understand app for contactless payments with favourable rates and a simple setup. You can download the app and open a GoSolo account for free. After that, you can immediately accept payments via iPhone and Android by activating the Tap to Pay function in the Payments section.

GoSolo offers a transparent fee structure: just 1.49% + 20p per transaction, with no monthly or setup fees. A major advantage is that there is no standard £100 limit per transaction. The system is not dependent on a Wi-Fi connection and works perfectly with mobile internet.

All payments are processed using the iPhone's in-built security protocols, and customers' financial details are secure. Transfers are completed in 1–4 business days. The service also provides an intuitive control panel for monitoring all your transaction activity.

Start accepting payments today - visit https://gosolo.net/tap-to-pay and empower your business.

Available on Web, iOS, and Android.

Back to Blog

Back to Blog