⚡ TL;DR: There are many ways small businesses in the UK can accept payments — from traditional card readers and online checkouts to modern solutions like payment links, QR codes, and Tap to Pay. This guide explores the pros and cons of each option to help you choose what works best for your business.

Let's get straight to the point. There are seven main payment options that small businesses can use, both for online and offline payments:

- Card payments (in-store, mobile, and online) - the most popular and, without a doubt, one of the most comfortable payment methods for a customer. Credit cards are used in 28% of offline sales, and 38% of all transactions are used with a contact interface, while e-wallets like Apple Pay or Google Pay are used in 35% of all transactions.

- Bank transfers are mostly used for paying salaries or processing business payments. Since 2023, they have overcome Direct Debit in the overall amount of payments.

- Invoicing – this payment method is used to process A2A payments and other business transfers.

- Direct Debit – 90% of the UK residents have at least one active Direct Debit account for payment processing, while Direct Debit is used for at least 58% of all online payments.

- Payment links and QR codes – since the COVID-19 times, QR-codes and payment links are rapidly growing in popularity, especially in the HoReCa sector.

- Mobile payment apps (Apple Pay, Google Pay) – as we have already mentioned above, this option takes up to one-third of all card payment transactions.

- Cash (declining but still relevant in some sectors) – even though cash usage has fallen dramatically to around 12%, in some locations all around the UK, especially in rural areas, cash still holds its position as the main payment method.

Accepting Card Payments for Small Businesses

As card payments are the most popular among other payment methods, it is significant to mention that there are some specifics and vital details regarding card payment solutions for small business, including different payment technologies, tools and providers:

Card Payment Types

Chip & PIN – you definitely know this technology, where you have to put your card in the terminal and use your PIN code to process payment. As for today, this is more of a legacy solution than something really relevant, yet some businesses still use it. Additionally, such terminals are sometimes used for processing large payments.

Contactless interface – this is the dominating card payment solution in the UK, as it allows customers to just touch the terminal with their credit card or e-wallet to get the payment processed. Most modern terminals have both contact and contactless interfaces, where the contact interface is used when contactless payment isn’t processed for some reason.

Tap to Pay – a newer technology, which allows a payment acceptor to use their smartphone as a terminal - this requires the client to touch their card or smartphone with a wallet to the smartphone of a seller, after which payment will be processed as in the case of a real terminal.

Card Payment Tools

Card reader – a separate device that works as connected to a smartphone or POS terminal that allows the system to read cards and process payments. The main difference from the mobile terminal is that the card reader works based on commission from each transaction it processes, which may be costly for high-performance businesses (in terms of sales), yet it is cheap to purchase and easy to set up.

Mobile terminal – another portable tool for processing card payments, yet this one works based on a monthly or yearly contract where you pay a fixed fee for using it. Also, the tool itself is more expensive, which makes it a great choice for a stable business, while beginners should aim for card readers.

Providers

Merchant account providers – a traditional type of card payment solution provider, which is more complicated in terms of setup and processing, yet they often offer you a personal business banking account and low fees.

Payment facilitators (PayFac) - modern all-in-one platforms that rely on simple setup, low prices and an intuitive interface that makes them a perfect choice for small businesses.

Bank solutions – direct services from banks, which also include your personal banking account and often require Pa OS terminal to be all set. In terms of price, they will be more expensive than payment facilitators and merchant account providers.

Fees and considerations

Fix price commission – the model where you pay a fixed price commission from each processed transaction. Works perfectly for big sum payments where a fixed commission won’t make much difference.

Percentage-based commission – charges a fixed percentage from each transaction, which works great with businesses that process hundreds of small-price operations.

You should also keep in mind the following fees you will have to pay:

- Terminal or POS monthly fee

- Cash-out and transfer fees

- Hardware or subscription fees

How to Start Taking Business Payments

When it comes to selecting the best card processing for small business, you will have to follow a strict algorithm to avoid making mistakes and putting financial risks on your business. Fortunately, we have such a guide for you:

1. Choose a provider

Selecting a provider is 50% of the future success. You have to take following features into consideration.

Fees and commissions – think of your business model and decide which way – fixed price or percentage-based – works better for you.

Setup process – you have to understand that the fast setup matters, as you can start processing payments earlier.

Ease of use – some platforms are easier to operate, especially PayFace systems that focus on the needs of small businesses.

Customer service – card payments are the critical part of your business, so you have to provide detailed information on potential downtimes and ways for their resolution.

Integrability with other tools – sometimes choosing a flexible system may result in new opportunities for scaling up in the future.

As we have mentioned, providers are segregated into three main groups:

Merchant and bank account providers – reliable, but legacy solutions, higher fees, and less flexibility.

PayFac platforms – modern technologies, high integrability, and speed setup.

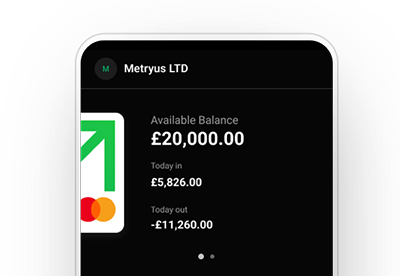

Open Banking solutions – the newest options for business, capable of processing A2A payments, focus on customer satisfaction. Such systems as GoSolo can offer even more benefits, including free bank transfers and a lower commission rate of 0.5% + 20p.

Available on Web, iOS, and Android.

Understand the costs

The costs of the software and hardware for card payment processing will determine one of the most important aspects of spending for your business. A wrong choice of commission model almost guarantees you problems in the near future, so consider carefully:

Review your payment model – calculate the average sum of a payment and number of payments monthly and apply different models to your results to find out where you can save.

Make the choice between fixed-price and percentage-based models, considering their applicability to your business needs.

Remember the following costs: monthly fees for terminals, subscription and hardware rent, and transfer and cash-out fees.

Connect to a bank account or payment platform

To understand how the link business-provider-bank works, imagine the provider as a mediator between the business and the bank. When the customer in the store uses their credit card for making a payment, the provider starts reviewing their bank to see if it can process the payment and if the customer has enough money in their account. If everything goes well, the provider charges the money and “freezes” it to give it back to the business after processing. Some providers can even offer instant cash-outs for businesses, but for additional fees only.

Most PayFac providers have direct integrations with both traditional banks and neobanks, such as GoSolo, which also offers you the ability to link your bank account directly to the payment system you use and receive direct transfers without long waiting times and additional costs for your business.

Legal/business registration requirements

To begin processing card payments, you have to get your business registered as a legal entity in accordance with the legal requirements. It has to be either a solo trader or an LTD (Limited Liability Company). You have to provide your ID and the evidence for the physical address, too.

Here is another time we have to mention GoSolo – this is an all-online service where UK-based entrepreneurs can not only open a banking account and set up card payments for their business but even register the LTD company with no significant effort compared to traditional routes.

Online Payment Options

Aside from card payments, which are required for offline businesses, the majority of transactions are processed online, and even businesses like HoReCa plan to move the majority of their transactions to the web. As a result, we must address the question of what online payment methods for small businesses are available and which ones will be most effective for your business.

Payment links

A simple technology, where you send a link to a customer which leads to the page with the payment interface. It can be sent either by hand or automatically, which is offered by some CRM systems and other business solutions. The page the link leads to offers an option to pay with a credit card, e-wallet, or sometimes PayPal or other similar services. This option works perfectly for cases where not a lot of payments are processed monthly, for instance, for freelancers, consultants, and small e-shops.

Invoicing apps

These are the systems which also send online invoices, but in a more formal form as a document where you can see all the information about the purchase and payment itself and pay either by bank transfer or by card. Invoices are suitable for B2B, where only formal payments can be accepted, but also work great for individual customers. Many business systems now offer an option to generate and send an invoice automatically when the order is placed. You can also integrate online invoices with the most popular accounting systems.

Keep in mind that in the UK, an e-invoice is always linked to your VAT.

Subscription or recurring payments

This model works for services which customers use permanently, for instance, subscriptions for online platforms, apps, and so on. A subscription or recurring payment is charged monthly, quarterly or yearly from the bank card you provided to the service when you purchased the subscription. Direct Debit can also be used for paying for subscriptions. This model allows businesses that rely on recurring payments to save more time on avoiding providing regular invoices and makes the process more comfortable for a customer, who provides his data only once.

eCommerce integrations

This payment model means the integration of payment services directly into the e-commerce platforms, making the purchase process extremely simple for a customer. From the side of the client, it looks in the following way – they can visit the e-commerce store, select the preferred item and pay for it in one click without even closing the web page. Almost all key CMS platforms in the UK support this technology, as well as a larger part of payment services providers offering such a service. If you represent an e-commerce business and use a CMS platform or look forward to using one, this payment option should be in your shortlist.

What's the Right Payment Option for Your Small Business?

Now we are at the end of the story – and it is time to make a conclusion that will help you find the perfect way for your business to adapt to new payment methods and delight your customers in the way they expect you to do so.

Consider your industry and customers

For e-commerce, choose CMS payment integration, while for offline stores, make sure you will use the most effortless card payment over there – consider the comfort of the buyer as the main priority.

Balance fees, speed, and convenience

Choose the commission model carefully and think of the setup terms, but remember – the more convenient it is for clients, the better it is for your business.

Think about integrations with accounting tools

To avoid unnecessary issues, integrate accounting to keep your finances secure and eliminate risks. Consider XERO as an accounting tool that unites capabilities, usability and integration options.

Besides the variety of payment options and numerous ways to implement those, our best tip for you will be the simple fact: the best payment method is the one that your customers prefer. Analyse your audience, communicate, and do your research – that’s the key to success.

But that will take a lot of time, won’t it? We have one recommendation that will help you save time and money. Want to partner with a reliable payment services provider? Try GoSolo's payment tools today; they are all included in a free business account, with no monthly subscriptions and the lowest transaction fees on the market.

Already running a business? Handle money and accept payments in one app.

Back to Blog

Back to Blog