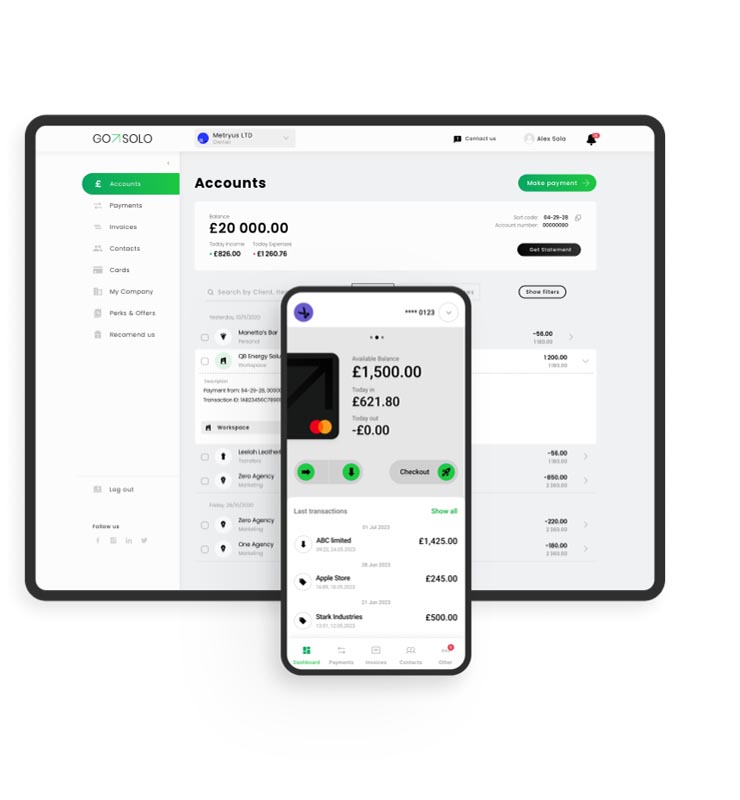

You don't just receive a business account. Gosolo provides innovative tools to receive payments, track spending, and send invoices. The great thing is that most features are free.

If you're an aspiring entrepreneur, Gosolo can ease the process of registering a new limited company. We are similarly providing a refreshing banking experience with friendly human support. Curious to find out more about banking through Gosolo? Here is extra information to know:

Business Account for Small and Medium-Sized Enterprises

You may need business account if you plan to operate a limited company, regarded as a separate entity under the law. Hence, it requires an individual account.

Sole traders may skip on the option to have a business account. It's not the best decision. Differentiating personal and business transactions may become harder. It may contribute to inaccuracies when determining the tax obligation.

When you're ready to open a business account in the UK, you may either do it in person or online. If you're looking for more features and flexibility, it's preferable to take the online route.

Gosolo is a top choice for entrepreneurs looking to open a business account online. Your funds are securely held in ring-fenced accounts of a tier 1 bank.

So, consider opening a business account online as it's faster and easier than in-person. The process is secure. You still need to pass identity checks and provide credible information about your business.

What Do I Need to Open an Online Business Account?

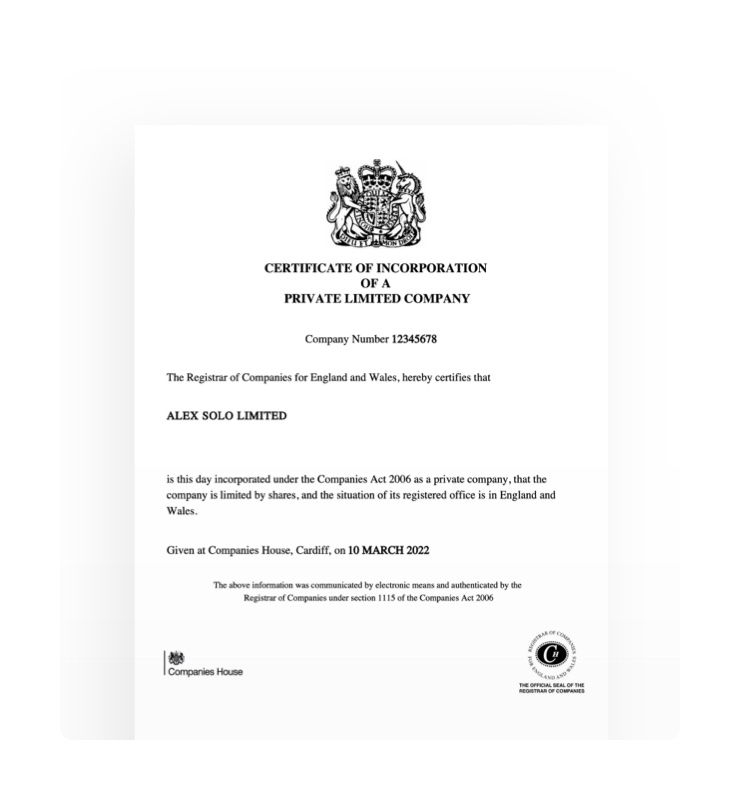

As an authorized financial entity, Gosolo has imposed requirements for users intending to apply for an online business account. The checks ensure conformity with operational rules and permitted practices. They similarly keep the platform safe.

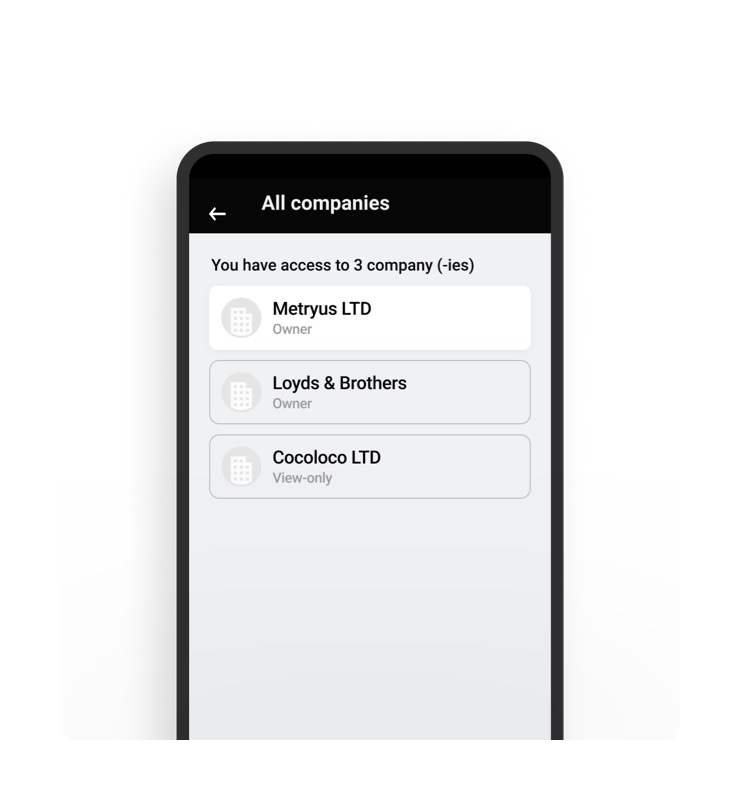

*Note that as of the moment, Gosolo only allows accounts for limited companies with a single director and owner.

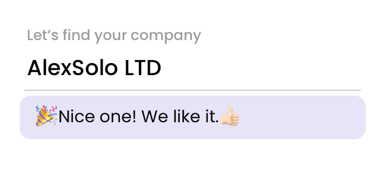

If you’re a sole trader looking to apply for an online account, start by registering a new limited company with the Companies House. Gosolo can facilitate the registration and business account creation process for you.

Organizations that can’t open a business account online with Gosolo include:

- Limited liability partnerships (LLPs);

- Companies with multiple Persons of significant control (PSCs) and Directors.

To get started with a new business account you’ll need to meet the following requirements:

- Age: Be at least 18 years old. Your ID should be ready for capture during the selfie verification;

- Residency: Be a UK resident and supply proof of address. You can submit various documents, including utility bills, bank statements, tax returns, or council bills;

- Business ownership: Be the single owner and director—businesses with multiple directors, partners, or PSCs are not currently supported;

- Nature of business: The nature of business must not fall into categories regarded as prohibited, high-risk, sanctioned, or illegal as per our terms and conditions;

- Trading history: Your company must be active. Proof may be required when the nature of the business is in doubt.

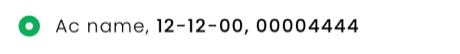

Opening a new business account entitles you to a MasterCard Debit card for regular business spending.

So, how do you get started? Access the registration form here. You can have your valid photo ID and other related business documents ready. We make the signup process faster by extracting information from uploaded documents.

Everything You Need in One Place, EFT Payments, Money Management, and More!

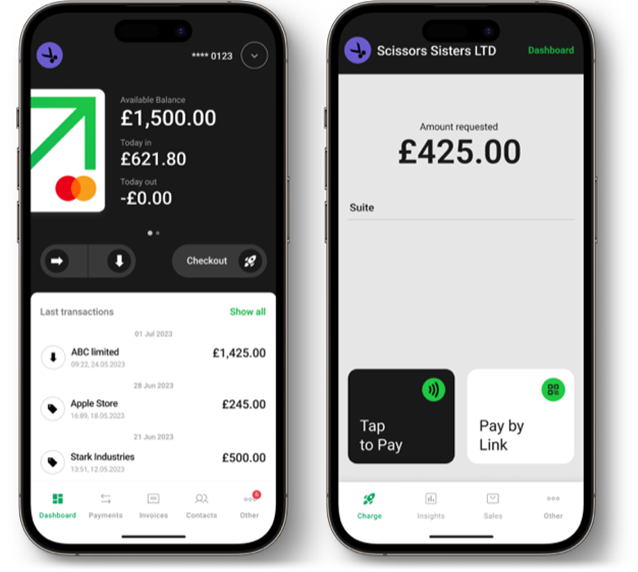

We recognize that you need more than a business account to succeed with your business. That's why Gosolo offers more features than are available with traditional business accounts:

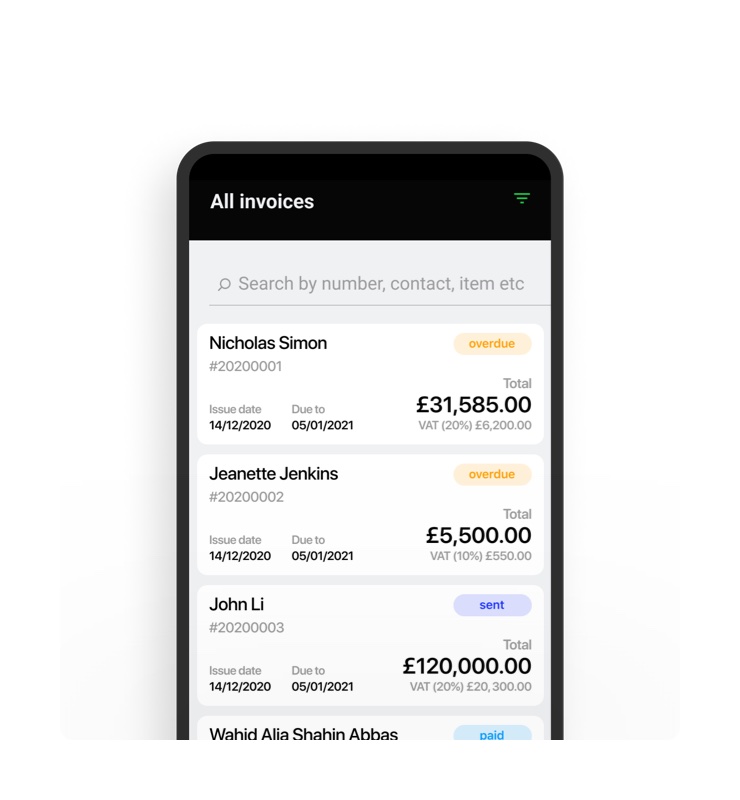

- Send and manage invoices: Use easily customizable templates to create professional-looking invoices. Do it within the mobile app or browser with no need to install invoicing software.

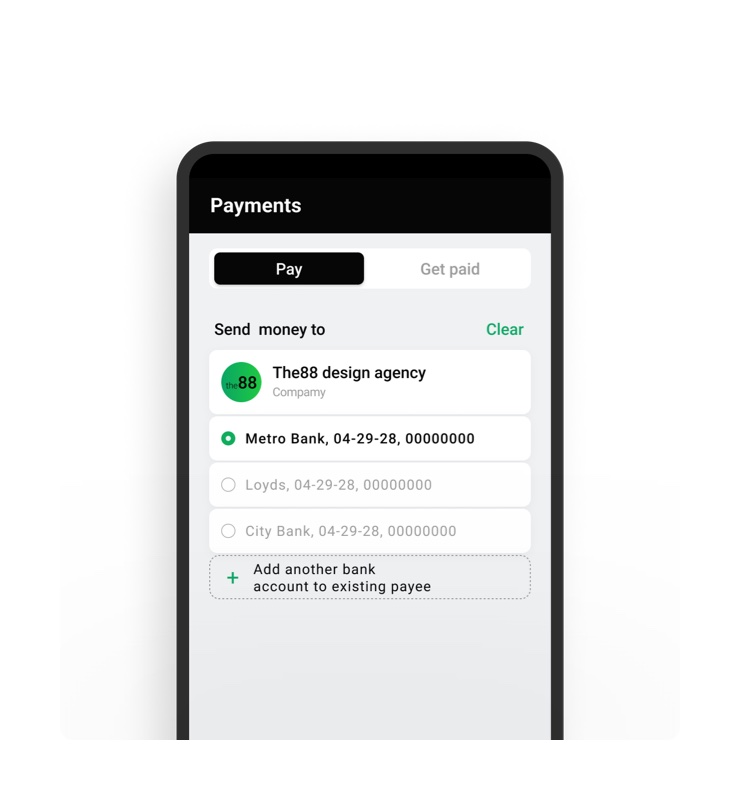

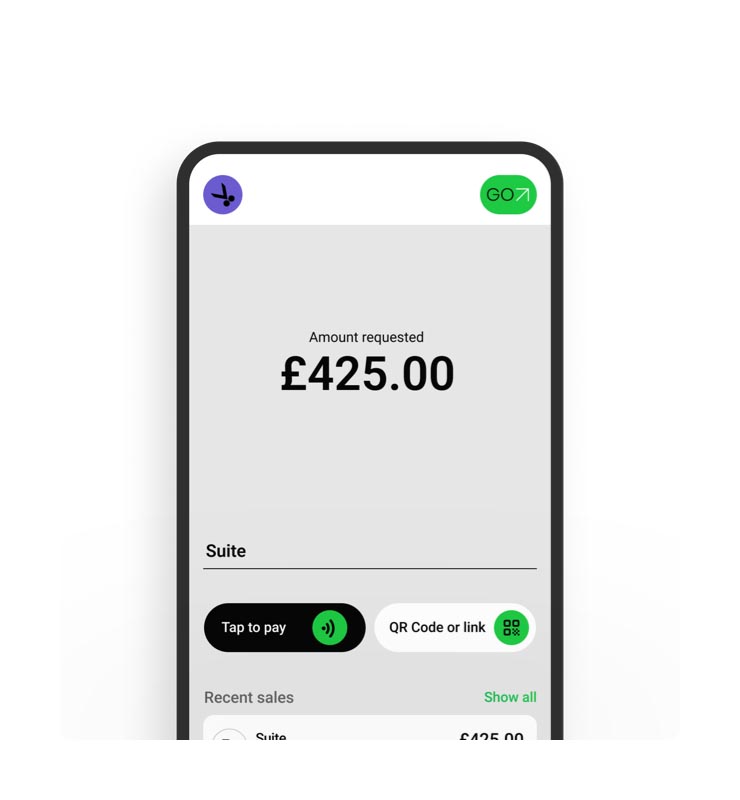

- Receive payments faster through FPS: Receive instant domestic payments from customers through the Faster Payments Service. Transactions now take place within a few seconds from one bank to another.

- Free MasterCard business debit card: Your physical debit card may arrive within 10 business days after application. Use it for business expenses to keep costs neatly separated.

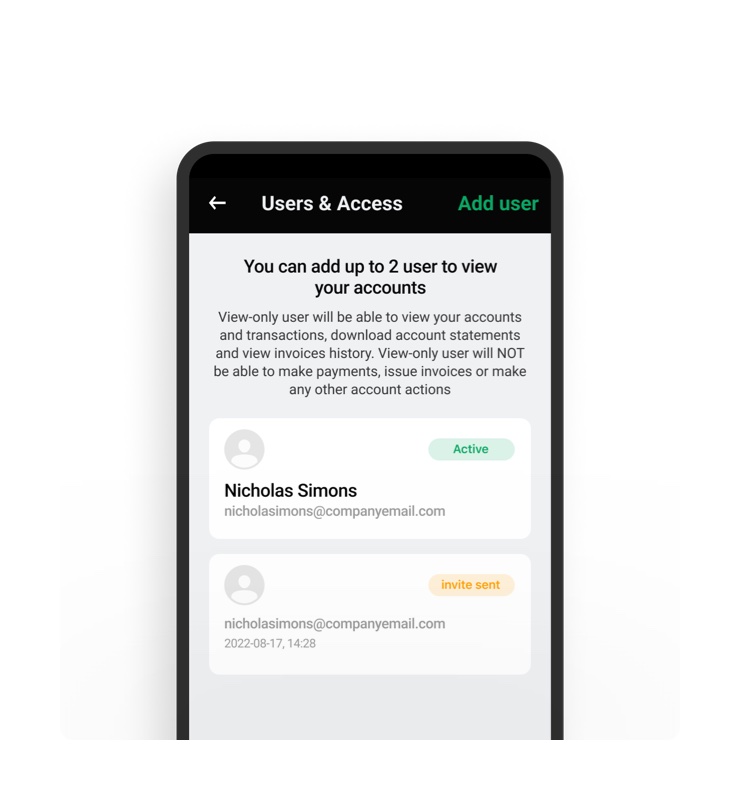

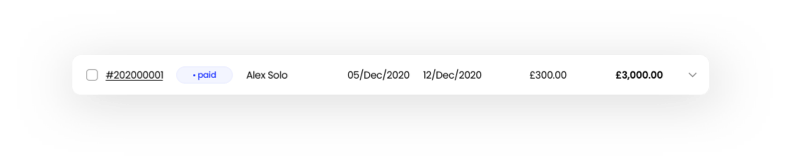

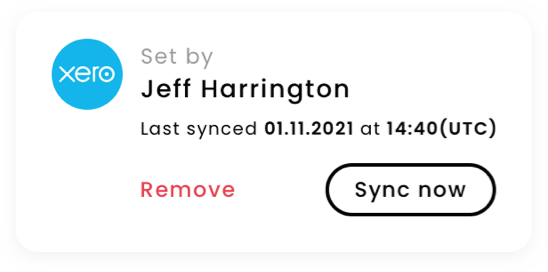

- Track and monitor spending: Track sales, revenues, and expenses from one place. You can see paid, overdue, and sent invoices. It’s also possible to invite accountants to review the records or share account statements.

Electronic Funds Transfer General Information

The concept of an EFT payment (electronic fund transfer) is not new. It's what makes bank money transfers possible, from one account to another between related or unrelated financial institutions.

Gosolo allows electronic funds transfer for business accounts. Here is some general information about making electronic fund transfers:

- All payments go through the Faster Payment Service as standard: Rather than receiving your money in three business days, your account gets credited in seconds after a customer makes a payment from their personal or checking account.

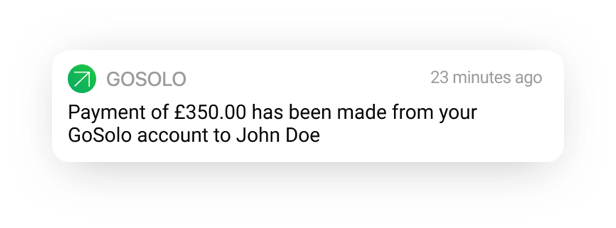

- Secured outbound transfers: With two-factor authentication in place, you can prevent scammers or unauthorized workers from making outbound payments.

- Higher limits on your MasterCard debit card: You can spend up to £1,000 per transaction with a maximum daily spending limit of £5,000.

- Allows international payments: Make secure payments to other UK accounts from your online account. Use your card to make international payments using business funds.

- Full control over funds: Gosolo does not have access to your account funds by the nature of using ring-fenced accounts.

- Maximum transaction limits for domestic transfers: Both inbound and outbound transfers to and from your online account are limited to £50,000 per transaction.

Benefits of Using Gosolo for Business Money Transfer, Payments, and Invoicing

Our goal is to simplify the process of receiving and sending out business money transfers. With the belief that managing financial aspects of a business should be as simple as possible, we also provide many more benefits:

- Fast money transfer: Supercharge your payments with transfers that take seconds, without the need to accept credit cards.

- Effortless invoicing: You'll be spoilt for choice with all the invoicing features. Set notifications and reminders, and even know when customers view invoices. With intelligent payments and invoices matching, Gosolo ticks paid invoices. Our invoice templates save you a lot of time spent starting from scratch.

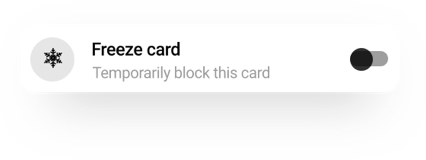

- Easily manage your master debit card: Get a better hold of your business spending by having the capability to freeze and unlock your card from your Gosolo account.

- Business insights at your fingertips: Don't operate in the dark. The Gosolo mobile app provides insights about your business performance from easy-to-use mobile apps.

- Intelligent AI-powered cash forecasting: Receive estimates about your cash flow to anticipate future profits or losses. Our AI-powered logic structure utilizes real-time insights from your transactions for more realistic estimates and forecasts.

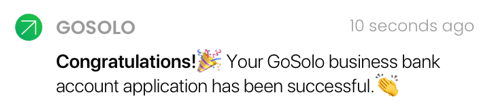

Ready to go the Gosolo way? Begin the effortless sign-up process and enjoy faster payments in the UK for your business.