If by “bank” you mean an institution that has a physical location and lots of cash stored in vaults then, no, we’re not that.

If you mean an institution that protects your funds and is as strictly regulated as all those physical institutions that have vaults of gold then, yes, we are that.

The lines and definitions of what is a bank and what isn’t have blurred since the advent of FinTech. Banks are no longer the only type of institutions that can handle your money for you.

Let us explain:

So what is GoSolo?

GoSolo is an institution that handles electronic money. So is Mastercard. So is PayPal. So is Stripe.

We have been approved by the rigorous and stringent rules set by the FCA (the Financial Conduct Authority) to be allowed to operate as a legal, responsible and ethical financial services firm. These are the same rules that banks must operate by.

Only by continually adhering to the FCA’s rules (and regularly reporting what we do) can we be allowed to continue to operate.

Our authorisation from the FCA as an electronic money agent allows us to facilitate business transactions and deliver certain financial services.

We are not allowed, however, to provide loans or FSCS deposit-guarantees. And we don’t handle physical money, whether that be cash or cheques. Unlike many traditional banks, we don’t offer phone assistance. (Although, let’s be honest, often that type of “assistance” leaves much to be desired!) But we do have a support team that can assist you by chat, WhatsApp or email.

Rest assured, however, that your money is 100% protected, secured and safeguarded in a “ring fenced” account with a tier-one UK bank that we have partnered with. Ring-fenced means that we don't have access to it and cannot move or use it somewhere, you are always in total control.

To be absolutely clear: Your money is safe with us.

Additionally, all transactions you run on your card are handled by the Mastercard network and are entirely protected under the Mastercard rules.

The benefits of not being a “traditional bank”.

Because we are not technically a traditional bank, we are free to invest in and to build technology faster and provide services that will assist users in the general area of their businesses and finances. Not being held down by the label of a traditional bank means we can be more innovative and listen to users’ needs more easily.

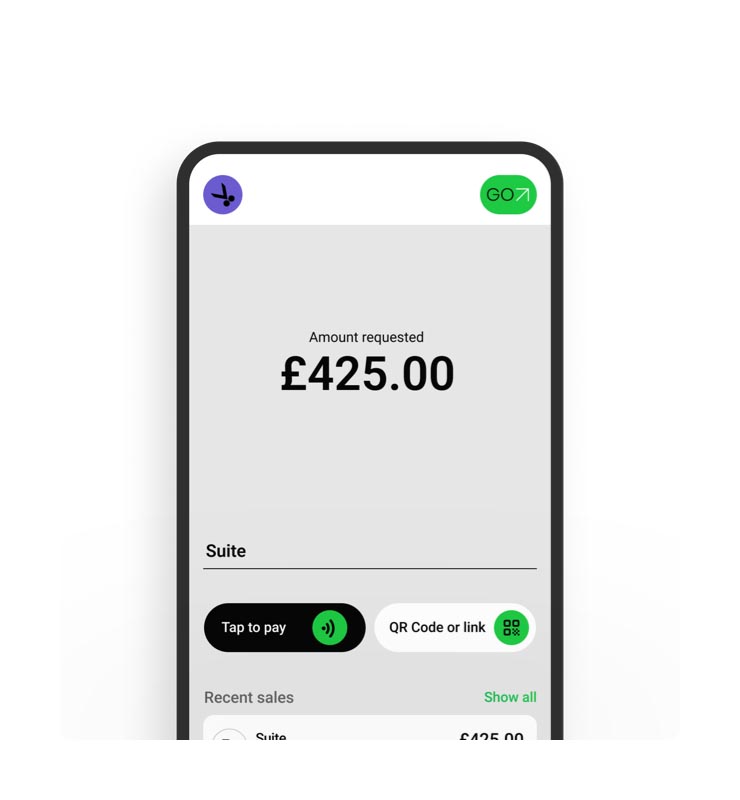

Our focus is on businesses and helping businesses to function with as little hassle as possible.

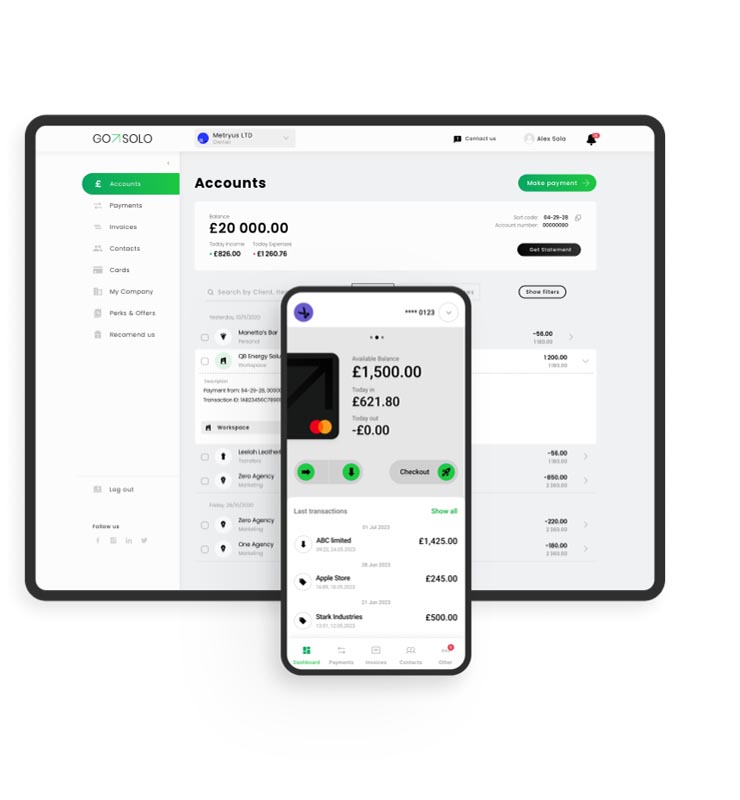

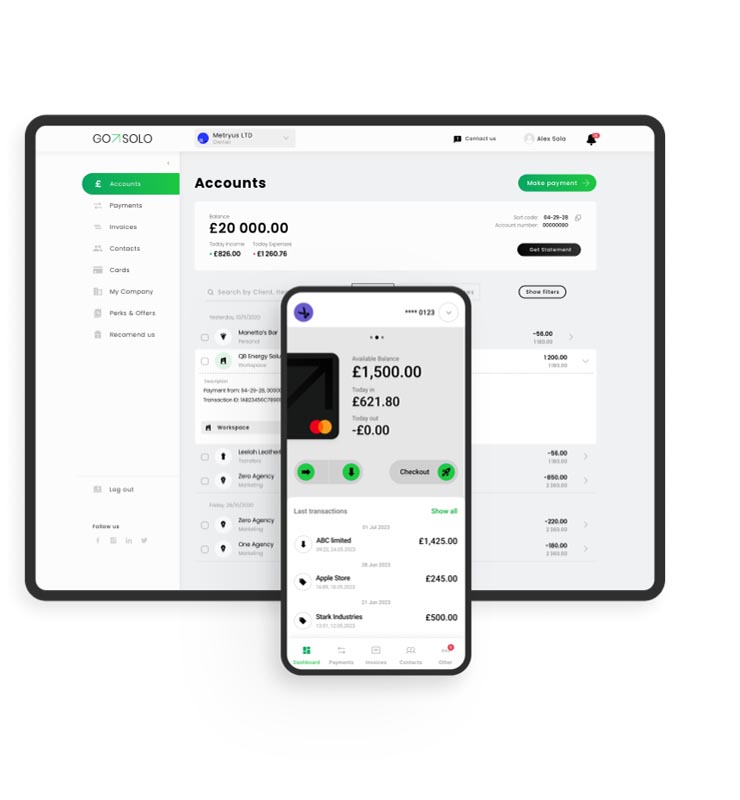

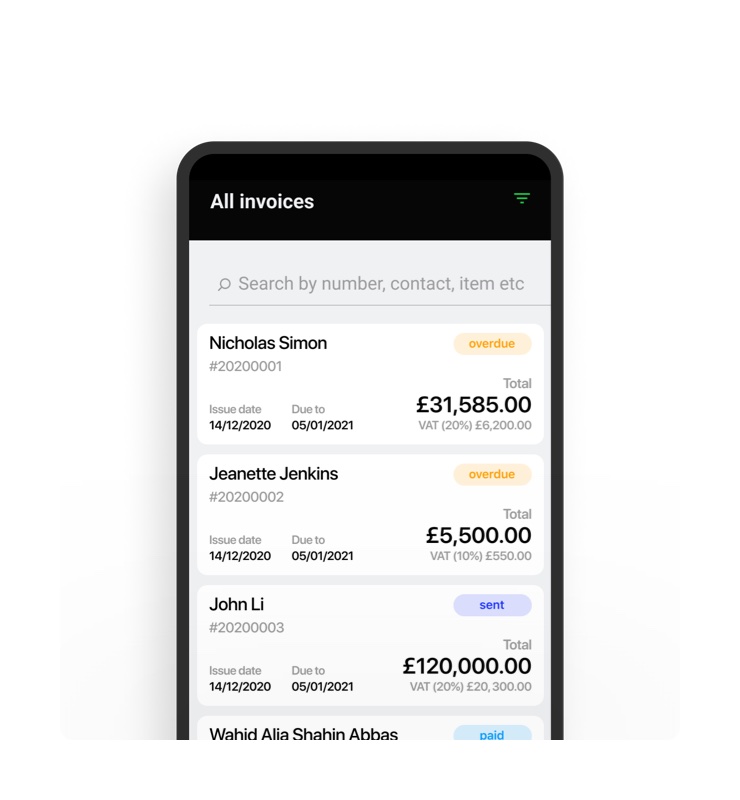

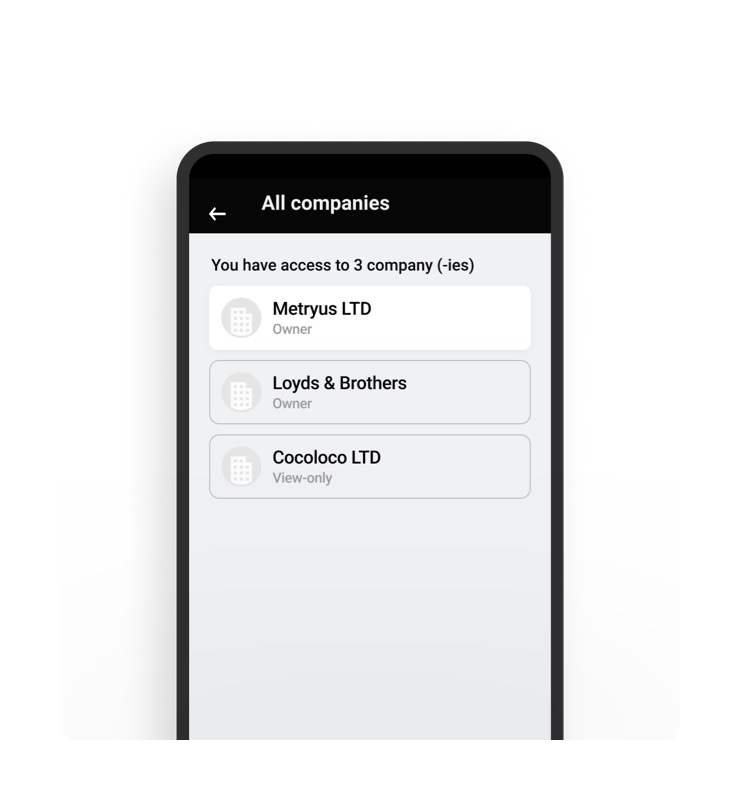

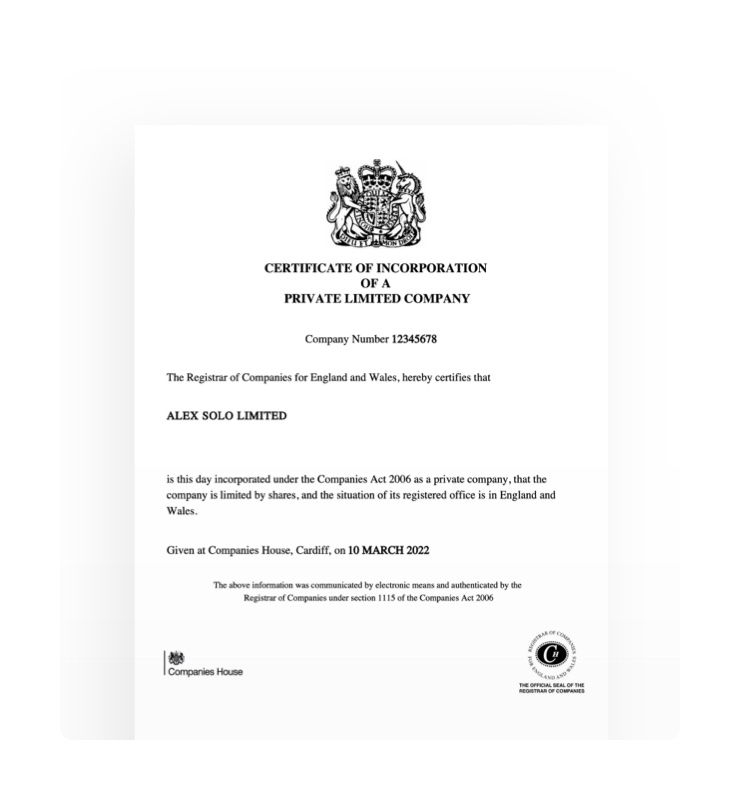

For that reason, we offer more than just a place for your company to hold its electronic money: We also register your company for you, give you simple invoice templates to send to your clients, automatically log payments for those invoices and even chase up slow payers, all within GoSolo!

Instead of having to invest in a basic accounting package and an online bank, we combine the two, in addition to taking the pain out of registering your Limited Company in the first place.

Traditional banks tend to focus on where to invest deposited funds. Our primary focus is on how to deliver fast service and innovation to our users.

Because we are small (by design), we are also more able to consider the requests of all our users, as opposed to only what “the majority” wants.

Legally, there are some differences between your GoSolo business account and a traditional business bank account.

But we have found that those differences don’t matter to users. People want a seamless, easy way to handle their money, not complicated forms and the slow-moving wheels of finance which can often be more of a hindrance than a solution in today’s fast-paced world.