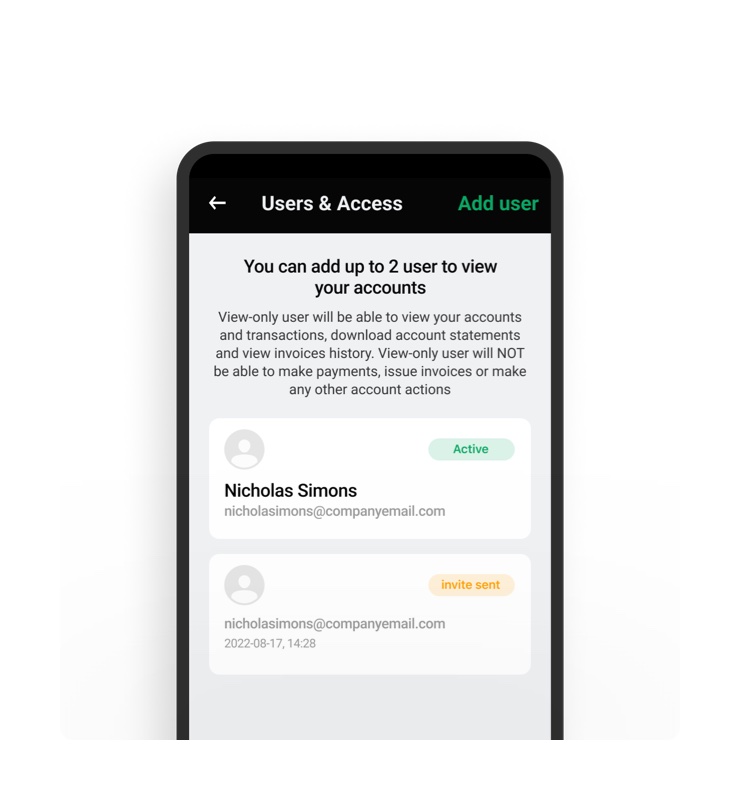

GoSolo has responded to this need by providing third-party access to business accounts. Here is the laydown of how it works:

Why Third-Party Access to Business Accounts

Giving a third-party authority to a business account entails sharing certain privileges with them.

There are two types of access offered by most banks with personal and business accounts:

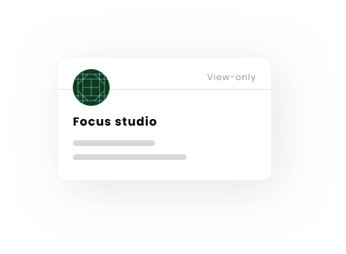

- View-only access (Non-value): Authorized third-party users may only view balances or transactions.

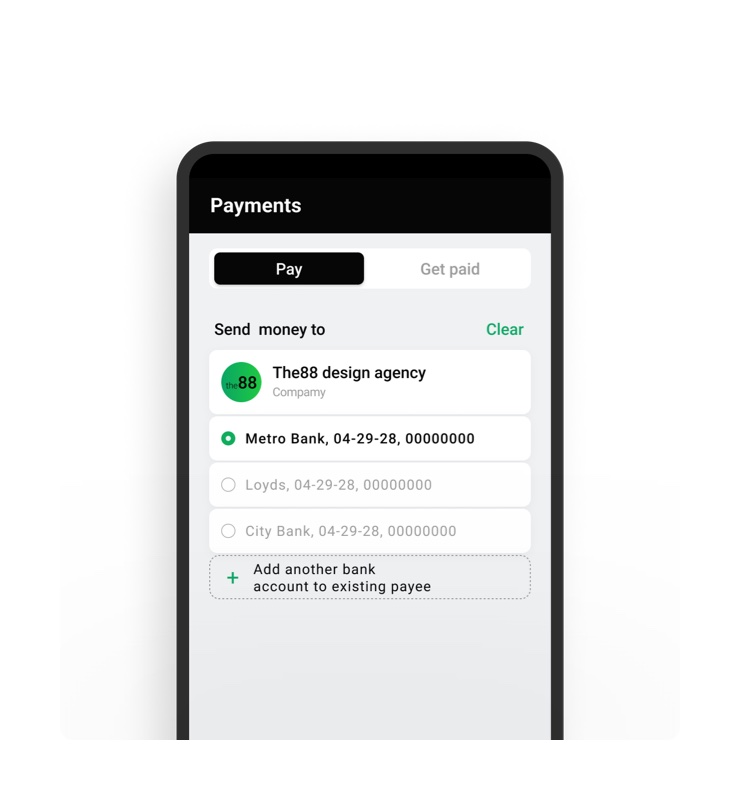

- View and transact access (Value): This type of access brings more responsibilities, such as making external transfers and internal payments. It’s used during the power of attorney executions or given to high-level employees to manage various aspects of the business.

Some key people who may need third-party business account access include bookkeepers, accountants, family members, and managers.

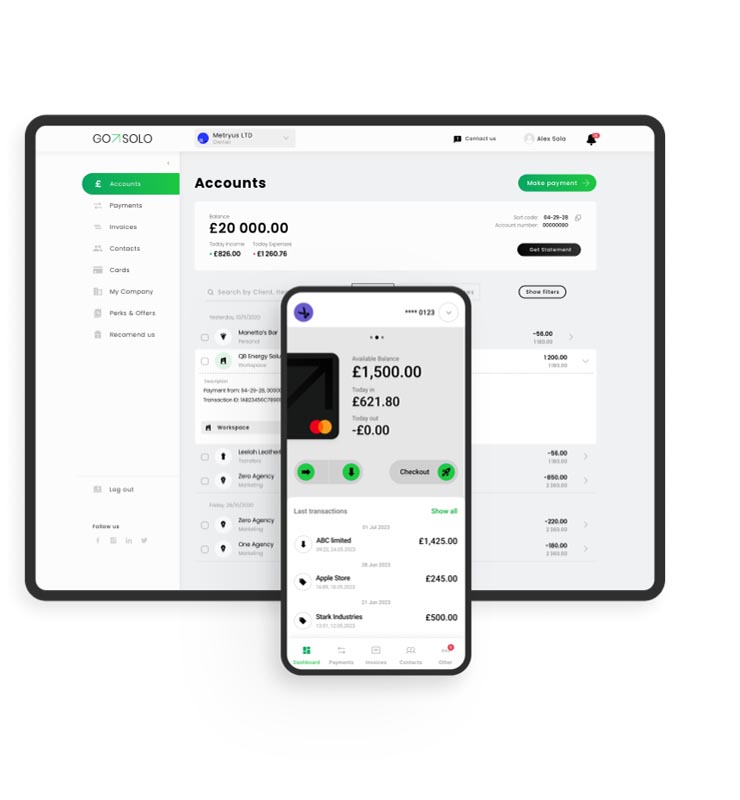

GoSolo’s Business Account for Teams

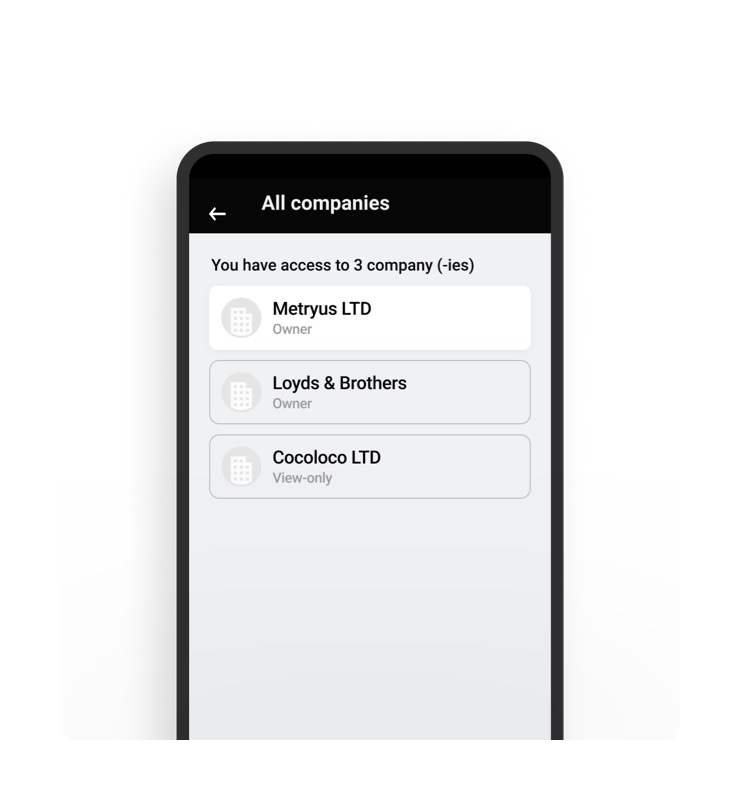

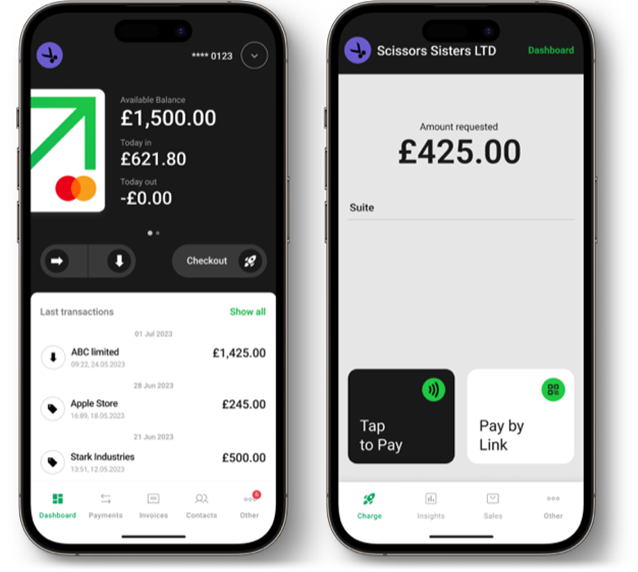

GoSolo allows single-owners of limited companies to create online business accounts. With the understanding that some customers will be working with teams or various support staff, we have taken the move to offer third-party access to business accounts. Currently, accounts can have two roles:

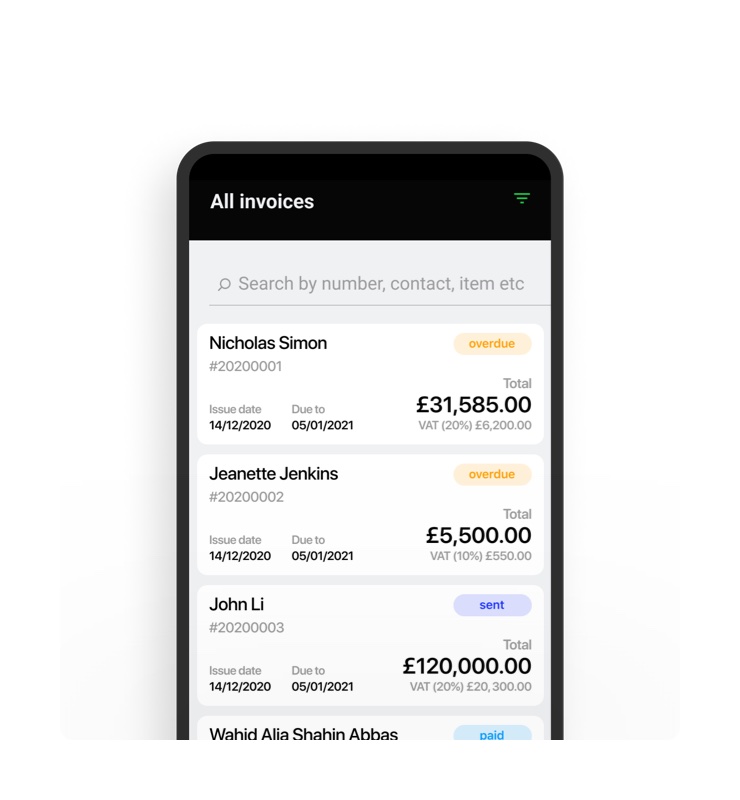

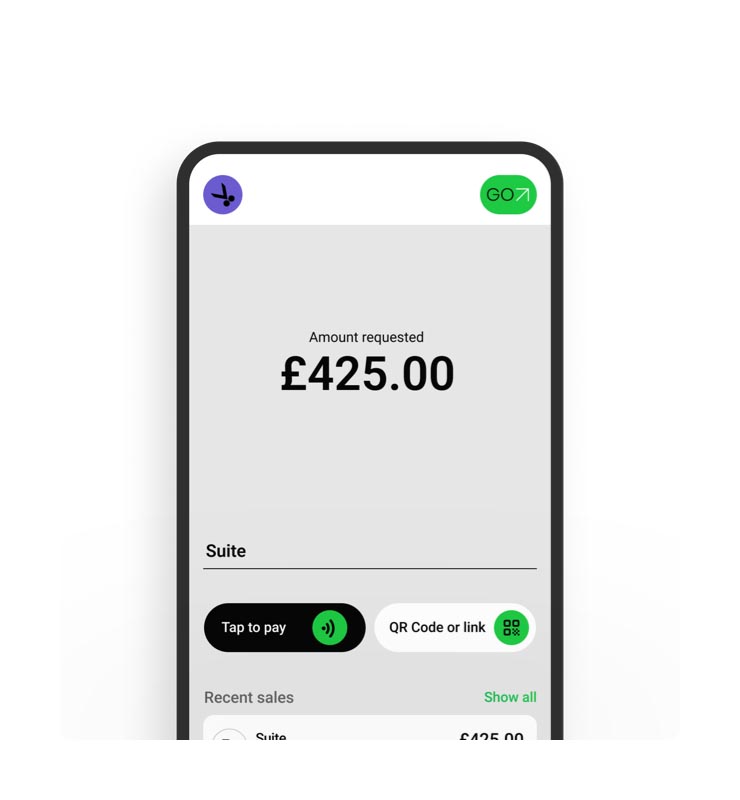

- Administrator: The primary account holder serves as the single admin. They can make payments, manage the Mastercard provided for spending, and send invoices.

- Viewer: The viewer has visibility over the account activities, including viewing past payments and invoices.

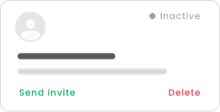

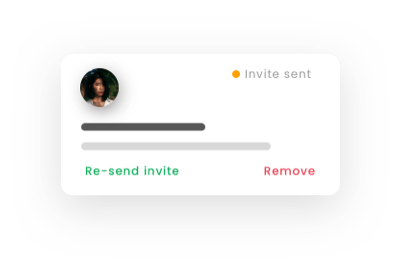

GoSolo’s multi-access feature allows account holders to create up to two third-party profiles. Users can view transactions, invoices, and contacts. They can similarly download account statements. Revoking and assigning access to third-party accounts may be done from the main admin account.

Our Benefits

The intuitive access to main accounts through separate third-party access comes with many benefits for your business:

- 100% secure: The app is protected by bank-security grade encryptions and algorithms. Similarly, there is no exposure of the main account to malpractices.

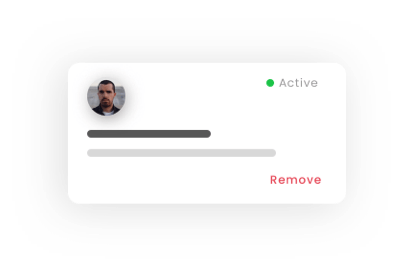

- Intuitive user management: You can easily manage shared account access and remove privileges in mere seconds.

- Shareable reports: Third-party users can download shareable reports to continue their work or review offline. It also saves time.

- Separate verification: Invited users need to pass a verification process and must have unique usernames and passwords.

Retain your peace of mind by adding verified third-party users to your business accounts. Get started today.