Features

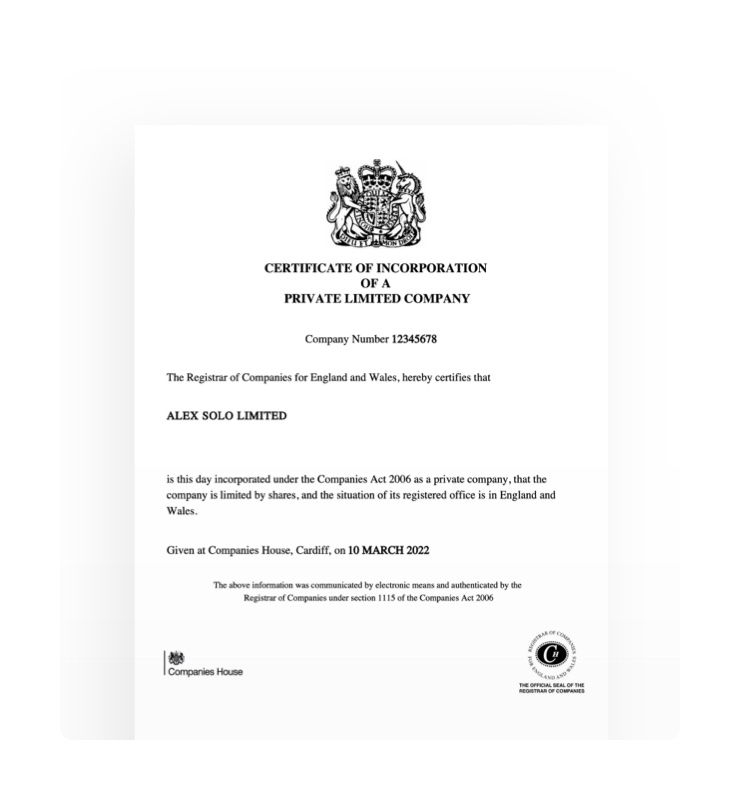

Company registration

Start your business by registering a limited company in the UK

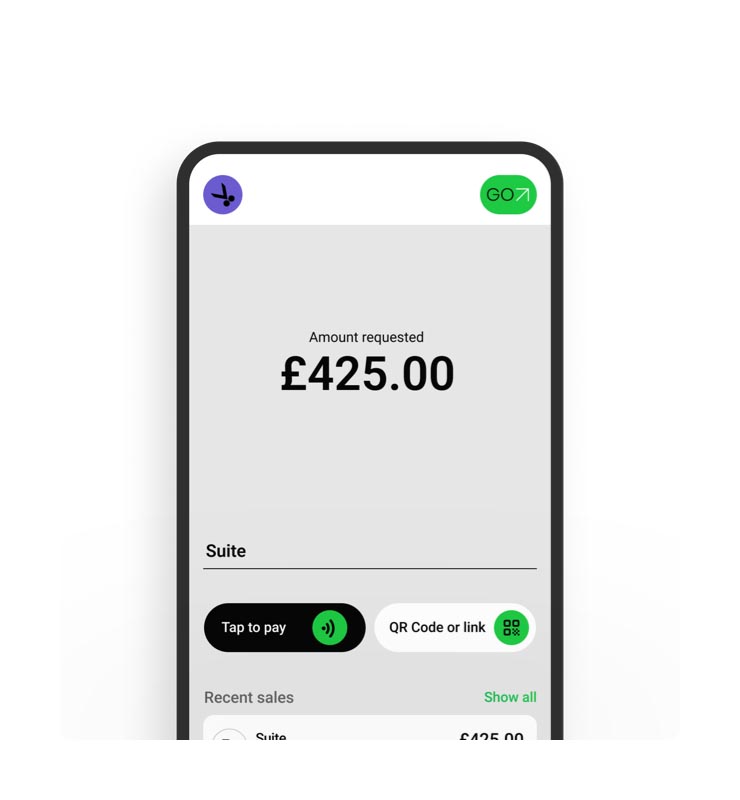

Checkout

Accept payments anywhere and anytime with your phone and a QR code or payment link

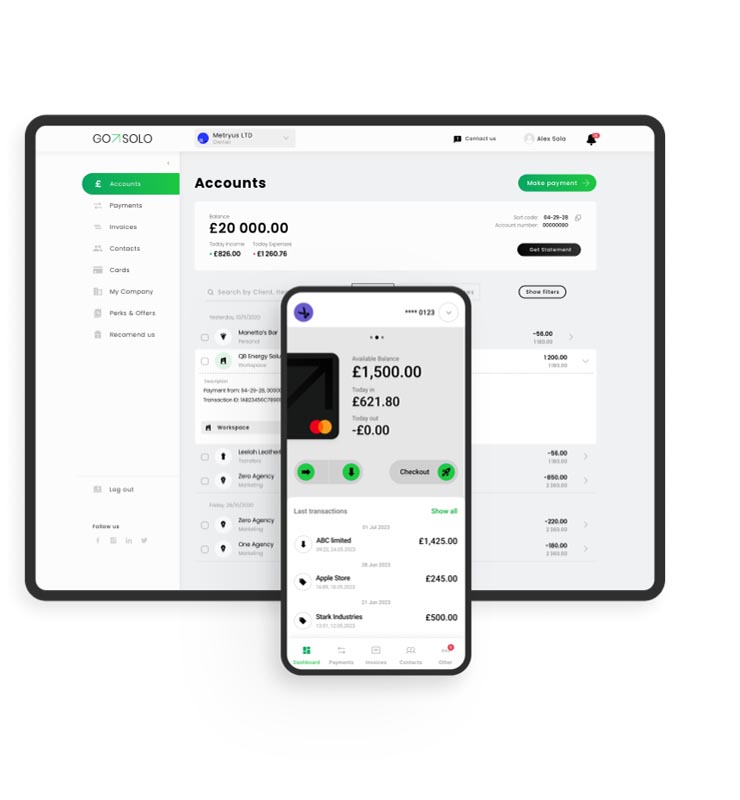

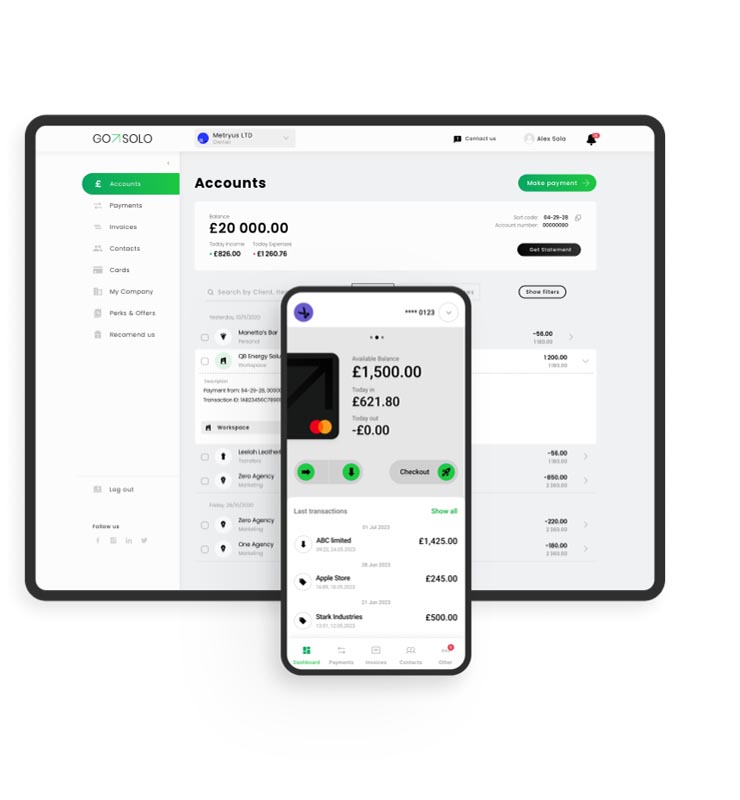

Business account

Open a Business Account for small businesses online

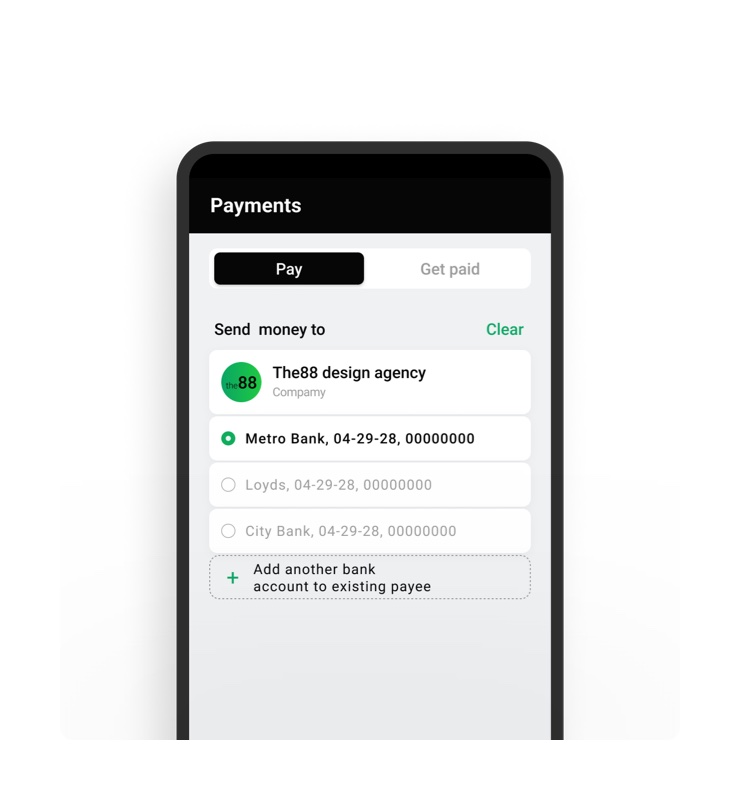

Payments

Secure and easy payments to suit all your business needs

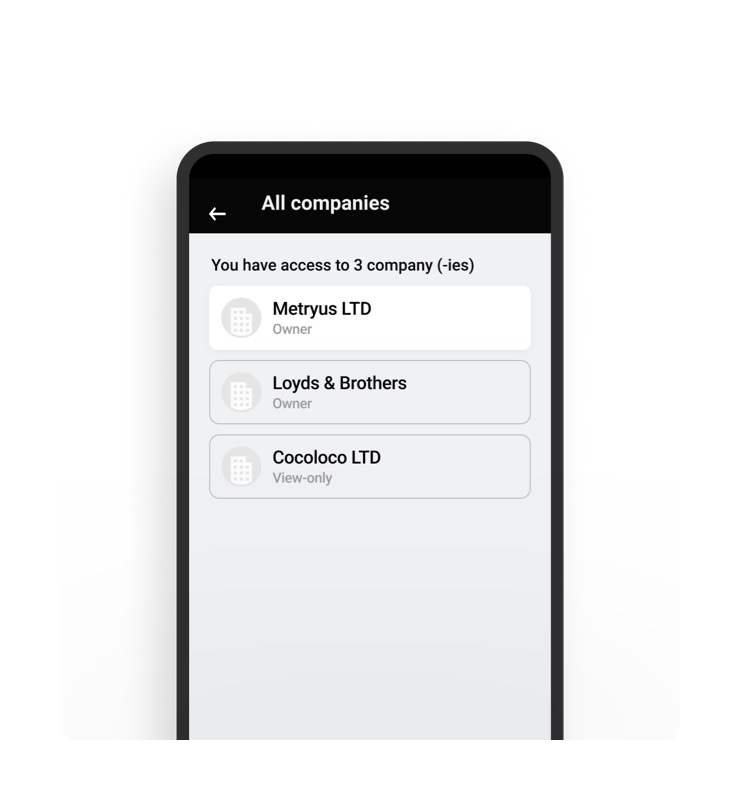

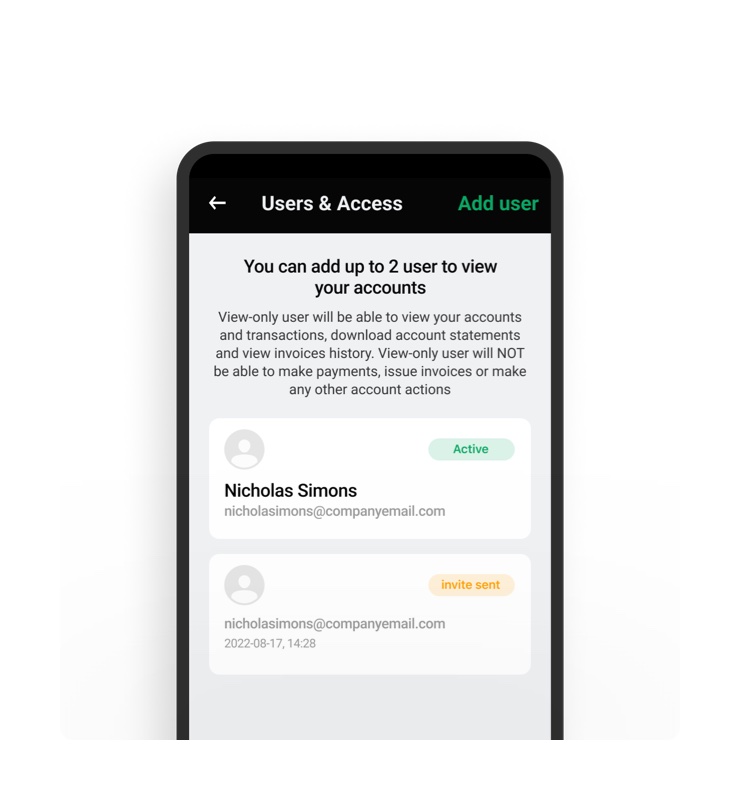

Third-party access

Allow your team members to access your account

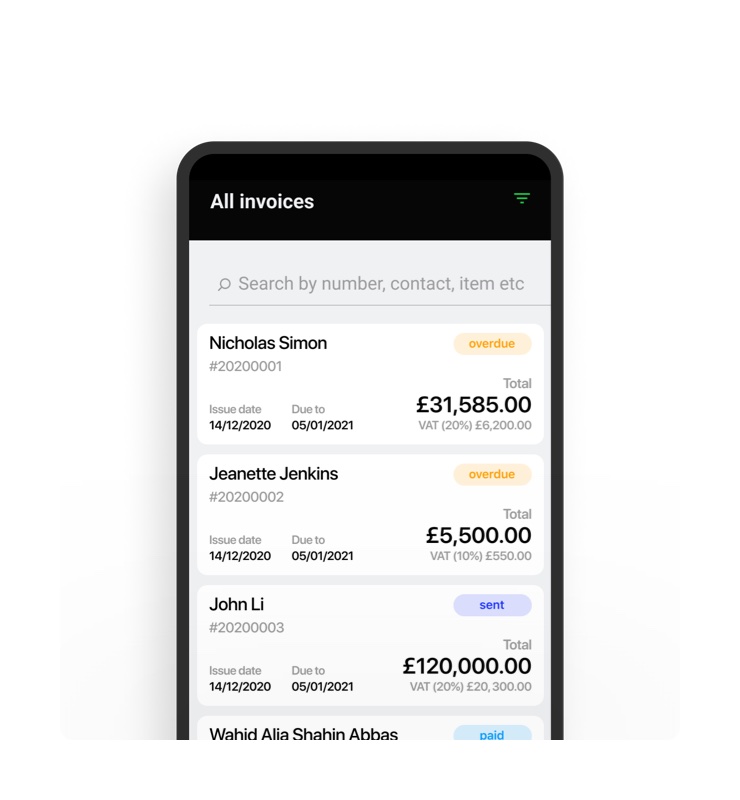

Invoicing

Create an send online invoices

Multi-company accounts

All your companies in one place

Use cases

Pricing

Company